Understanding The Difference Between Pre Qualificatio Vrogue Co But there's a wrinkle to keep in mind. lenders use their own terms to describe the different application and approval phases. for simplicity, we're using the terms "pre qualification" to refer to. A mortgage pre qualification is usually a much shorter process that requires you to honestly report your own financial information, while a mortgage pre approval typically requires you to submit more documentation like w 2s to verify your financials — making it a lengthier process. neither pre qualification nor pre approval will guarantee you.

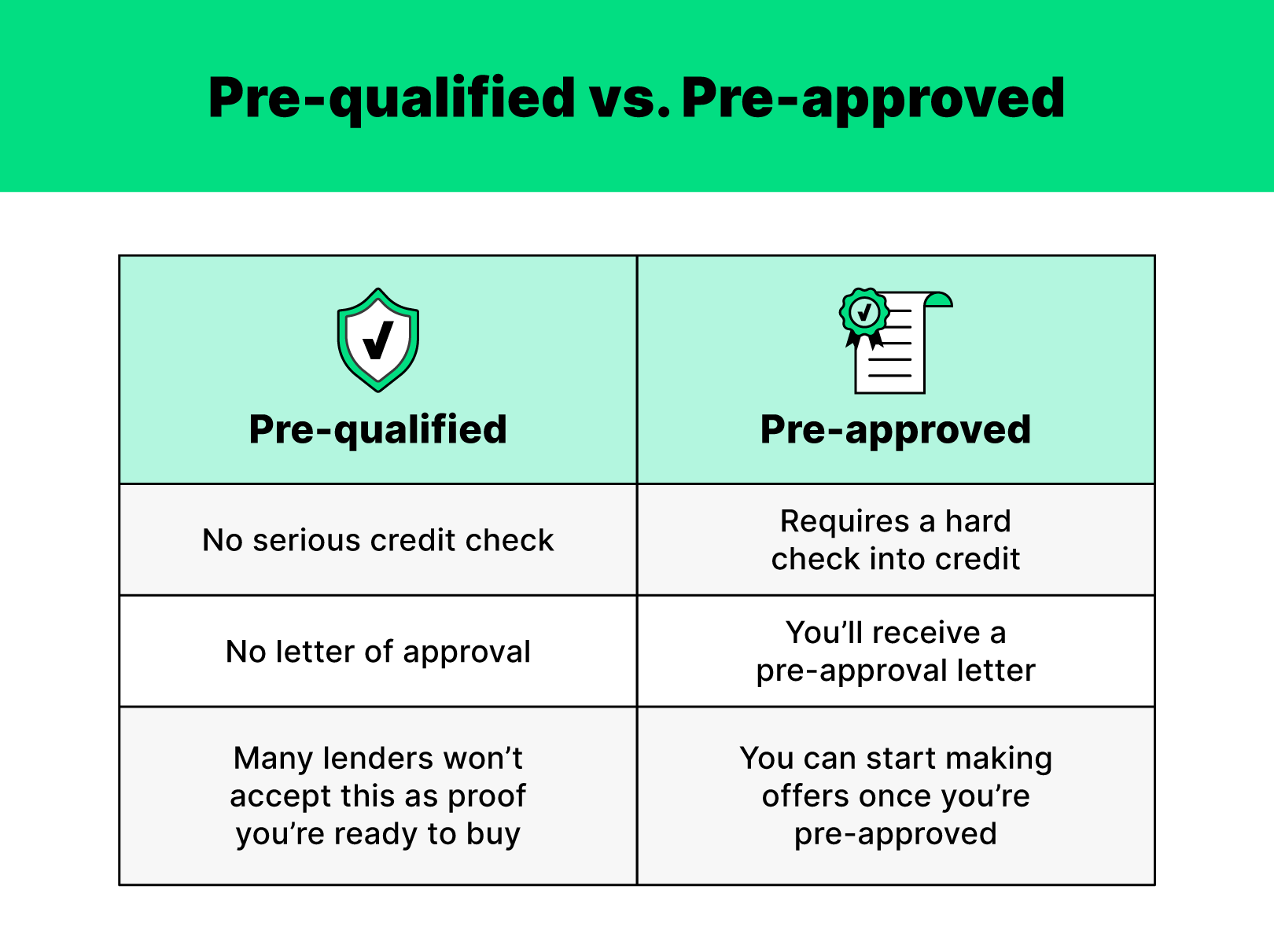

Whatтащs Better юааpreюаб Qualified юааvsюаб юааpreюаб Approved Leia Aqui Which Is A preapproval is a stronger indication of what you can afford and adds more credibility to your offer than a prequalification. you’ll receive a preapproval letter to supply to sellers, demonstrating that a lender has verified your financial information and that you can afford a mortgage. after you’re preapproved, your lender will provide a. Prequalifying at bank of america is a quick process that can be done online, and you may get results within an hour. for mortgage preapproval, you’ll need to supply more information so the application is likely to take more time. you should receive your preapproval letter within 10 business days after you’ve provided all requested information. The main difference between prequalified and preapproved: preapprovals hold more weight when trying to buy a home. prequalifying involves providing some basic financial info to get a general idea. But getting prequalified can allow you to quickly get a ballpark figure on a mortgage amount and an interest rate you qualify for, and preapproval has at least three selling points: 1. preapproval lets you know the specific amount you are qualified to borrow from a particular lender. 2.

Pre Qualification Vs Pre Approval What S The Difference Stillman The main difference between prequalified and preapproved: preapprovals hold more weight when trying to buy a home. prequalifying involves providing some basic financial info to get a general idea. But getting prequalified can allow you to quickly get a ballpark figure on a mortgage amount and an interest rate you qualify for, and preapproval has at least three selling points: 1. preapproval lets you know the specific amount you are qualified to borrow from a particular lender. 2. A pre approval letter is the real deal, a statement from a lender that you qualify for a specific mortgage amount based on an underwriter’s review of all of your financial information: credit. Mortgage lenders may use prequalification to determine if a borrower's debt to income ratio is within lending standards, but don't examine detailed information about the borrower or perform a.

How Long Is A Mortgage Pre Approval Good For A pre approval letter is the real deal, a statement from a lender that you qualify for a specific mortgage amount based on an underwriter’s review of all of your financial information: credit. Mortgage lenders may use prequalification to determine if a borrower's debt to income ratio is within lending standards, but don't examine detailed information about the borrower or perform a.

What S The Difference Between Pre Approval Vs Pre Qualification

Comments are closed.