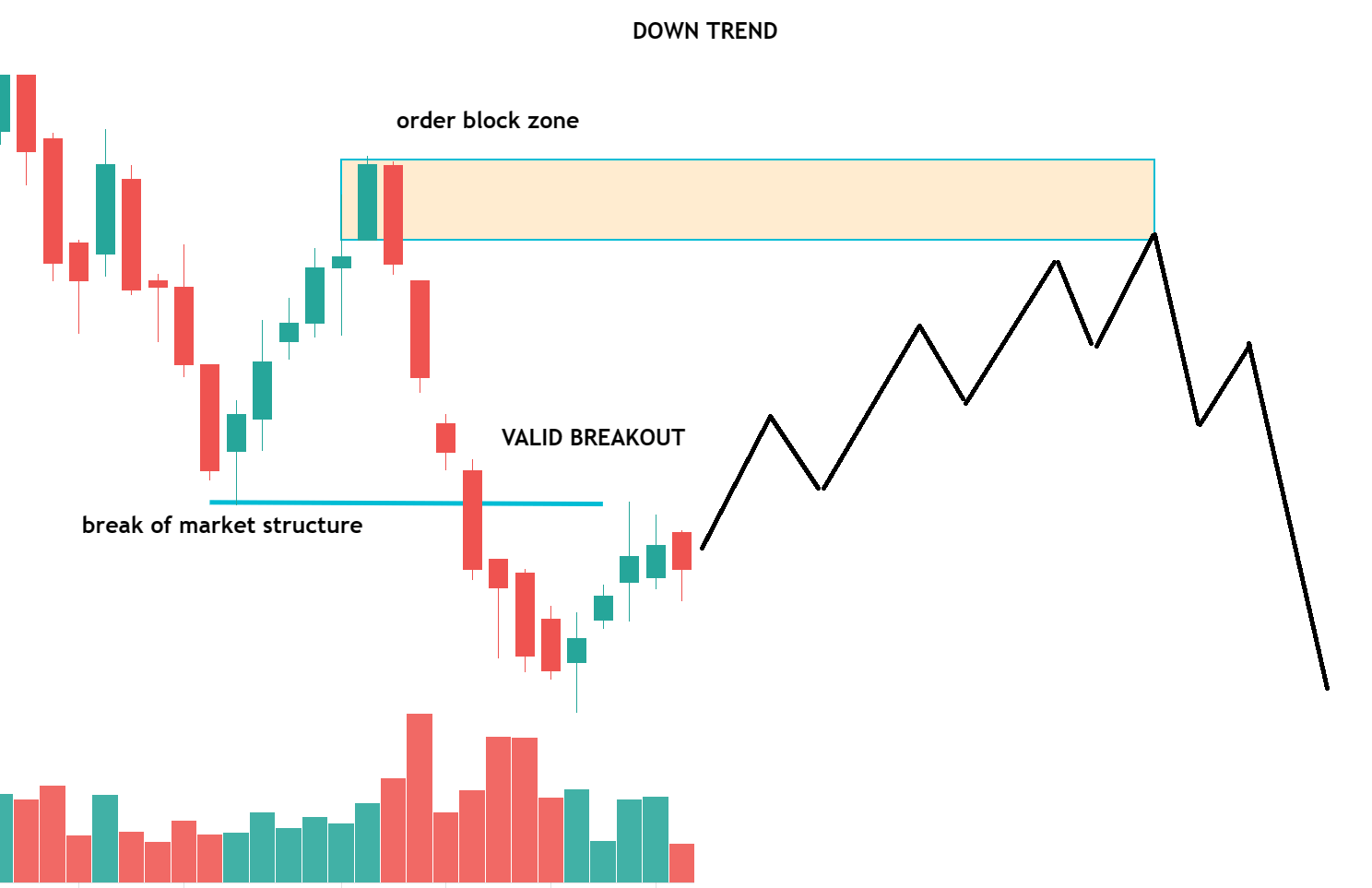

Ultimate Guides To Smart Money Concepts For Forex Noobies Market Step 1: determine the trend. the first thing you need to do when trading the smc is to identify the primary trend. in smc trading, determining the trend is based on a sound understanding of market structure. if this analysis is done correctly, we will often find trades on the right side of the market. In this comprehensive guide, we dive deep into the world of forex trading, specifically focusing on "how to master market structure " using smc techniques. d.

1 Smart Money Concepts How To Use Market Structure Forex Trading Learn how to trade forex with smart money concepts, an advanced tutorial on market structure and trend identification. What is the best way to map market structure, find key levels, and identify the market direction in forex, crypto and stock markets? in today’s video is goin. The smart money concept trading method in the forex market focuses on deciphering the actions of institutional traders and understanding market liquidity. this nuanced approach helps traders navigate the forex market more effectively, leveraging smc concepts to predict and react to market movements. forex. trading basics. Under the smart money concepts framework, retail traders are advised to construct their strategies around the activities of the "smart money," denoting the capital controlled by these market makers. the core concept involves replicating the trading behaviour of these influential entities, with a specific focus on variables such as supply.

Smart Money Market Structure Trading Strategy Dot Net Tutorials The smart money concept trading method in the forex market focuses on deciphering the actions of institutional traders and understanding market liquidity. this nuanced approach helps traders navigate the forex market more effectively, leveraging smc concepts to predict and react to market movements. forex. trading basics. Under the smart money concepts framework, retail traders are advised to construct their strategies around the activities of the "smart money," denoting the capital controlled by these market makers. the core concept involves replicating the trading behaviour of these influential entities, with a specific focus on variables such as supply. Liquidity. think of liquidity as how many buyers and sellers are present, and whether transactions can take place easily. example, if there is 10 people buying at £1, there needs to be 10 people selling for £1 for it to be a perfectly liquid market. now on a much larger scale, there is on average $6.6 trillion traded daily on the forex market. Conclusions. in conclusion, smart money concepts (smc) provides traders with a strategic framework that focuses on understanding the actions and motives of market makers, particularly institutions such as banks and hedge funds. this approach involves replicating the trading behaviour of influential entities, focusing on variables such as supply.

Step By Step Guide Smart Money Concepts Strategy Order Blocks Smc Liquidity. think of liquidity as how many buyers and sellers are present, and whether transactions can take place easily. example, if there is 10 people buying at £1, there needs to be 10 people selling for £1 for it to be a perfectly liquid market. now on a much larger scale, there is on average $6.6 trillion traded daily on the forex market. Conclusions. in conclusion, smart money concepts (smc) provides traders with a strategic framework that focuses on understanding the actions and motives of market makers, particularly institutions such as banks and hedge funds. this approach involves replicating the trading behaviour of influential entities, focusing on variables such as supply.

Comments are closed.