Series On Tax Reform New Deduction Pass Through Entities Sikich And there are many layers to that calculation, but let’s say you’re eligible for that maximum pass through deduction, it’s 20% of pass through taxable income, and by claiming the full amount of that 20% deduction, it has a result of getting your effective tax rate (if you’re at the top tax rate of 37% before that deduction) it drops your effective tax rate to 29%. The tax cuts and jobs act (tcja), the massive tax reform law that took effect in 2018, established a new tax deduction for owners of pass through businesses, such as sole proprietorships, partnerships, limited liability companies (llcs), s corporations, and limited liability partnerships (llps).

Impact Of 2018 Tax Reform On Corporations Pass Through Entities Under the tcja, tax rates for individuals are generally lowered over seven brackets, featuring a top tax rate of 37%. in contrast, c corporations will be taxed at a flat rate of 21%, which might. What tax reform did for pass through entities. section 11011 of the tax reform law created new section 199a of the internal revenue code, which provides for a deduction of up to 20% of a pass. The tax cuts and jobs act provides businesses with a variety of changes in tax reporting starting with tax year 2018. one such change in the latest tax reform is the 20% deduction for pass through entities’ qualified business income. the qualified business income deduction starts in tax year 2018 and, as of now, ends after tax year 2025. Impact on pass through entities. the act introduces new rules aimed at providing greater parity between the tax treatment of owners of pass through entities and corporations, but also includes guardrails intended to prevent pass through owners from recharacterizing wage income as more lightly taxed business income.

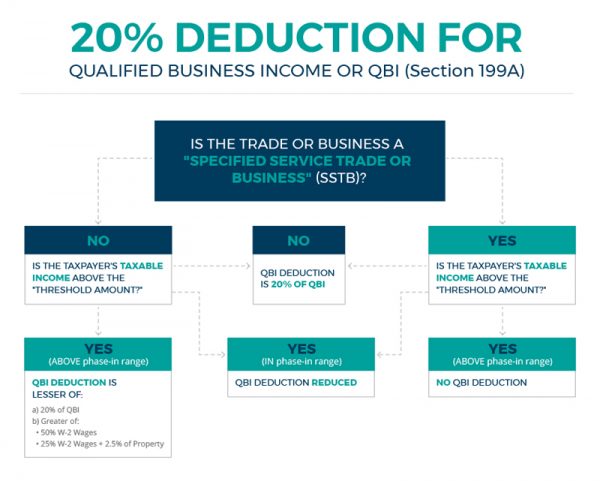

Multi State Pass Through Entities A Guide For Navigating Federal Tax The tax cuts and jobs act provides businesses with a variety of changes in tax reporting starting with tax year 2018. one such change in the latest tax reform is the 20% deduction for pass through entities’ qualified business income. the qualified business income deduction starts in tax year 2018 and, as of now, ends after tax year 2025. Impact on pass through entities. the act introduces new rules aimed at providing greater parity between the tax treatment of owners of pass through entities and corporations, but also includes guardrails intended to prevent pass through owners from recharacterizing wage income as more lightly taxed business income. This deduction enables pass through owners to deduct up to 20 percent of their qualifying business income against their taxable income . the pass through deduction includes several limitations based on wages paid and capital for high income taxpayers. the deduction lowers the effective statutory tax rate on pass through business income. Tax reform created a new benefit for pass through businesses: a 20% deduction for qualified business income from an entity that is treated for tax purposes as a partnership, s corporation, or sole proprietorship. but the lower rate is not as significant as corporate rate reduction, prompting many past through businesses to investigate conversion.

The Tax Cuts And Jobs Act Presented To Birmingham Association Of This deduction enables pass through owners to deduct up to 20 percent of their qualifying business income against their taxable income . the pass through deduction includes several limitations based on wages paid and capital for high income taxpayers. the deduction lowers the effective statutory tax rate on pass through business income. Tax reform created a new benefit for pass through businesses: a 20% deduction for qualified business income from an entity that is treated for tax purposes as a partnership, s corporation, or sole proprietorship. but the lower rate is not as significant as corporate rate reduction, prompting many past through businesses to investigate conversion.

Comments are closed.