Alcohol Trends 2023 Key Factors Shaping The Industry This Year As of 2022, revenue in the alcoholic beverage segment reached $261.1 billion in the us. between 2022 and 2025, the market is expected to grow by another 10.51% per year. the majority of revenue, $111.5 billion, can be attributed to beer sales. from a global perspective, china has generated the highest revenue numbers with sales of $319.8 billion. Summary. inflation for beverage alcohol has been 6.3% over the last year, among the lowest across the store and far below the total food and beverage inflation rate of 13.2%. while premium spirits have lost some ground to value oriented premixed cocktails, consumers have raised a glass in growing support of premium beer and wine products.

2023 Beverage Alcohol Trends Ekos Sales were up 5.1% last year to an all time high total of $37.6 billion, while volumes rose 4.8% to 305 million 9 liter cases. driving this incredible growth is whiskey and tequila. the former was up 10.5% in sales in 2022 to $5.1 billion, while the latter increased 17.2% to $3.1 billion. 5 premiumisation drives growth of the rtd category. iwsr data shows that, globally, rtd value will rise at a cagr of 7% between 2022 and 2026, outpacing a volume cagr of 5%. this compares with a volume cagr of 14%, 2016 2021. the value growth reflects the recent strong performance of premium plus rtd products across key markets. As beer and cider sales dropped across most channels in 2023, sales grew at convenience outlets by 3.1%.1 similarly, wine sales were down overall by 1.4%1 – but convenience boosted the trend with sales up 9.6%1 vs. the year before. consumers are valuing experiences more, and getting out of the house is putting convenience outlets front and. This timely report examines key market drivers impacting consumers' alcohol choices, highlighting the effects of these factors on various beverage alcohol segments and sub segments, while offering insights on key trends and market drivers relating to wine and spirits and beer. it looks at the blurring of alc and non alc segments, alliances between.

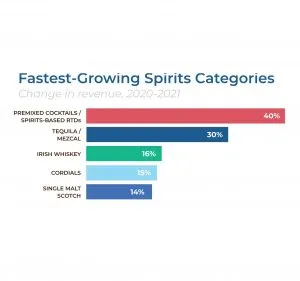

Top 10 Alcohol Industry Trends In 2023 Startus Insights As beer and cider sales dropped across most channels in 2023, sales grew at convenience outlets by 3.1%.1 similarly, wine sales were down overall by 1.4%1 – but convenience boosted the trend with sales up 9.6%1 vs. the year before. consumers are valuing experiences more, and getting out of the house is putting convenience outlets front and. This timely report examines key market drivers impacting consumers' alcohol choices, highlighting the effects of these factors on various beverage alcohol segments and sub segments, while offering insights on key trends and market drivers relating to wine and spirits and beer. it looks at the blurring of alc and non alc segments, alliances between. Spirits revenue market share grew from 28.7% in 2000 to 42.1% in 2022, surpassing beer for the first time ever, according to the distilled spirits council of the united states. beer holds a 41.9%. 2023 is shaping up to be an exciting year for the craft alcohol industry. with the rise in e commerce, an increased focus on sustainability, a demand for unique offerings, the local movement, the importance of effective distribution, and the integration of technology, craft brands have numerous opportunities to connect with their customers and.

Comments are closed.