An Overview Of The Tax Cuts Jobs Act Of Ppt Download 4 quick facts on tcja tax cuts & jobs act of 2017 (tcja) signed into law december 22, 2017 largest overhaul of the tax code since 1986 individual tax implications are temporary; set to “sunset” after 12 31 2025. Overview • changes under the new tax law, the tax cuts and jobs act (tcja), impact individual taxation: – generally effective for the 2018 tax year – most are temporary and due to expire after dec. 31, 2025. – with the changes to the standard deduction, many taxpayers will now opt not to itemize deductions.

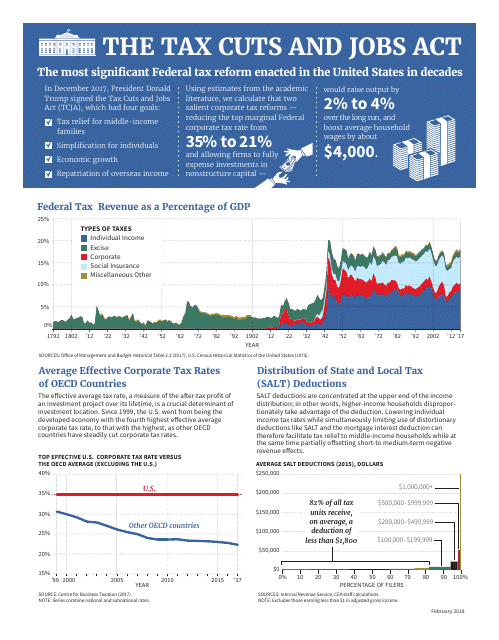

The Tax Cuts And Jobs Act Fill Out Sign Online And Download Pdf Download ppt "an overview of the tax cuts & jobs act of 2017" similar presentations american taxpayer relief act of 2012 john kilroy, cpa, cfp ® january 23, 2013. Many changes ahead guidance is needed effect on tax provisions effect on financial statements the tax cuts & jobs act (or its official title of “to provide for reconciliation pursuant to titles ii and v of the concurrent resolution on the budget for fiscal year 2018”) provides for many changes to business tax provisions. with a few minor exceptions, the provisions are generally effective. This document provides a summary of the 2019 tax plan and updates from a presentation given by bj hoffman and michael kline. it discusses changes to individual and business taxes from the tax cuts and jobs act. for individuals, key changes include increased standard deductions, limits on certain deductions, and changes to tax brackets. Introduction. on november 2, 2017, chairman kevin brady (r tx) of the house committee on ways and means released a tax reform plan, known as the house tax cuts and jobs act. the plan would reform the individual income tax code by lowering tax rates on wages, investment, and business income; broadening the tax base; and simplifying the tax code.

Ppt Tax Cuts Jobs Act Powerpoint Presentation Free Download Id This document provides a summary of the 2019 tax plan and updates from a presentation given by bj hoffman and michael kline. it discusses changes to individual and business taxes from the tax cuts and jobs act. for individuals, key changes include increased standard deductions, limits on certain deductions, and changes to tax brackets. Introduction. on november 2, 2017, chairman kevin brady (r tx) of the house committee on ways and means released a tax reform plan, known as the house tax cuts and jobs act. the plan would reform the individual income tax code by lowering tax rates on wages, investment, and business income; broadening the tax base; and simplifying the tax code. The tax policy center has also released an analysis of the macroeconomic effects of the tax cuts and jobs act as passed by congress. we find the legislation would boost us gross domestic product (gdp) 0.8 percent in 2018 and would have little effect on gdp in 2027 or 2037. the resulting increase in taxable incomes would reduce the revenue loss. On december 22, 2017, the president signed into law a federal tax reform bill commonly known as the tax cuts & jobs act (the “tax act”). the tax act resulted in significant changes to the u.s. tax system on a number of fronts. this webinar will provide an overview the provisions of the tax act relevant to sbic’s. we will also address the.

Impact Of The Tax Cuts And Jobs Act On Law Firms Ppt Download The tax policy center has also released an analysis of the macroeconomic effects of the tax cuts and jobs act as passed by congress. we find the legislation would boost us gross domestic product (gdp) 0.8 percent in 2018 and would have little effect on gdp in 2027 or 2037. the resulting increase in taxable incomes would reduce the revenue loss. On december 22, 2017, the president signed into law a federal tax reform bill commonly known as the tax cuts & jobs act (the “tax act”). the tax act resulted in significant changes to the u.s. tax system on a number of fronts. this webinar will provide an overview the provisions of the tax act relevant to sbic’s. we will also address the.

вђњtax Cuts And Jobs Actвђќ Signed Into Law Scott Company Columbia Sc

Comments are closed.