Avoiding Financial And Identity Theft Scams A Reference Guide A Most scams and scammers have two main goals to steal your money and your identity. you should know what to look for, how they work, and what to do, so you can protect yourself and your finances. maintaining cybersecurity is very important, even for consumers. it is not simply something that concerns large corporations and other businesses. Elder fraud. each year, millions of elderly americans fall victim to some type of financial fraud or confidence scheme. common scams that target older citizens include romance scams, tech support.

Personal Finance 101 Preventing Identity Theft Fraud But you can reduce your risk of being hurt by identity theft. how can i protect my identity? protect your personal information. that helps you protect your identity. here are some things you can do: at home: keep your financial records, social security and medicare cards in a safe place; shred papers that have your personal or medical information. How to report identity theft. to report identity theft, contact: the federal trade commission (ftc) online at identitytheft.gov or call 1 877 438 4338; the three major credit reporting agencies. ask them to place fraud alerts and a credit freeze on your accounts. the fraud department at your credit card issuers, bank, and other places where you. 1. credit identity theft. credit identity theft happens when a criminal uses your personal information, such as birthdate and social security number, to apply for a new credit line. warning signs. Avoid unsecure public wi fi networks, which can be easy for hackers to exploit and capture your information 5. 1. steinberg, scott. “ the latest ways identity thieves are targeting you — and what to do if you are a victim. ” cnbc . published february 27, 2020.

Three Essential Steps To Avoid And Recover From Identity Theft 1. credit identity theft. credit identity theft happens when a criminal uses your personal information, such as birthdate and social security number, to apply for a new credit line. warning signs. Avoid unsecure public wi fi networks, which can be easy for hackers to exploit and capture your information 5. 1. steinberg, scott. “ the latest ways identity thieves are targeting you — and what to do if you are a victim. ” cnbc . published february 27, 2020. Use usa.gov’s scam reporting tool to identify a scam and help you find the right government agency or consumer organization to report it. identity theft learn what identity theft is, its warning signs, and how to protect yourself. Hang up and 'go to the source'. if you're contacted by anyone claiming to be your bank or other familiar company, end the conversation and call the institution’s verified number yourself.

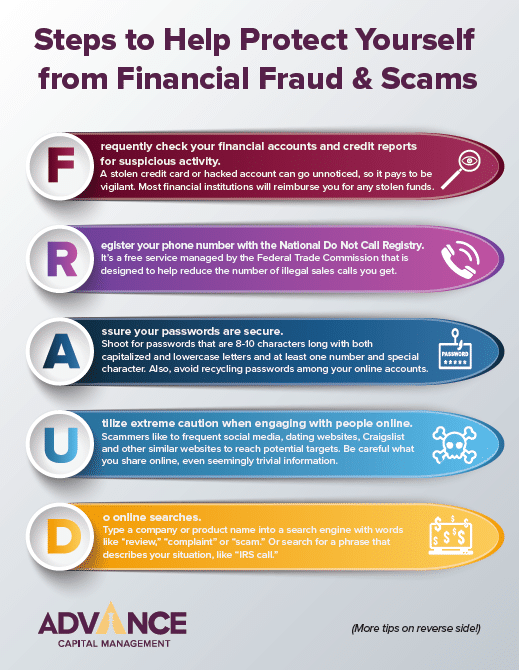

Steps To Avoid Financial Fraud And Scams Use usa.gov’s scam reporting tool to identify a scam and help you find the right government agency or consumer organization to report it. identity theft learn what identity theft is, its warning signs, and how to protect yourself. Hang up and 'go to the source'. if you're contacted by anyone claiming to be your bank or other familiar company, end the conversation and call the institution’s verified number yourself.

Avoiding Financial And Identity Theft Scamsвђ U S Quick Reference Guid

Comments are closed.