Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical Key takeaways: hmos and ppos have different rules about covering healthcare services delivered by out of network providers. hmos limit your choice of providers but often have a lower deductible and premiums. ppos offer you more flexibility than hmos in choosing doctors and hospitals. lpettet istock via getty images. An hmo often costs less than a ppo but you’re limited to in network providers and you’re responsible for all out of network costs except those resulting from medical emergencies. a ppo provides greater flexibility in terms of which providers you can see.

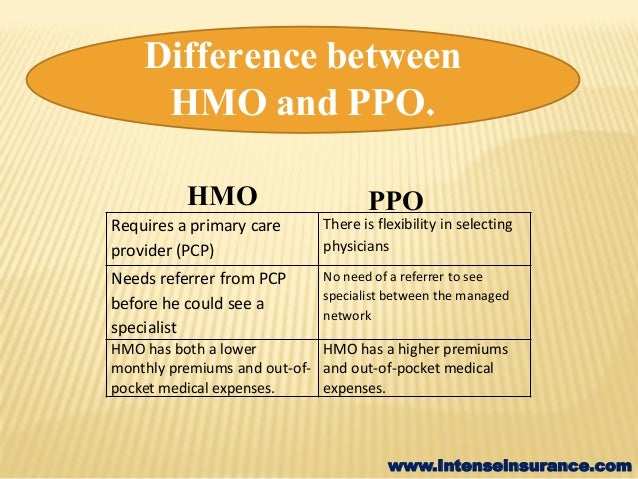

Between Hmo And Ppo Which One Should You Choose Lower cost. hmo plans typically have lower monthly premiums. you can also expect to pay less out of pocket. higher cost. ppos tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. out of pocket medical costs can also run higher with a ppo plan. That’s compared to $512 monthly for a ppo plan for the same person. the difference is more than $1,000 over a year on average. cheaper out of pocket costs: hmo plans typically have lower out of. Hmos are more budget friendly than ppos. hmos usually have lower monthly premiums. both may require you to meet a deductible before services are covered, but it’s less common with an hmo. with a. Health maintenance organization (hmo) and preferred provider organization (ppo) are two of the most popular types of major medical health insurance plans. the major differences between hmo vs ppo plans can be found in the: size of the network. the cost of the plan. the ability to see specialists without referrals. the size of the in network.

Between Hmo And Ppo Which One Should You Choose Hmos are more budget friendly than ppos. hmos usually have lower monthly premiums. both may require you to meet a deductible before services are covered, but it’s less common with an hmo. with a. Health maintenance organization (hmo) and preferred provider organization (ppo) are two of the most popular types of major medical health insurance plans. the major differences between hmo vs ppo plans can be found in the: size of the network. the cost of the plan. the ability to see specialists without referrals. the size of the in network. An epo plan is somewhere between an hmo and ppo in terms of flexibility and cost. you don’t need a referral to see a specialist, but there aren’t any out of network benefits. point of service (pos) a pos plan also combines different parts of hmo and ppo plans. with a pos plan, you usually need a referral from a primary care doctor to see a. “the maximum out of pocket amount an hmo plan can set is $8,850, while a ppo can set one as high as $13,300.” are there better supplemental benefits in an hmo vs. a ppo plan?.

Comments are closed.