Chapter 1 General Principles Of Taxation Pdf Taxes Jurisdiction ¶1.1. taxation principles and theory. introduction ¶1.1 kinds of taxes ¶1.2 functions of taxation ¶1.3 tax expenditures ¶1.4 structural features of taxes ¶1.5 tax system design ¶1.6 features of a good tax system ¶1.7 the tax unit ¶1.8 tax evasion, tax avoidance and tax planning ¶1.9 sovereign right to tax ¶1.10 jurisdiction to tax ¶1.11. Taxation. chapter 1 introduces the concept of taxation and discusses a number of fundamental issues relating to taxati. n theory. chapter 2 introduces the primary sources of taxation law, being statute and common law, and the broad range of secondary material that can be used in researching and resolving tax.

Gen Principles Of Taxation Pdf Tax Exemption Taxes 1. taxation is the process by which the sovereign raises income to defray the necessary expenses of the government. the power of taxation is unlimited and plenary, subject only to constitutional and inherent limitations. 2. the legislature has broad discretion to select subjects of taxation such as persons, property, businesses, transactions, rights, and privileges. taxation is based on the. After completing this chapter, you should be able to: 1.1 explain the basic types of taxes and the bases on which they are levied by various governmental units. 1.2 compare the effects of progressive, proportional, and regressive tax systems on taxpayers’ incomes. 1.3 explain the characteristics of a good tax system using characteristics of. General principles of taxation fundamental principles in taxation . × download free pdf. This document provides an overview of taxation principles under philippine law. it defines taxation as the means by which the government raises funds through legislation. the primary purpose of taxation is to provide revenue to promote general welfare and protect citizens. taxation powers are broad but subject to constitutional and inherent limitations. the basis of taxation is the reciprocal.

Chapter 1 Introduction To Taxation Pdf Taxes Double Taxation General principles of taxation fundamental principles in taxation . × download free pdf. This document provides an overview of taxation principles under philippine law. it defines taxation as the means by which the government raises funds through legislation. the primary purpose of taxation is to provide revenue to promote general welfare and protect citizens. taxation powers are broad but subject to constitutional and inherent limitations. the basis of taxation is the reciprocal. Fiscal policy and tax policy 1.2. the budgetary balance of tax, debt and expenditure in fiscal policy 1.3. policy principles for a state to raise taxation 1.3.1. what is a tax? 1.3.2. theories justifying taxation 1.3.3. justifying taxation through its use chapter 2: principles of taxation 1 1 3 3 4 6 9 2.1. features of a good tax policy 2.1.1. Each country’s tax system is grounded on certain basic principles and the tax structure tends to be similar (smith, 2015).almost all countries around the world, especially at the oecd level, have in place an income tax for individuals and a corporate tax for firms, a vat or a sales tax based on consumption, and also taxes on specific goods such as fuel, tobacco, and liquor, as well as taxes.

Chapter 1 General Principles And Concepts Of Taxation Pdf Tax Fiscal policy and tax policy 1.2. the budgetary balance of tax, debt and expenditure in fiscal policy 1.3. policy principles for a state to raise taxation 1.3.1. what is a tax? 1.3.2. theories justifying taxation 1.3.3. justifying taxation through its use chapter 2: principles of taxation 1 1 3 3 4 6 9 2.1. features of a good tax policy 2.1.1. Each country’s tax system is grounded on certain basic principles and the tax structure tends to be similar (smith, 2015).almost all countries around the world, especially at the oecd level, have in place an income tax for individuals and a corporate tax for firms, a vat or a sales tax based on consumption, and also taxes on specific goods such as fuel, tobacco, and liquor, as well as taxes.

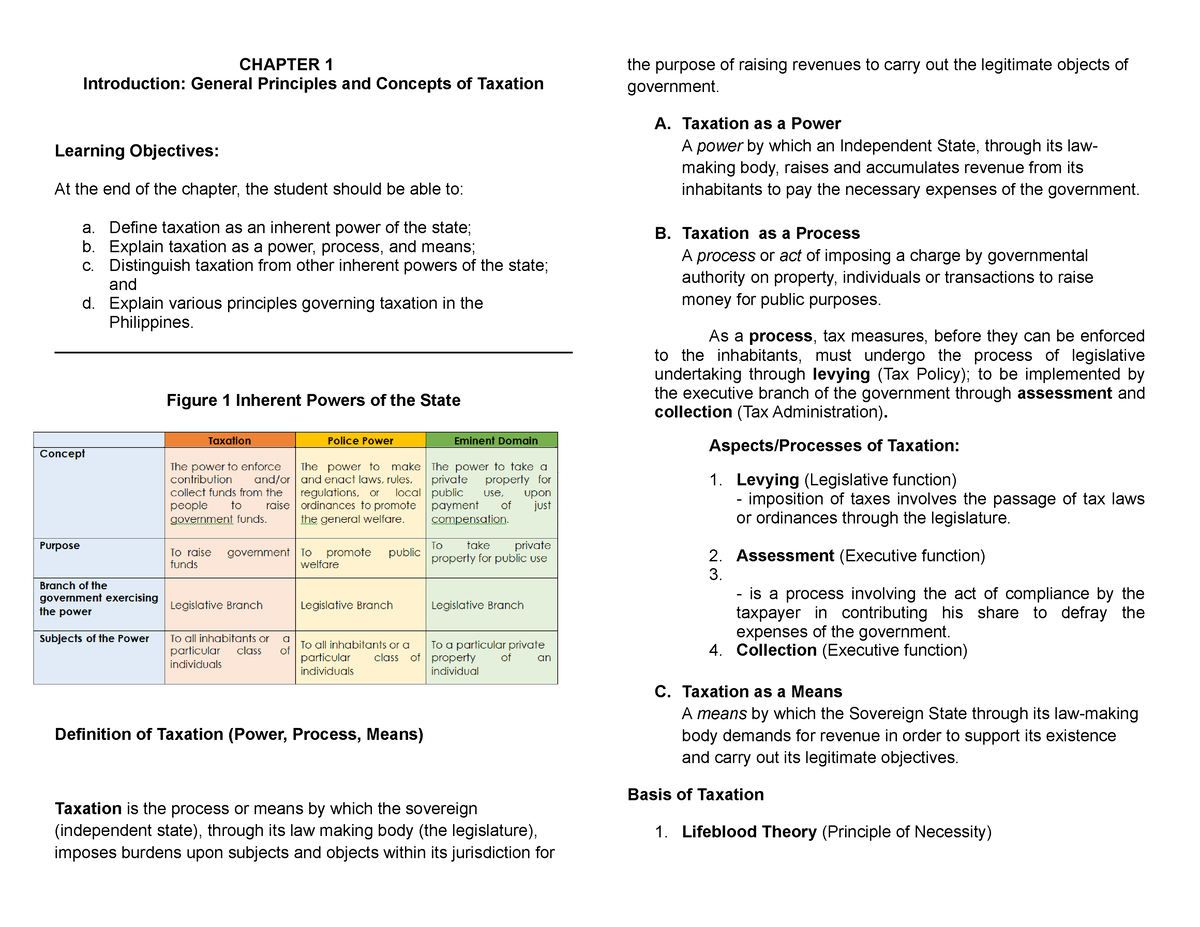

Chapter 1 General Principles Of Taxation Chapter 1 Introdu

Comments are closed.