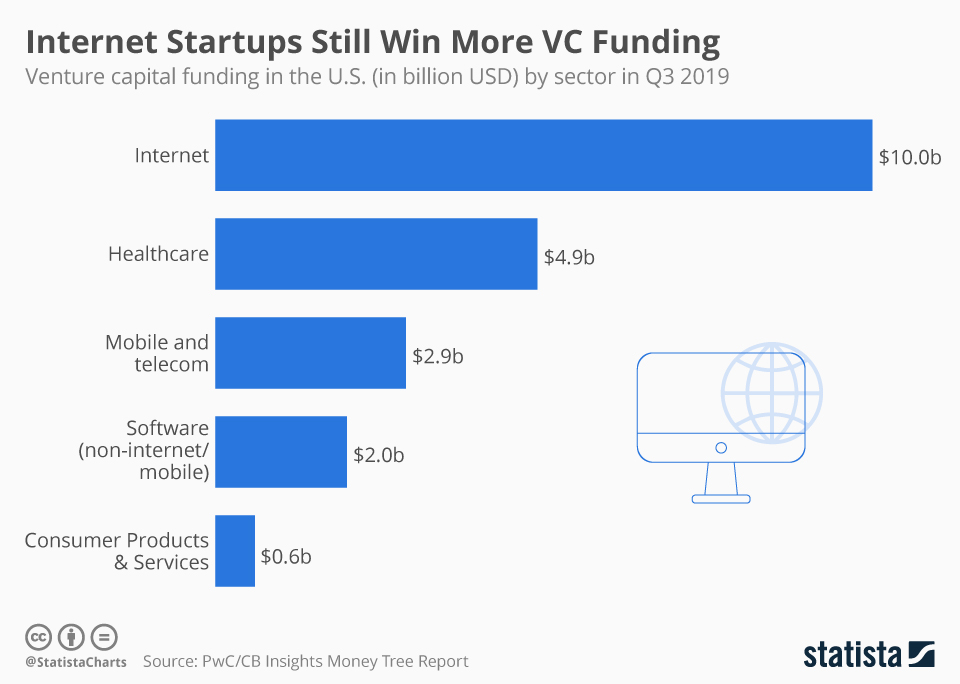

Chart Internet Startups Still Win More Vc Funding Statista This chart shows venture capital funding (in billion usd) by sector in q3 2019. internet startups still win more vc funding the statista "chart of the day" currently focuses on two sectors. According to cb insights, there were more than 1,200 unicorn startups (companies valued at $1 billion or more) in the world as of october 2023. around 40 are decacorns, valued at $10 billion or.

Chart Startup Funding Shows Signs Of New Tech Bubble Statista Pitchbook analysts say that mega rounds of $100 million or more, of which nontraditional investors have been a major driver, are being completed at a much slower pace as growth investors take a more cautious approach. us vc firms raised $121.5 billion in the first six months of 2022. funds of more than $1 billion account for nearly 64% of that. In generative ai, foundation models and development tools continue to attract the most funding. in the second quarter of 2024, global venture capital funding climbed 5% quarter over quarter, reaching $94 billion across 4,500 deals (see figure 1). this marked the second consecutive quarter of growth following a year of decline. Here’s the state of vc in six charts. dive deeper with the pitchbook nvca venture monitor. despite a fundraising boom, the market environment is moving sharply away from a startup and founder friendly environment to one that favors investors. that’s according to the pitchbook vc dealmaking indicator, which quantifies how startup friendly. More about statista. u.s. venture capital funding climbed to $55 billion in the first six months of 2019, the second highest recorded total since the peak of the dot com boom in 2000.

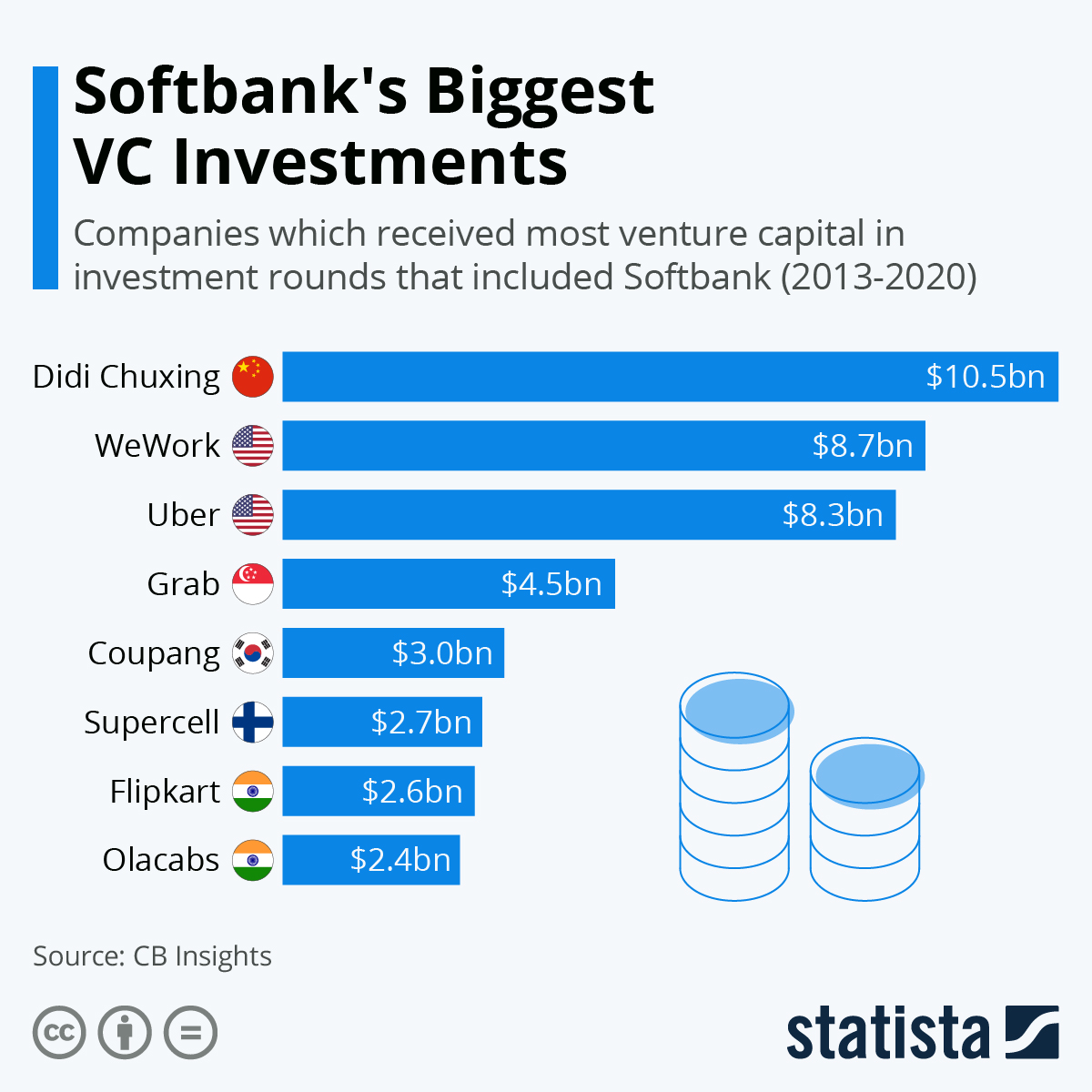

юааchartюаб Softbankтащs Biggest юааvcюаб Investments юааstatistaюаб Here’s the state of vc in six charts. dive deeper with the pitchbook nvca venture monitor. despite a fundraising boom, the market environment is moving sharply away from a startup and founder friendly environment to one that favors investors. that’s according to the pitchbook vc dealmaking indicator, which quantifies how startup friendly. More about statista. u.s. venture capital funding climbed to $55 billion in the first six months of 2019, the second highest recorded total since the peak of the dot com boom in 2000. 3 charts: the us has more startups than vcs can support. by rosie bradbury. published: april 15, 2024. request access to startups data. 2024 may well become the year of the bootstrapped founder. the startup “mass extinction event” that doomsayers have predicted for two years is likely to ramp up in 2024. new founders facing a brutal funding. And the saas industry still reigns supreme—although other industries are gaining ground. here are five charts showing some of the significant sector based trends that have emerged in 2023: 1. the biotech seed market is booming. back in q1 2020, the median pre money valuation for biotech startups raising seed funding on carta was $7 million.

Comments are closed.