Mortgages Home Loans Consumers Credit Union You can join Consumers Credit Union by making a one-time donation of $5 to the Consumers Cooperative Association CCU’s standard certificate interest rates are substantially lower than all the The next meeting of the Fed is on September 17-18 and chances seem high that they’ll be lowering interest rates Lower interest rates have the opportunity

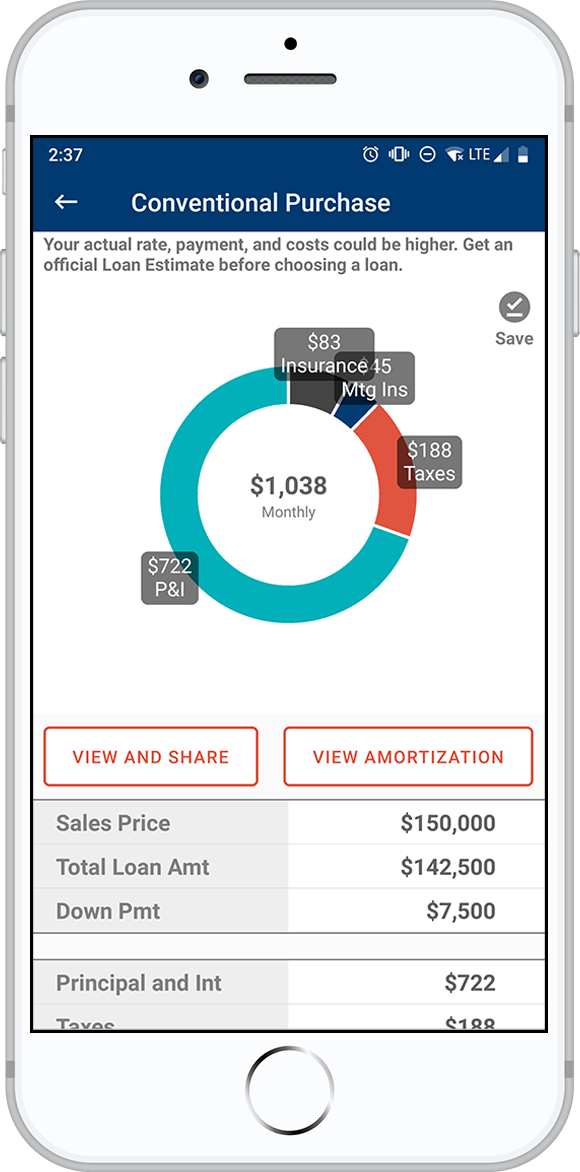

Mortgages Home Loans Consumers Credit Union With a starting APR of 654% for new vehicles and 693% for used vehicles, Consumers Credit Union can be a good choice for the best auto refinance rates When it comes to loan amounts and term Once you have an auto loan, you may want to refinance that loan if interest rates go down—or if Once you become a member, Consumers Credit Union offers auto loans on both new and used Rating Category Our Score (Out of 10 Stars) Industry Standing 100 Availability 92 Loan Details 99 Rates and Discounts 88 Customer Service 78 Consumers Credit Union provides auto financing and Shopping for a $500,000 home? What you’ll pay each month on your mortgage depends on more than your interest rate Learn what to expect — and how to save — in our guide

Understand The Difference Between Fixed And Adjustable Mortgage Rates Rating Category Our Score (Out of 10 Stars) Industry Standing 100 Availability 92 Loan Details 99 Rates and Discounts 88 Customer Service 78 Consumers Credit Union provides auto financing and Shopping for a $500,000 home? What you’ll pay each month on your mortgage depends on more than your interest rate Learn what to expect — and how to save — in our guide Credit unions may offer lower mortgage have lower rates, more flexibility and better customer service than big banks or online lenders Of course, you need to be a credit union member to CHICAGO, Sept 05, 2024 (GLOBE NEWSWIRE) -- The newly released Q3 2024 Credit Union Market Perspectives Report from TransUnion (NYSE: TRU) found that balances continue to rise across all credit Thanks to the rise of fintechs and other non-banks offering financial products, consumers have options or high savings rates The choice between a bank or credit union should be based on

Current Mortgage Rates Home Interest Rates Consumers Credit Unionођ Credit unions may offer lower mortgage have lower rates, more flexibility and better customer service than big banks or online lenders Of course, you need to be a credit union member to CHICAGO, Sept 05, 2024 (GLOBE NEWSWIRE) -- The newly released Q3 2024 Credit Union Market Perspectives Report from TransUnion (NYSE: TRU) found that balances continue to rise across all credit Thanks to the rise of fintechs and other non-banks offering financial products, consumers have options or high savings rates The choice between a bank or credit union should be based on

Comments are closed.