Thinkanswers Net Types Of Credit Reports There’s one more reason why you might have different credit scores with different credit bureaus. if one of your credit reports contains an error, it could affect your credit score. There are a few different vantagescore models, including vantagescore 3.0 and vantagescore 4.0. each of these models uses a different formula to calculate credit scores. vantagescore 3.0 and 4.0 scores range from 300 to 850. and a vantagescore credit score between 661 and 780 is considered a good credit score. source: vantagescore .

Types Of Credit List Of Top 8 Types Of Credit With Explanation While there’s no exact answer to which credit score matters most, lenders have a clear favorite: fico® scores are used in over 90% of lending decisions. while that can help you narrow down. Here’s what you need to know about these two popular credit score types. fico scores. when you apply for a loan, credit card, mortgage, or any other type of financing, there’s a good chance. Fico ® scores have been updated to reflect this change in behavior. if we didn't, seemingly normal credit usage today would be considered a higher risk than in years past.the result is that there are multiple fico score versions available, in addition to the most widely used version, fico score 8. experian. equifax. General fico ® scores range from 300 to 850, and so do vantagescore 3.0 and 4.0 scores. but industry focused fico ® scores range from 250 to 900, and vantagescores 1.0 and 2.0 range from 501 to 990. even though the precise number of the ranges might vary, in practice, the differences aren't major: the higher your credit score, the better.

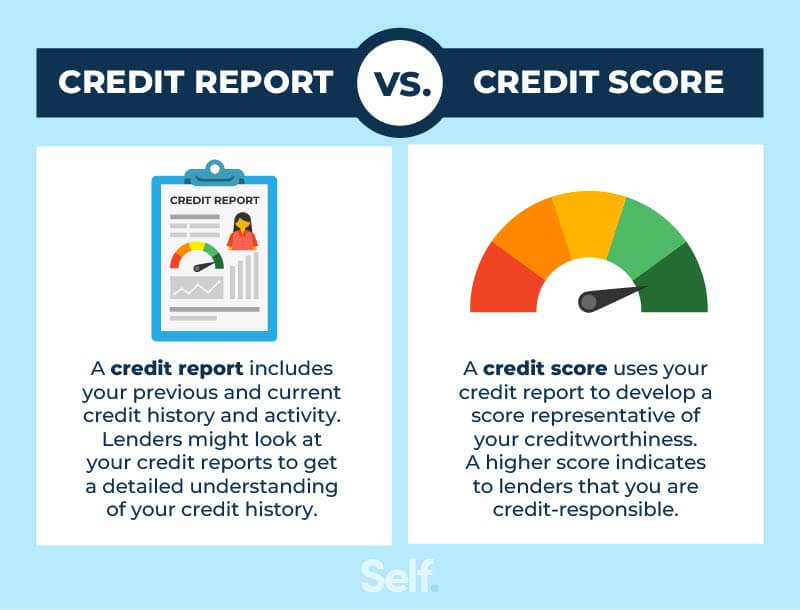

Credit Report Example How To Read And Understand Yours Self Fico ® scores have been updated to reflect this change in behavior. if we didn't, seemingly normal credit usage today would be considered a higher risk than in years past.the result is that there are multiple fico score versions available, in addition to the most widely used version, fico score 8. experian. equifax. General fico ® scores range from 300 to 850, and so do vantagescore 3.0 and 4.0 scores. but industry focused fico ® scores range from 250 to 900, and vantagescores 1.0 and 2.0 range from 501 to 990. even though the precise number of the ranges might vary, in practice, the differences aren't major: the higher your credit score, the better. A fico score is a credit score model from the fair isaac corporation that lenders have used since 1989 to assess the credit risk of individual consumers. fico scores are three digit numbers, which. There are four main ways to get your credit score: check your credit or loan statements. talk to a credit or housing counselor. find a credit score service. buy your score from one of the three major credit reporting agencies: equifax, experian, or transunion. learn more from the consumer financial protection bureau (cfpb) about each method of.

Types Of Credit That You Should Have For Your Business Reality Paper A fico score is a credit score model from the fair isaac corporation that lenders have used since 1989 to assess the credit risk of individual consumers. fico scores are three digit numbers, which. There are four main ways to get your credit score: check your credit or loan statements. talk to a credit or housing counselor. find a credit score service. buy your score from one of the three major credit reporting agencies: equifax, experian, or transunion. learn more from the consumer financial protection bureau (cfpb) about each method of.

The 3 Main Types Of Credit Explained Self Credit Builder

Comments are closed.