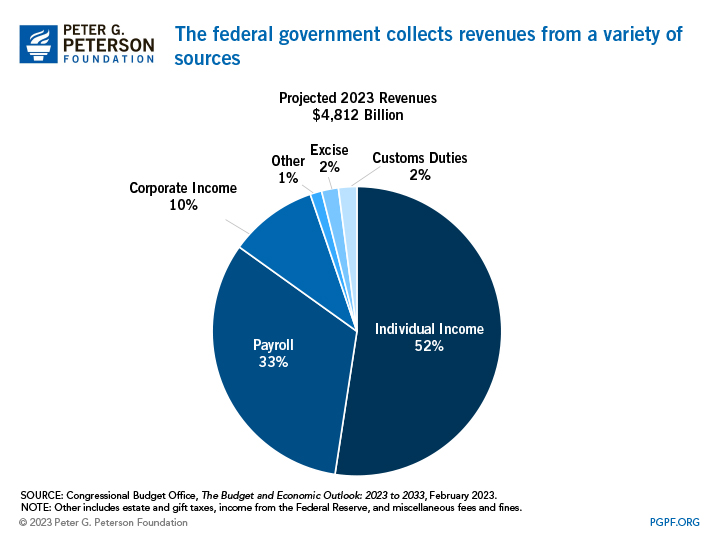

The U S Corporate Tax System Explained The economic evidence suggests that in the long run, workers and consumers, rather than shareholders, bear a sizable share of the corporate tax burden. reviewing some of this evidence in greater detail shows that many vulnerable groups would likely be impacted by these corporate tax changes. in a large study of german municipalities over a 20. The reality: the federal government collected about $230 billion in corporate taxes in 2019, about 6.5 percent of federal revenues in 2019. that’s down from 9 percent of federal revenue in 2017, before passage of the tax cuts and jobs act (tcja). the share of federal tax revenues from the corporate income tax has been dropping for decades.

Impact Of 2018 Tax Reform On Corporations Pass Through Entities First, corporations do not pay any corporate tax — individuals do. that is because companies pass on their costs. some of the tax is paid by consumers, who pay higher prices. company employees. Here is a tax trick you hear all the time: we shouldn't tax corporations because they just "pass the taxes along to customers." go to any of the usual anti tax, anti government sites and you'll see them trying to trick people with this. this post was published on the now closed huffpost contributor platform. contributors control their own work. President obama ’s top economist, austan goolsbee, said that debates over who pays the corporate tax are “an argument about whether making corporations pay more income taxes would trickle down. The corporate income tax. a tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. provides a good example of the importance of tax incidence. tax incidence is a measure of who ultimately pays a tax, either.

Comments are closed.