Distributional Impact Of The Tax Cuts And Jobs Act Over The Next Decad The tax cuts and jobs act (tcja) reduced tax rates on both business and individual income, and enhanced incentives for investment by firms. those features most likely have raised output in the short run and will continue to do so in the long run, but most analysts estimate the modest effects offset only a portion of revenue loss from the bill (table 1). Introduction. on november 2, 2017, chairman kevin brady (r tx) of the house committee on ways and means released a tax reform plan, known as the house tax cuts and jobs act. the plan would reform the individual income tax code by lowering tax rates on wages, investment, and business income; broadening the tax base; and simplifying the tax code.

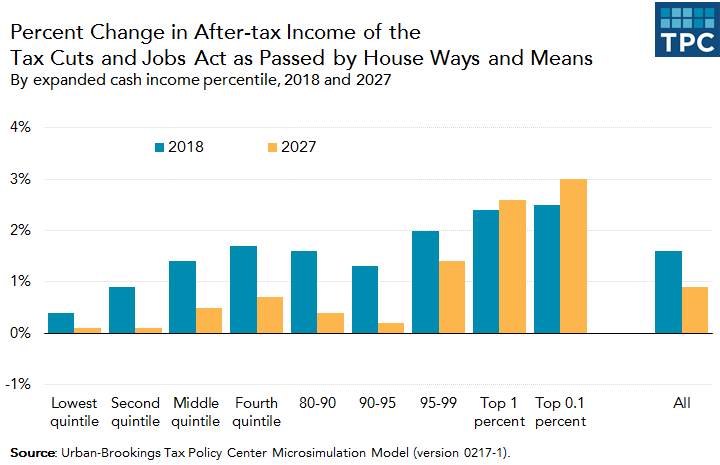

Distributional Consequences Of The Tax Cuts And Jobs Act Econbrowser In “ effects of the tax cuts and jobs act: a preliminary analysis ” (pdf), william gale, hilary gelfond, aaron krupkin, mark j. mazur, and eric toder summarize the provisions of the bill and. This paper examines the tax cuts and jobs act (tcja) of 2017, the largest tax overhaul since 1986. the new tax law makes substantial changes to the rates and bases of both the individual and corporate income taxes, cutting the corporate income tax rate to 21 percent, redesigning international tax rules, and providing a deduction for pass through income. A. the tax cuts and jobs act made significant changes to individual income taxes and the estate tax. almost all these provisions expire after 2025. the tax cuts and jobs act (tcja) made substantial changes to tax rates and the tax base for the individual income tax. the major provisions follow, excluding those that only affect business income. A major rewrite of the federal tax code awaits the winners of the upcoming 2024 elections. unless congress passes new legislation, the 2017 tax cuts and jobs act (tcja) individual income and estate tax provisions will expire after 2025. lawmakers may also seek to alter business tax deductions made less generous by the tcja to offset the cost of.

Comments are closed.