Gross Income Part 1 Module 1 Of 5 Youtube Visit us at lawshelf to earn college credit for only $20 a credit! we now offer multi packs, which allow you to purchase 5 exams for the price of. Module 1: gross income, part 1 . overview of federal income taxation. the internal revenue code, or title 26 of the united states code, sets forth the statutory basis for federal tax law. in addition to these statutes, “tax law” includes many other sources of law that clarify the relevant statutes.

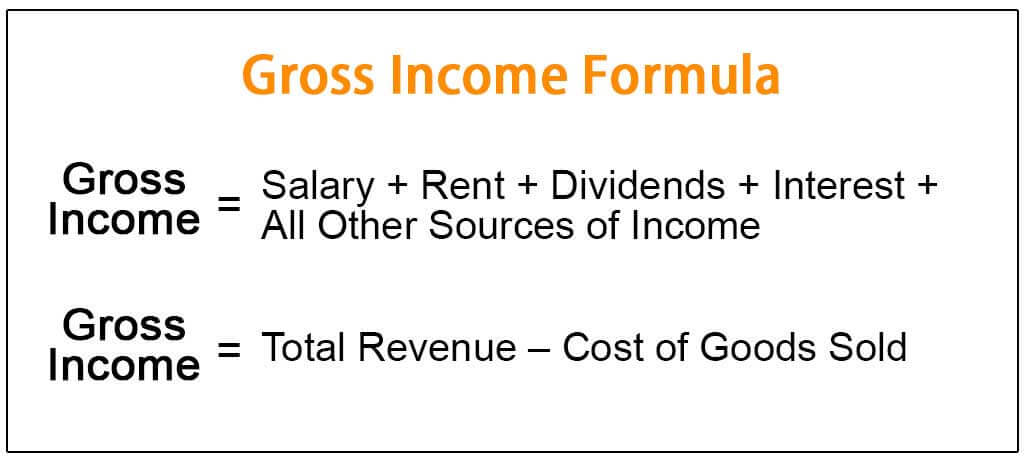

Guide To Gross Income Vs Net Income Income tax n6 (calculation of tax liability natural persons gross income part 1) presentationreference november 2016 exam question paper. Instructions 1. select a case from the module two adjusted gross income list found in the supporting materials section of the module two adjusted gross income assignment guidelines andrubric. 2. research the topic using the tax research guide found in the supporting materials section of the module two adjusted gross income assignment guidelines. Gross income. all income from whatever source derived, cash, property (fmv), or services obtained, regardless of if it was "earned". noncash income, is recognized at the fmv as income. realization. the accrual or receipt of cash, property, or services, or a change in the form or the nature of the investment (a sale or exchange) recognition. Part i – income tax: module 1: initial pages : chapter 1 basic concepts: chapter 2 residence and scope of total income: chapter 3 incomes which do not form part of total income: module 2: initial pages : chapter 4 heads of income unit 1: salaries; unit 2: income from house property; unit 3: profits and gains of business or profession; unit 4.

Comments are closed.