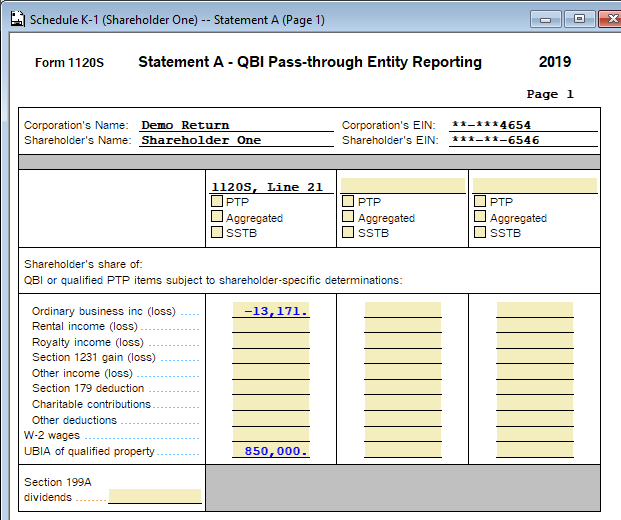

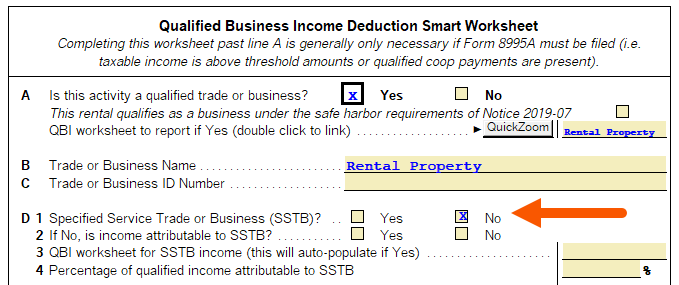

How To Enter And Calculate The Qualified Business Income Deduction Individual returns, schedule e. enter income and expenses within the schedule following your normal workflow. scroll down to the bottom of the schedule to review the qualified business income deduction smart worksheet. check yes to is this activity a qualified trade or business to activate the qbi calculations. Purpose of form. use form 8995 to figure your qualified business income (qbi) deduction. individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20% of their net qbi from a trade or business, including income from a pass through entity, but not from a c corporation, plus 20% of qualified real estate investment trust (reit) dividends and qualified publicly.

How To Enter And Calculate The Qualified Business Income Deduction You only need to enter this explanation on one activity in the aggregation. enter explanation of change in aggregation from prior year, if applicable. all rentals: you will need to enter a 1 in business is a qualified trade or business: 1=yes, 2=no [o] to force the qbi calculation. back to table of contents. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi) deduction – also called the section 199a deduction – for tax years beginning after december 31, 2017. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20. The qualified business income deduction (qbi) is a tax deduction that allows eligible self employed and small business owners to deduct up to 20% of their qualified business income on their taxes. This worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider, including the application of the qualified business income (qbi) deduction. the best tax strategies may include a combination of business entities to optimize the tax results for the taxpayer. qbi entity selection calculator.

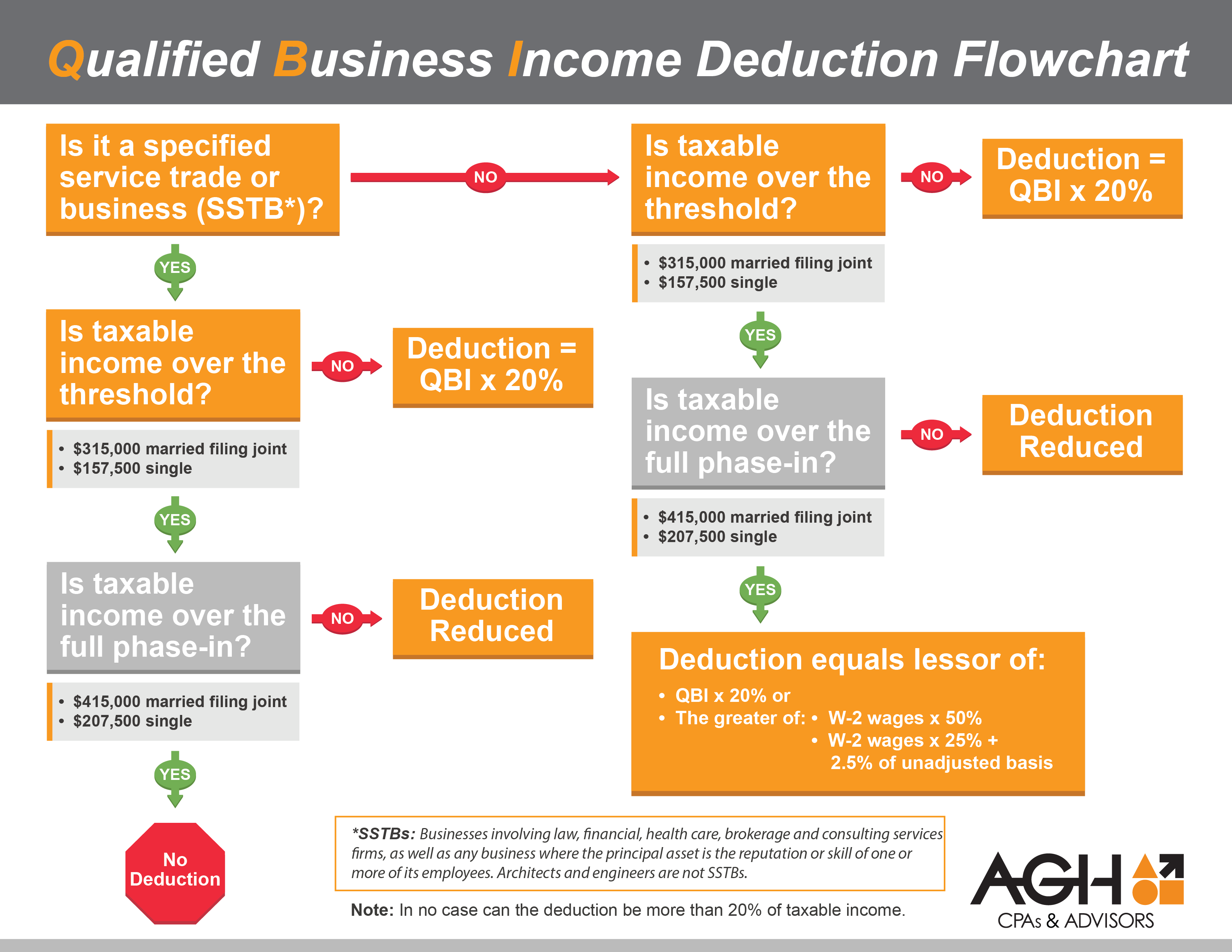

How To Enter And Calculate The Qualified Business Income Deduction The qualified business income deduction (qbi) is a tax deduction that allows eligible self employed and small business owners to deduct up to 20% of their qualified business income on their taxes. This worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider, including the application of the qualified business income (qbi) deduction. the best tax strategies may include a combination of business entities to optimize the tax results for the taxpayer. qbi entity selection calculator. Married filing separately. $160,725. $163,300. here’s an example: your taxable income is $150,000, of which $60,000 is qbi. you simply multiply qbi ($60,000) by 20% to figure your deduction. Exception 1: if your 2023 taxable income before the qbi deduction is less than or equal to $182,100 if single, head of household, qualifying surviving spouse, or are a trust or estate, or $364,200 if married filing jointly, your sstb is treated as a qualified trade or business. exception 2: if your taxable income before the qbi deduction.

Qualified Business Income Deduction Flowchart Married filing separately. $160,725. $163,300. here’s an example: your taxable income is $150,000, of which $60,000 is qbi. you simply multiply qbi ($60,000) by 20% to figure your deduction. Exception 1: if your 2023 taxable income before the qbi deduction is less than or equal to $182,100 if single, head of household, qualifying surviving spouse, or are a trust or estate, or $364,200 if married filing jointly, your sstb is treated as a qualified trade or business. exception 2: if your taxable income before the qbi deduction.

Comments are closed.