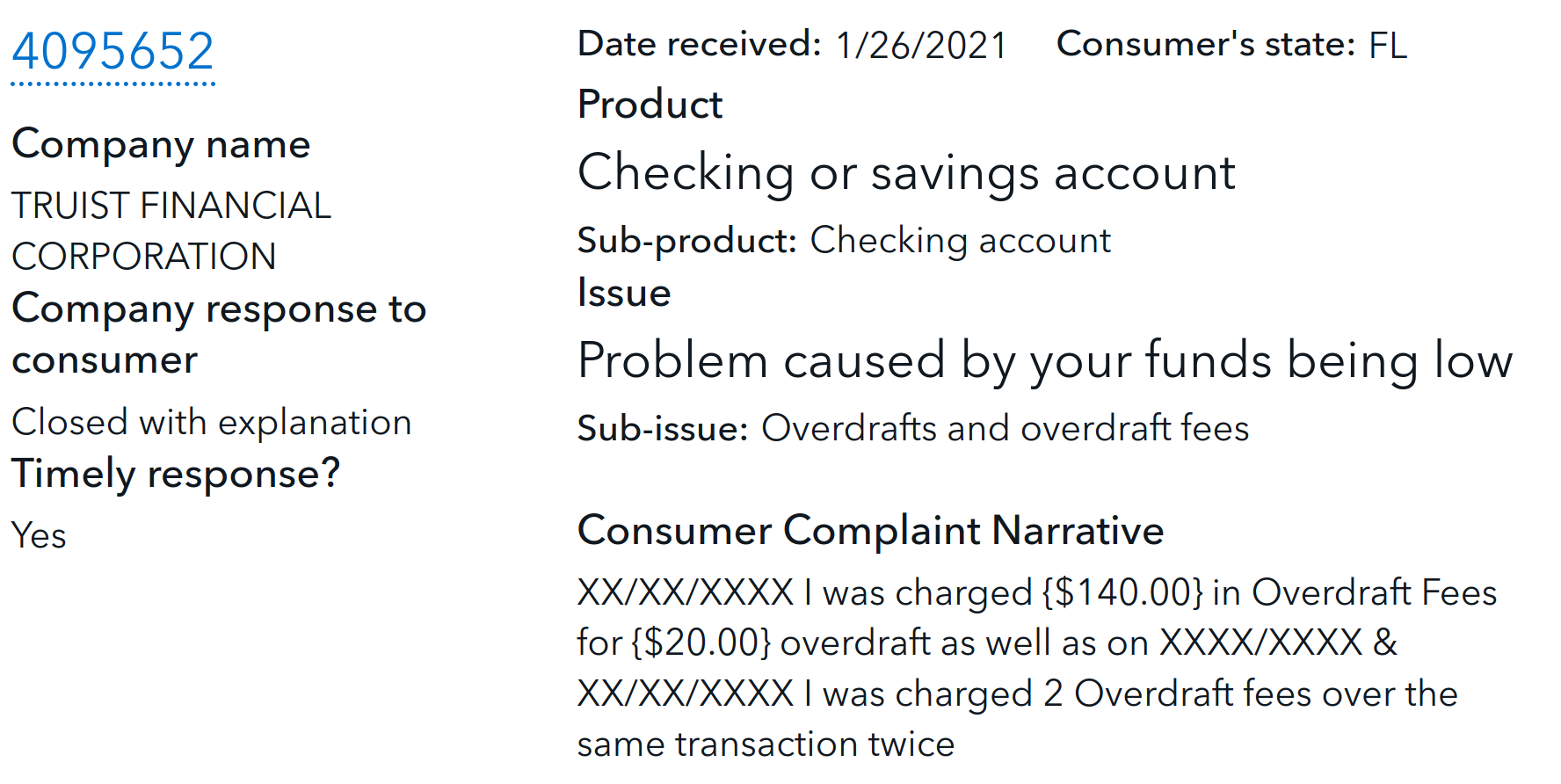

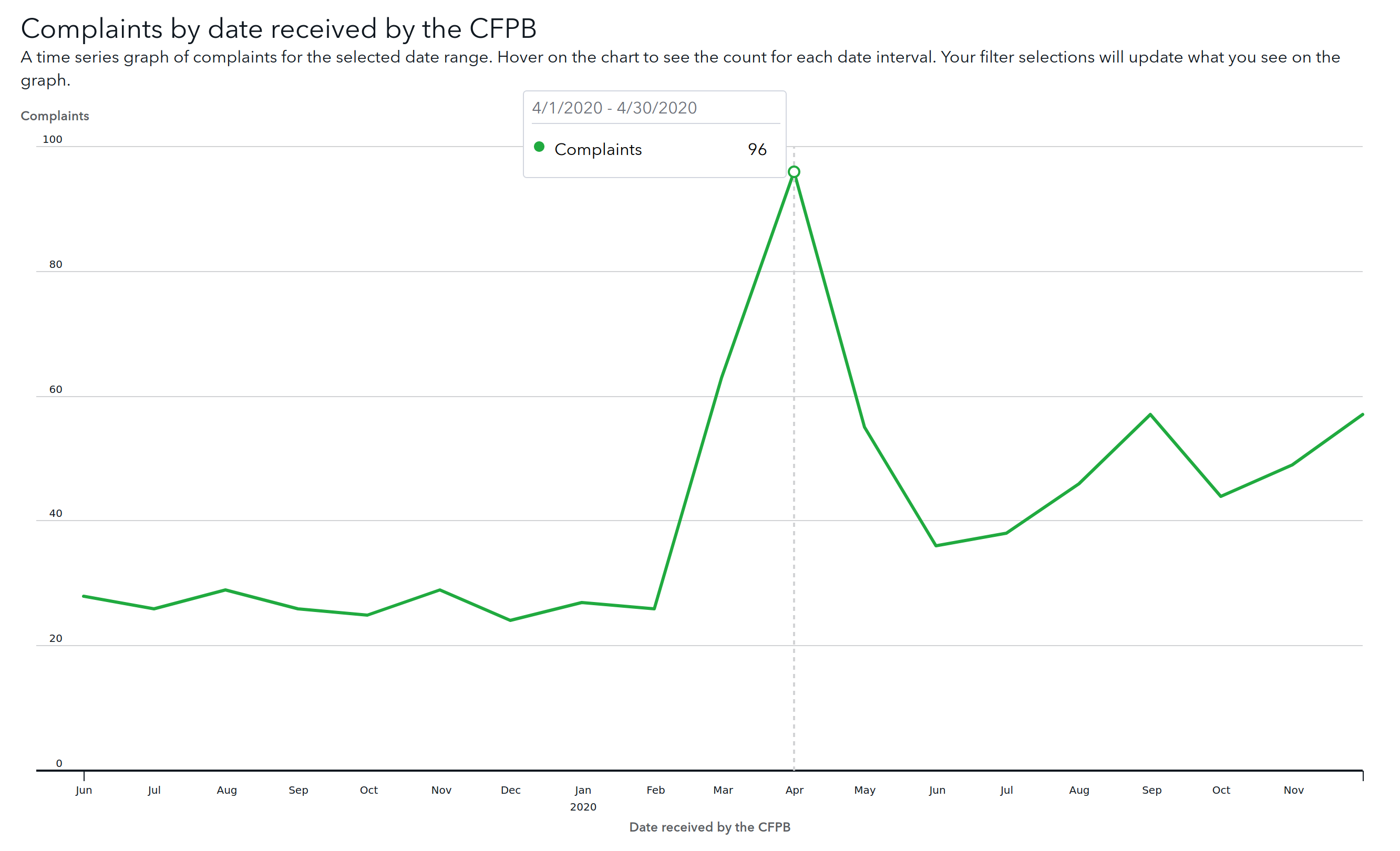

How To Explore Consumer Problems In The Financial Marketplace Using The Artificial intelligence (ai) technology has transformed the consumer financial services market and how consumers interact with the financial services ecosystem. this paradigm shift has been driven. Seniors are hesitant to use financial technology as they navigate through the financial marketplace due to a lack of knowledge regarding the technology available to them, fear of this technology, reluctance to change the status quo, and a lack of trust in regards to how this financial technology operates. this paper will focus on those who are.

How To Explore Consumer Problems In The Financial Marketplace Using The Consumer issues refer to a wide range of problems that consumers may encounter in the process of purchasing, using, or disposing of goods and services. these problems may include: deceptive advertising; poor product quality; hidden charges; unfair contracts; predatory lending; dangerous or defective products; breaches of consumer warranties;. Consumers, then, have benefitted through a combination of improved access to financial services, convenience, and greater selection. at the same time, as with all innovation, the increased use of technology is giving rise to new risks, risks that if unchecked, can become systemic and put into question the stability of the global financial system. The consumer base is increasingly diverse. the current consumer base has evolved in the cross currents of a set of broader demographic trends that have turned what was a homogeneous mass market into a heterogeneous marketplace, consisting of multiple competitive options to choose from. The number of consumers shopping online at least monthly on a personal computer dipped slightly over the past year, from 56% in our april 2021 survey to 51% this year. meanwhile, the proportion of consumers who regularly shop online via their phone was flat year over year at 49%. at the same time, the number of consumers shopping in a physical.

How To Explore Consumer Problems In The Financial Marketplace Using The The consumer base is increasingly diverse. the current consumer base has evolved in the cross currents of a set of broader demographic trends that have turned what was a homogeneous mass market into a heterogeneous marketplace, consisting of multiple competitive options to choose from. The number of consumers shopping online at least monthly on a personal computer dipped slightly over the past year, from 56% in our april 2021 survey to 51% this year. meanwhile, the proportion of consumers who regularly shop online via their phone was flat year over year at 49%. at the same time, the number of consumers shopping in a physical. Biggest consumer behavior shifts. 1. consumers are warming up to purchasing products through social media apps. in may 2022, only 12% of consumers preferred purchasing products through social media apps like instagram shop or facebook marketplace. in the past three months, 41% of social media users have shared that they feel comfortable. Consumer businesses that market exclusively to younger consumers are thus missing out; they ignore wealthy aging consumers at their own risk. 3. the squeezed but splurging middle. we expect that cost of living increases in advanced economies will continue to put pressure on middle income consumers.

Ppt Lesson 4 Common Consumer Problems Powerpoint Presentation Free Biggest consumer behavior shifts. 1. consumers are warming up to purchasing products through social media apps. in may 2022, only 12% of consumers preferred purchasing products through social media apps like instagram shop or facebook marketplace. in the past three months, 41% of social media users have shared that they feel comfortable. Consumer businesses that market exclusively to younger consumers are thus missing out; they ignore wealthy aging consumers at their own risk. 3. the squeezed but splurging middle. we expect that cost of living increases in advanced economies will continue to put pressure on middle income consumers.

Comments are closed.