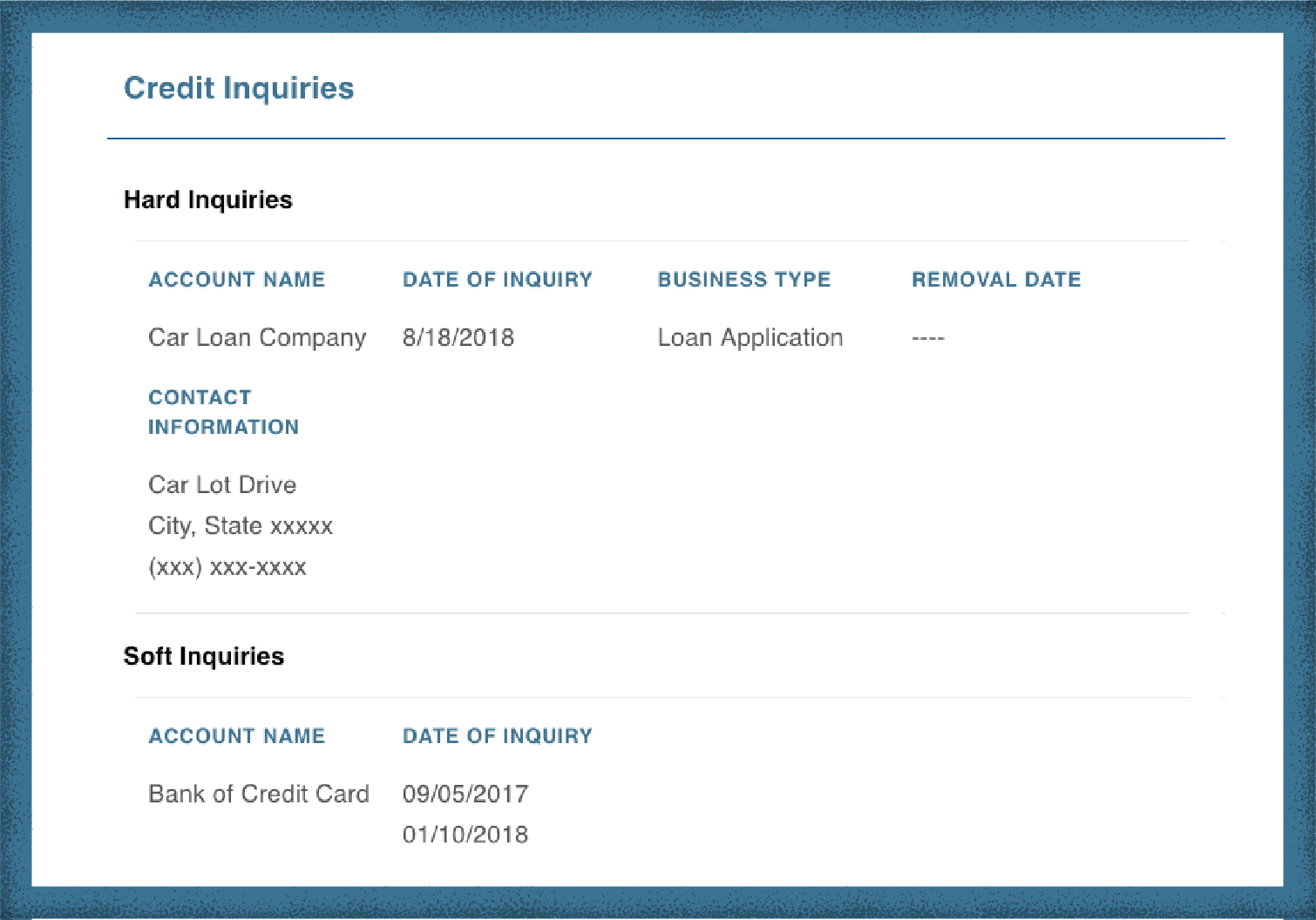

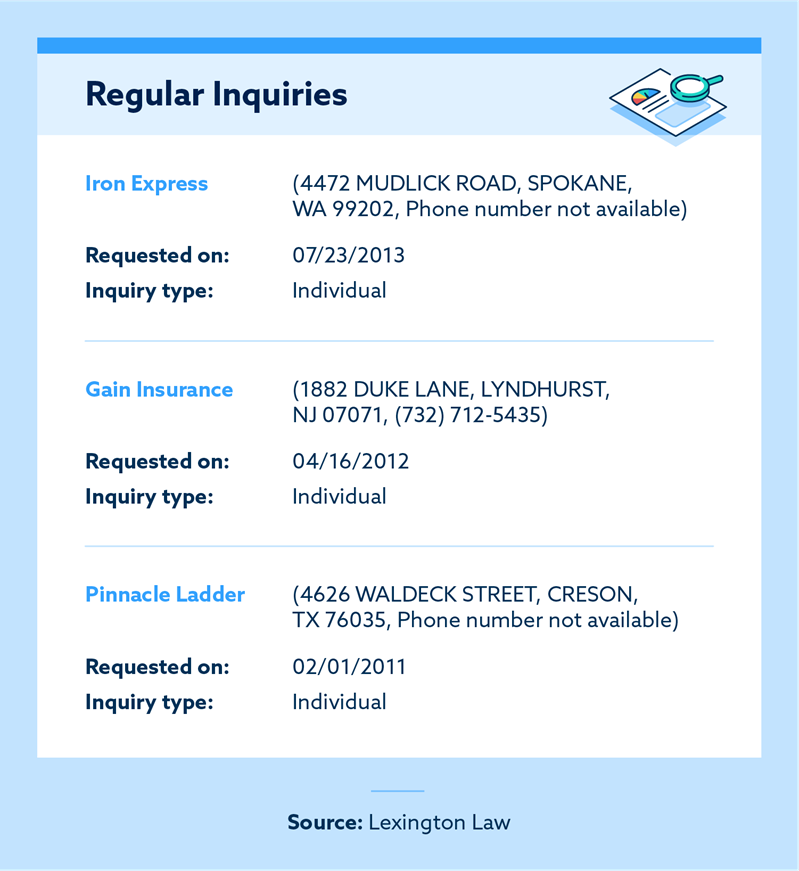

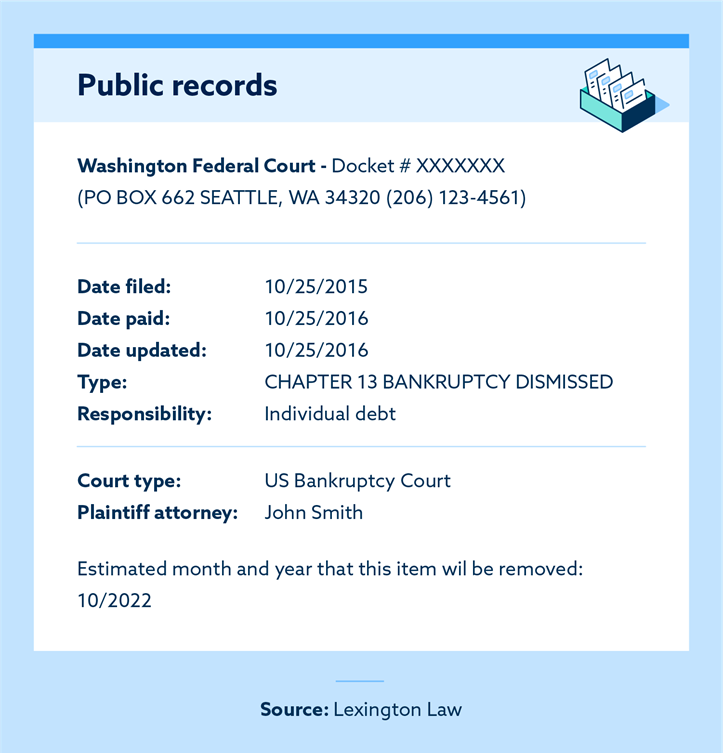

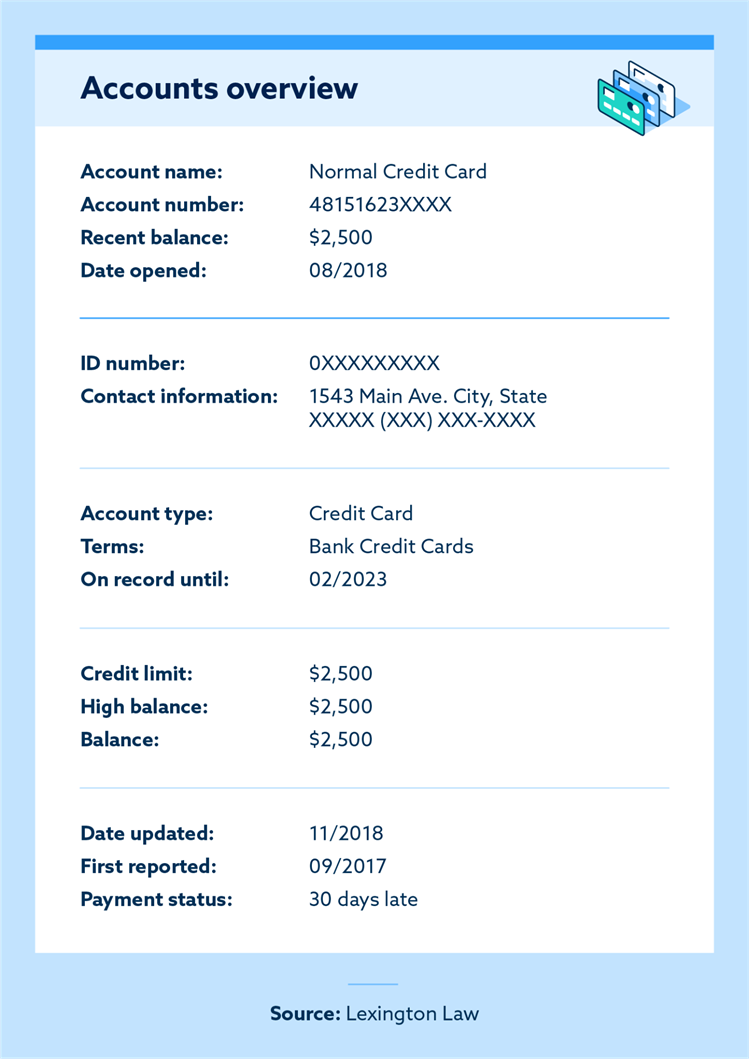

How To Read Your Credit Report Lexington Law A credit report breaks down your credit history into five main sections: personal information, public records, credit inquiries, account information and consumer statements. while a credit score offers a high level overview of your current financial standing, a credit report offers an in depth look at your lending history. Credit reports are important because they provide the basis for your credit score, which is used by lenders to make decisions about whether to offer you a loan or credit card. each of the five factors that are used to determine your credit score can be traced back to information in your credit report. here’s how your score is calculated.

How To Read A Credit Report Lexington Law There’s no way to predict in advance how long it will take to repair your credit, as every credit report is unique. however, last year alone, lexington law clients saw over 4 million removals on their credit reports, and typically stayed with us for six months. learn more about the credit repair timeline. learn more about how we count removals. A credit report is a detailed summary of your credit history. it includes key details such as your payment history, account balances, credit checks and any public records like bankruptcies. credit reports are compiled by the three major credit bureaus: equifax, experian, and transunion. these agencies gather and organize data from your. Credit report analysis lexington law pulls and reviews your credit reports. experienced professionals will strategize and create a plan on how to dispute negative items affecting your credit. credit disputing lexington law disputes inaccurate items and corresponds with equifax, experian, and transunion on your behalf. dispute escalating. Lexington law vs. credit saint. credit saint offers three service packages ranging from $79.99–$129.99 per month. the $99.99 credit remodel plan is most similar to lexington law’s suite of.

How To Read A Credit Report Lexington Law Credit report analysis lexington law pulls and reviews your credit reports. experienced professionals will strategize and create a plan on how to dispute negative items affecting your credit. credit disputing lexington law disputes inaccurate items and corresponds with equifax, experian, and transunion on your behalf. dispute escalating. Lexington law vs. credit saint. credit saint offers three service packages ranging from $79.99–$129.99 per month. the $99.99 credit remodel plan is most similar to lexington law’s suite of. Excluding the lex ontrack plan, which doesn’t really offer anything of value, the minimum monthly charge that you’ll be looking at is $89.95. moreover, if you want the full works, which you might need if your credit score is really adverse, then you’ll likely need to go for the top tier package at $129.95 per month. Lexington law offers a single credit repair package for $99.95. the company's services include disputing unfairly reported items or inaccurate information with the credit bureaus, creditor intervention letters and up to $1m identity theft insurance. you also get personalized strategies on how to improve your credit score.

How To Read A Credit Report Lexington Law Excluding the lex ontrack plan, which doesn’t really offer anything of value, the minimum monthly charge that you’ll be looking at is $89.95. moreover, if you want the full works, which you might need if your credit score is really adverse, then you’ll likely need to go for the top tier package at $129.95 per month. Lexington law offers a single credit repair package for $99.95. the company's services include disputing unfairly reported items or inaccurate information with the credit bureaus, creditor intervention letters and up to $1m identity theft insurance. you also get personalized strategies on how to improve your credit score.

How To Read A Credit Report Lexington Law

Comments are closed.