W1 Module 1 General Principles And Concepts Of Taxation Taxођ Module 1: general principles and concepts of taxation income taxation. we have two types of government tax collected in the philippines; local taxes and national taxes which include donor taxes, land taxes, value added taxes and income taxes. The government. true. taxation is a process or means by which the sovereign, through its. law making body raises income to defray the expenses of the. government. true. eminent domain may be exercise even by public service corporations and public entities. true. police power regulates both liberty and property.

Summary Of Income Taxation Module 1 вђњgeneral Principles Of Income taxation. module 1: principles of taxation. 1.1: nature, scope, classification and essential characteristics of taxation. taxation refers to the practice of government collecting money from its citizens to defray government's cost of operations for public services. Income taxation module 1 general principles and concepts of taxation copy 1 free download as pdf file (.pdf), text file (.txt) or read online for free. taxation income taxation module 1 general principles and concepts of taxation copy 1. Income tax. b. indirect tax – the incidence of or liability for payment of the tax falls on one person but the burden thereof can be shifted or passed on to another e. vat. c. as to purpose: a. general tax – levied for the general or ordinary purpose of the government. b. special tax – levied for special purpose. d. as to measure of. Study with quizlet and memorize flashcards containing terms like taxation, nature of taxation, nature of taxation and more. scheduled maintenance: june 26, 2024 from 09:00 pm to 11:00 pm hello quizlet.

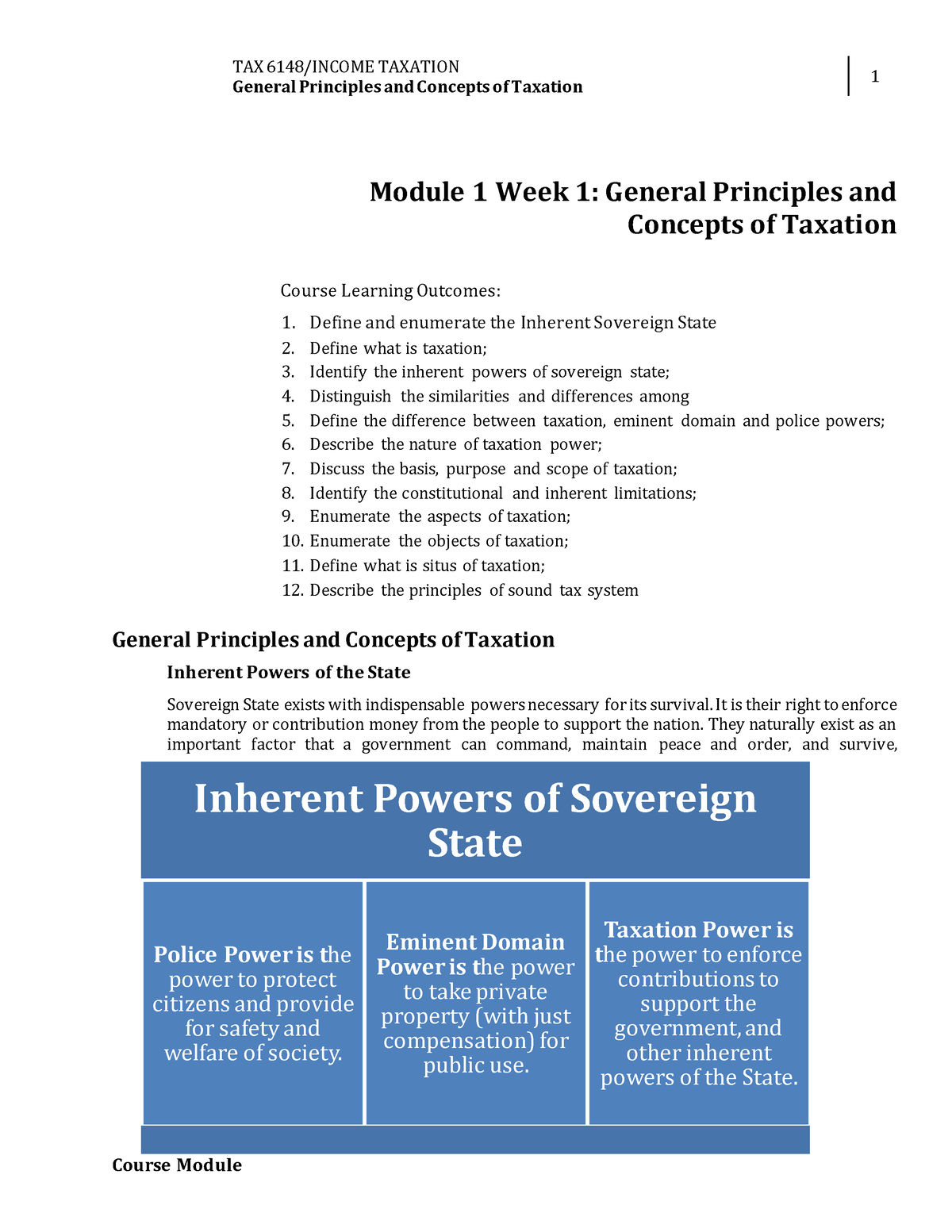

W1 Module 1 General Principles And Concepts Of Taxationnnn Tax 6 Income tax. b. indirect tax – the incidence of or liability for payment of the tax falls on one person but the burden thereof can be shifted or passed on to another e. vat. c. as to purpose: a. general tax – levied for the general or ordinary purpose of the government. b. special tax – levied for special purpose. d. as to measure of. Study with quizlet and memorize flashcards containing terms like taxation, nature of taxation, nature of taxation and more. scheduled maintenance: june 26, 2024 from 09:00 pm to 11:00 pm hello quizlet. 1 the ability to pay principle. tz 2 income is considered to be an indicator of an individual or company’s economic performance. thus, one of the main principles of income taxation is that of measuring an individual’s ability to pay, and so the income tax act (ita) regulates which types of accretion of wealth are deemed to be income and. This chapter presents an overview of the various types of taxation, the basic concepts important to the evaluation and understanding of taxation, and an introduction to alternate business forms and taxable entities. these serve as a backdrop to the more detailed provisions of income tax law that follow in subsequent chapters.

Comments are closed.