Market Insights Tax Reform And Stocks Fisher Investments It proposes replacing the flat 21% corporate tax rate with a graduated scale that ranges from 18% to 26.5% for businesses earning over $5 million annually—topping out higher than the 25% proposed by moderate senate democrats, but below president joe biden’s preferred 28%. it raises the tax rate on corporations’ overseas earnings but also. For more market insights from fisher investments, read our latest articles. investing in securities involves a risk of loss. past performance is never a guarantee of future returns. the results for individual portfolios and for different periods may vary depending on market conditions and the composition of the portfolio.

Macro Insights Q3 2022 Fisher Investments Institutional Group Europe Providing succinct, entertaining and savvy thinking on global capital markets. our goal is to provide discerning investors the most essential information and commentary to stay in tune with what's happening in the markets, while providing unique perspectives on essential financial issues. and just as important, fisher investments marketminder. In this episode, fisher investments’ senior vice president of research aaron anderson chats with naj srinivas about our outlook for capital markets in 2024. Research reports published by fisher investments. each quarter, the investment policy committee publishes an independent investment research report called the stock market outlook. this timely investment research report includes detailed analysis of the current investing climate and the underlying market, economic, and political factors driving it. Fisher investments charges a fee based on the total amount of assets it manages on your behalf. additionally, the company will charge you between $7 $10 per trade (this is a pass through commission that goes to its broker). the fees range from 1–1.5%, depending on the size of your account.

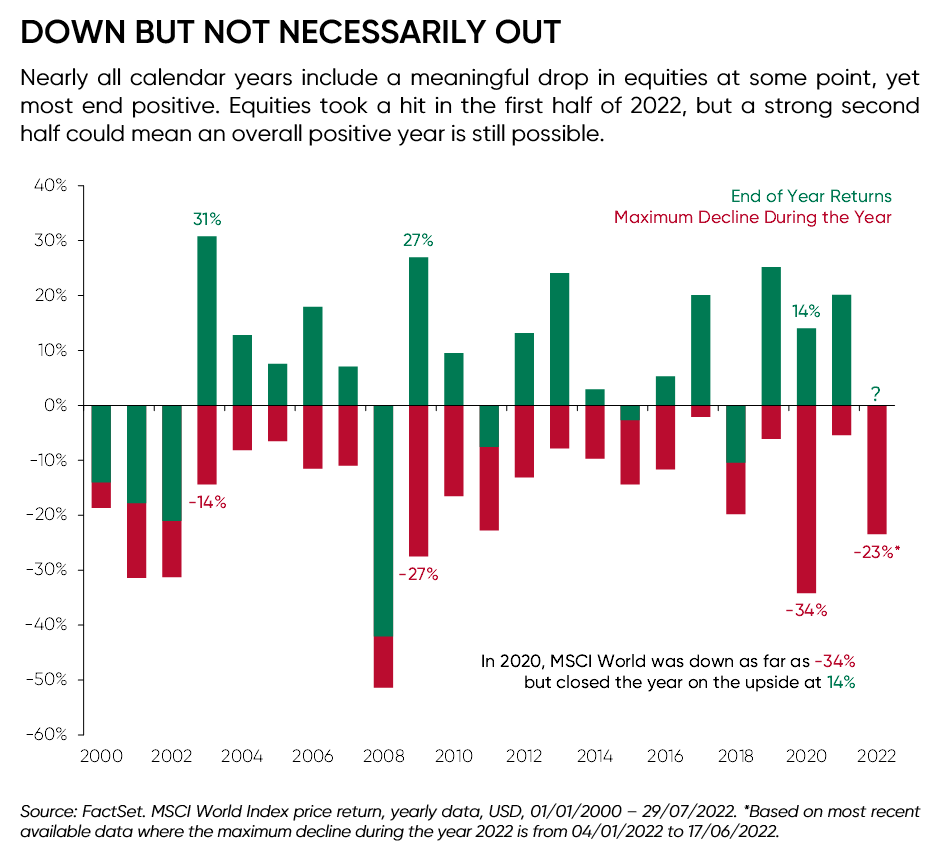

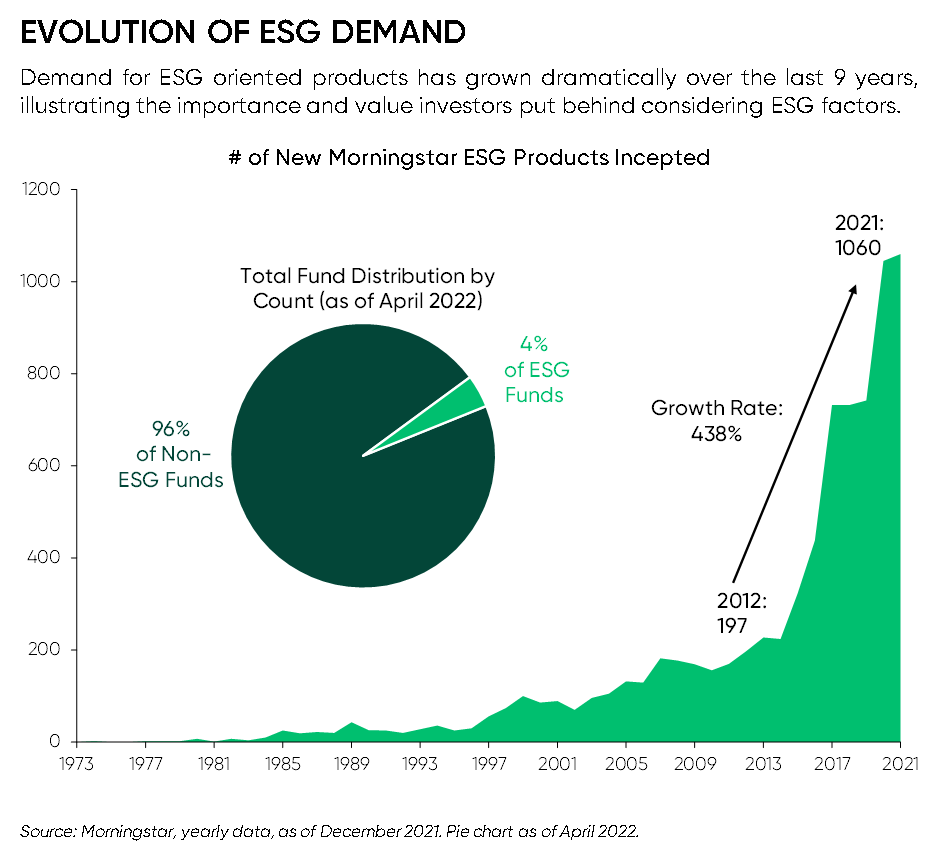

Esg Insights 2022 Fisher Investments Institutional Group Europe Research reports published by fisher investments. each quarter, the investment policy committee publishes an independent investment research report called the stock market outlook. this timely investment research report includes detailed analysis of the current investing climate and the underlying market, economic, and political factors driving it. Fisher investments charges a fee based on the total amount of assets it manages on your behalf. additionally, the company will charge you between $7 $10 per trade (this is a pass through commission that goes to its broker). the fees range from 1–1.5%, depending on the size of your account. In all cases, while the timing is impossible to pinpoint, we think the conditions are ripe for a new bull market to get cooking in 2023. stocks’ three main drivers—politics, economics and sentiment—point positively. politically, the presidential cycle’s third year supports better than average returns. Fisher investments charges an assets under management (aum) fee to run your portfolio. the fee is a percentage of the total amount you invest with fisher investments, and it depends on the size of.

Comments are closed.