Multi State Pass Through Entities A Guide For Navigating Federal At this point, close to 30 states have implemented a form of pass through entity tax (ptet) which seeks to allow individuals a workaround for the cap on state and local tax deductions. the benefits and burdens differ drastically from state to state and keeping track of this is imperative for passthrough business. learning objectives:. If the pte does not elect the ptet, the taxpayer pays state tax at a rate of 7.65%, or a total of $38,250. if the pte elects the ptet the entity pays tax at a rate of 7.9%, or a total of $39,500. the pte reduces federal taxable income passed to the owner by this amount.

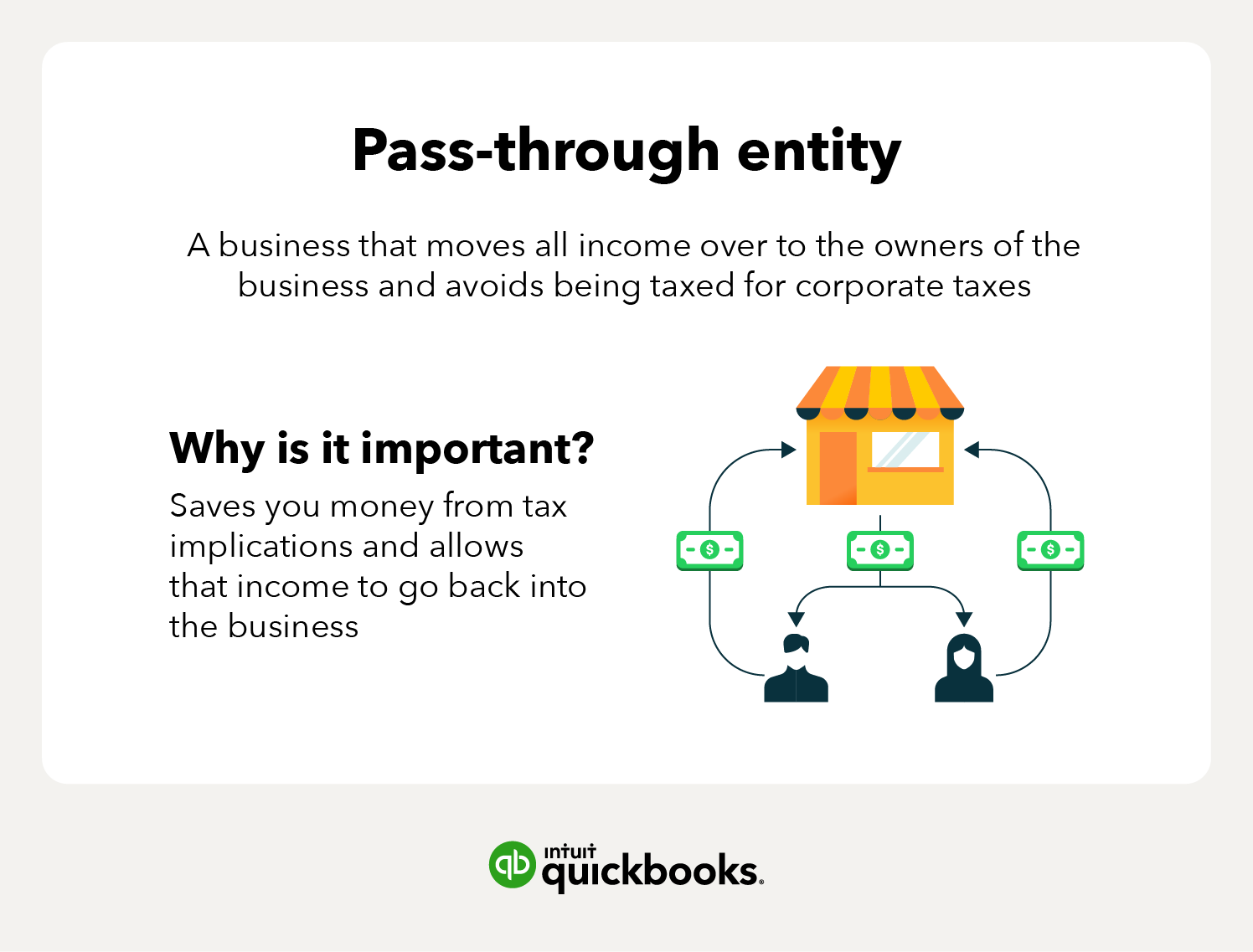

Pass Through Entity Definition And Types To Know Quickbooks Federal implications of passthrough entity tax elections. • the law known as the tax cuts and jobs act, p.l. 115 97, imposed a $10,000 limitation on individuals’ deduction of state and local taxes (salt) for tax years 2018 through 2025. • in notice 2020 75, the irs announced forthcoming regulations under which partnerships and s. The $100,000 of pass through income is reduced by the owner's state taxes of $5,000. therefore, you are only taxed at the federal level on $95,000 of pass through income. assuming a 25% tax bracket, this saves the owner $1,250 in federal income taxes. these benefits are amplified at higher income levels and tax rates. The defining characteristic of a pass through entity (pte), for tax purposes, is how it “passes” its income through to its owners to be taxed on their respective returns, rather than at the entity level. this is generally true for both federal and state purposes. an owner would thus pay both federal and state tax on their distributive share. The amount of state tax paid becomes a deduction reducing ordinary income for federal income tax purposes, very much in the same way local taxes or payroll taxes offset ordinary income. by lowering the ordinary income, the respective shareholders partners report less pass through income on their federal tax returns, effectively deducting the.

Comments are closed.