New U S Construction Sector Report Reveals Trends And Expectations The u.s. construction sector accounts for roughly 25 percent of all commercial trucks and truck equipment sold. the report segments the sector into industry groups and specific industries, and details how the structure of the sector has changed since the 2007–2009 recession. Firms anticipate adding workers in 2024 to accommodate the higher demand for projects. more than two thirds (69 percent) of the responden. s expect to add to their headcount, compared to only 10 percent who expect a decrease. while just under half (47 percent) of firms expect to increase.

New U S Construction Sector Report Reveals Trends And Expectations Construction industry growth rate. the construction market is projected to grow from $10,436.02 billion in 2023 to $16,108.43 billion by 2030, with a compound annual growth rate (cagr) of 5.9% from 2024 to 2030. specifically, the construction market in north america is likely to experience significant growth. Tinues to exert a consistent efect on construction costs. industry experts note that material costs, a significant element of. the cci, remain elevated compared to pre pandemic levels. these costs are expected to stay high in 20. stained demand in the construction sector.trending down:in 2024, the construction sector anticipates a persistent i. According to bls data, average hourly wages increased by 5.2% year over year to us$36.70 in august 2023 and around 17% since the beginning of the pandemic lockdowns in march 2020 (figure 3). 43 construction wages are expected to experience upward pressure in 2024 as labor demand continues to outpace supply. The federal open market committee (fomc) continues fine tuning interest rates to return inflation to the targeted 2% range. the cbre construction cost index showed a decline in annual escalation compared to the record high 2022. 2023 concluded at 4.9% (± 2%). this is still higher than the industry pre covid average of 2 5% per year.

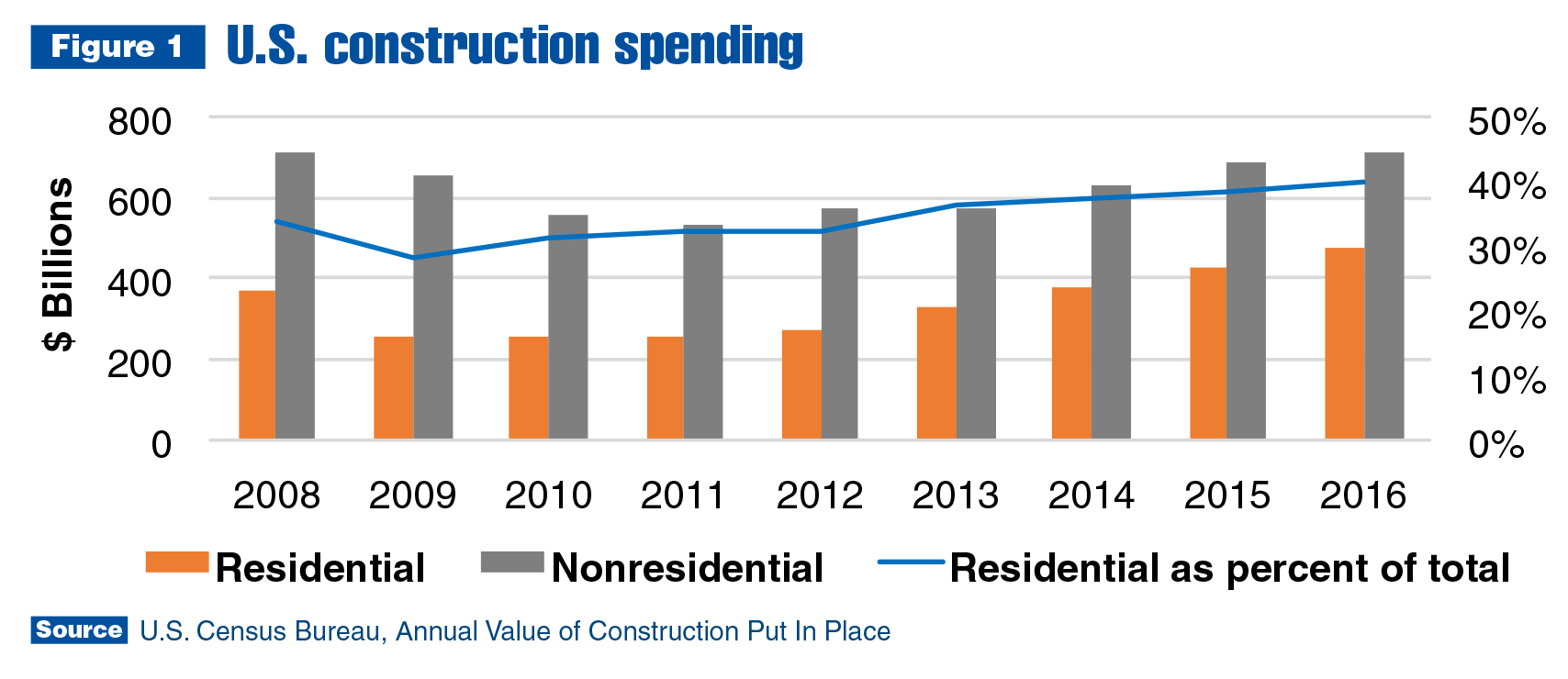

Us Construction Market Size Trends By Sector Forecast 2027 According to bls data, average hourly wages increased by 5.2% year over year to us$36.70 in august 2023 and around 17% since the beginning of the pandemic lockdowns in march 2020 (figure 3). 43 construction wages are expected to experience upward pressure in 2024 as labor demand continues to outpace supply. The federal open market committee (fomc) continues fine tuning interest rates to return inflation to the targeted 2% range. the cbre construction cost index showed a decline in annual escalation compared to the record high 2022. 2023 concluded at 4.9% (± 2%). this is still higher than the industry pre covid average of 2 5% per year. There is a net positive reading of 4 percent for multifamily residential construction. expectations are bearish for lodging, with a net negative reading of 3 percent; retail construction, 15 percent; and private office construction, 24 percent. “on balance, c ontractors remain upbeat about the available dollar value of projects to bid on. As of march 2022, commercial construction spending had not yet reached the pre pandemic peak. the increase in total spending is, in part, driven by inflating input prices (i.e., materials, labor) but, even when adjusted for inflation, spending is up 4.4% since january 2020. figure 4: u.s. historical construction spending by sector.

Comments are closed.