Pass Through Businesses And Comprehensive Tax Reform Designin This deduction enables pass through owners to deduct up to 20 percent of their qualifying business income against their taxable income . the pass through deduction includes several limitations based on wages paid and capital for high income taxpayers. the deduction lowers the effective statutory tax rate on pass through business income. Answer: when a pass through business earns profits, it does not directly send a portion of the profits to the internal revenue service (irs). instead, the profit is “passed through” the business and onto the tax returns of the business owners. the owners are then responsible for paying the tax to the irs. that means that pass through.

An Overview Of Pass Through Businesses In The United States Tax Pass through business income has been persistently higher than corporate income since 1998, with the exception of 2005, when corporate net income peaked at $1.6 trillion. the most recent data shows that pass through businesses earned $1.3 trillion in net income, or 63.9 percent of total business net income in 2011. The house republican tax reform plan released in june 2016 would reduce the top individual income tax rate to 33 percent, reduce the corporate rate to 20 percent, and cap the tax rate on profits of pass through businesses at 25 percent. president trump's revised campaign plan would reduce the top individual income tax rate to 33 percent and. Tcja’s pass through business provisions are set to expire on jan. 1, 2026. context. republicans defended the pass through deduction as a way to “treat corporate and noncorporate business income more similarly under the income tax,” given c corporations received a rate cut of 14 percentage points (40%). sen. Under the proposed changes, individuals who make more than $400,000 annually and couples who make more than $500,000 would have to pay a 3.8% tax on earnings from their pass through business income.

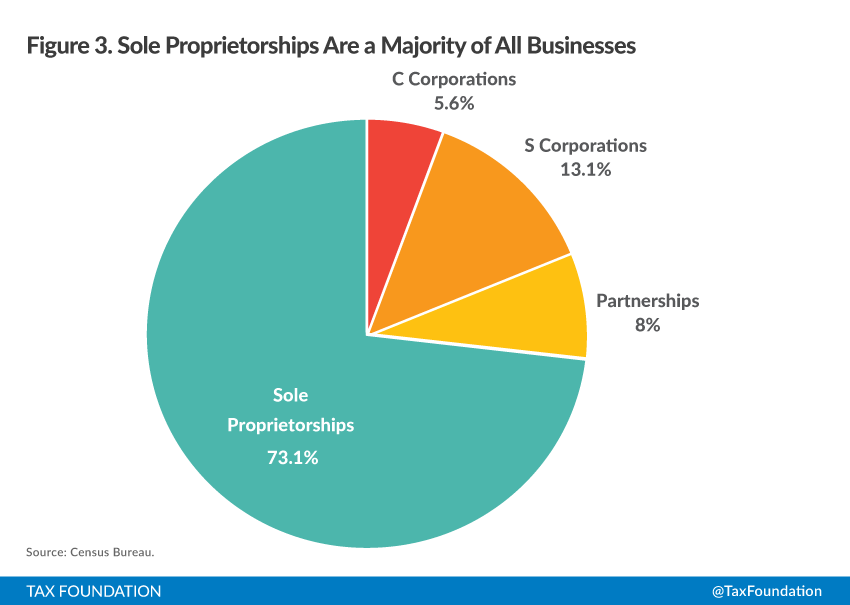

Here S A Primer On What You Need To Know About The Comprehensive Tax Tcja’s pass through business provisions are set to expire on jan. 1, 2026. context. republicans defended the pass through deduction as a way to “treat corporate and noncorporate business income more similarly under the income tax,” given c corporations received a rate cut of 14 percentage points (40%). sen. Under the proposed changes, individuals who make more than $400,000 annually and couples who make more than $500,000 would have to pay a 3.8% tax on earnings from their pass through business income. A. pass through businesses are not subject to an entity level tax; instead, profits flow through to owners and are taxed under the individual income tax. some pass through income is eligible for a 20 percent deduction through 2025. pass through income is only subject to a single layer of income tax and is generally taxed as ordinary income up. The tax cuts and jobs act (tcja), the massive tax reform law that took effect in 2018, established a new tax deduction for owners of pass through businesses, such as sole proprietorships, partnerships, limited liability companies (llcs), s corporations, and limited liability partnerships (llps).

Comments are closed.