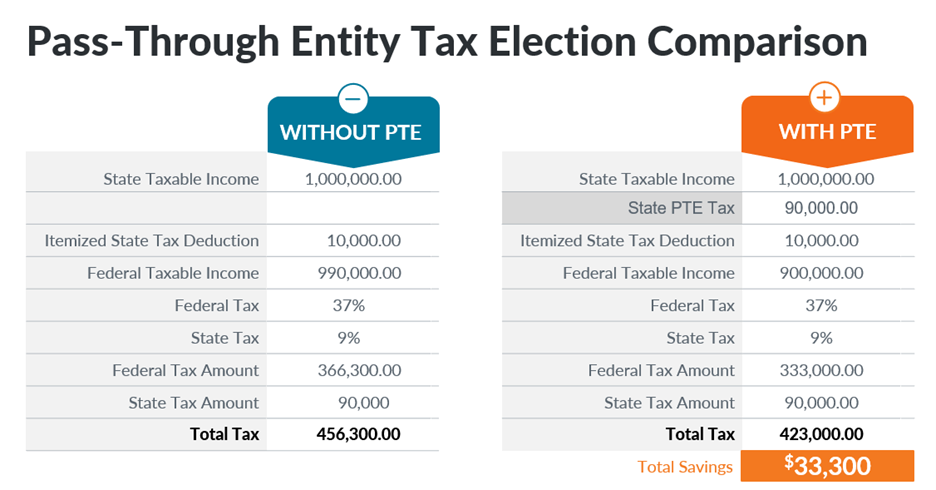

Pass Through Entities State Tax Elections Pros Cons Dmlo Cpas Dmlo cpas. april 5, 2022. more than 20 states now allow pass through entities (ptes) to elect to be taxed at the entity level to help their residents avoid the $10,000 limit on federal itemized deductions for state and local taxes, also known as the “salt cap.”. for ptes electing into a state pte tax regime, the federal pass through income. State pass through entity tax elections: weighing the pros and cons. tax strategist insight. more than 20 states now allow pass through entities (ptes) to elect to be taxed at the entity level to help their residents avoid the $10,000 limit on federal itemized deductions for state and local taxes, also known as the “salt cap.”.

Critical Decision State Pass Through Entity Tax Elections Aprio Client accounting services; dmlo payroll services; dmlo wealth planning; forensic accounting; high net worth; litigation support services; peer reviews; tax services; trusts & estates; industries menu toggle. construction; credit unions; employee benefit plan audits; dmlo healthcare consultants; hospitality; insurance; long term care. Pass through entity level tax elections pose significant opportunities and risks for pass through entities and their owners across the states. as of the first of the year, thirty six states and one locality (new york city) allow pass through entities to elect to pay income tax at the entity level rather than the partner or shareholder level. Law no. 115 97, commonly referred to as the tax cuts and jobs act (tcja)) was a limit on the amount of state and local taxes an individual can deduct for regular federal income tax purposes. congress amended section 164 by imposing a $10,000 limit for most individuals and married couples filing a joint return and a $5,000 limit on married. Federal implications of passthrough entity tax elections. • the law known as the tax cuts and jobs act, p.l. 115 97, imposed a $10,000 limitation on individuals’ deduction of state and local taxes (salt) for tax years 2018 through 2025. • in notice 2020 75, the irs announced forthcoming regulations under which partnerships and s.

Pass Through Entity Definition And Types To Know Quickbooks Law no. 115 97, commonly referred to as the tax cuts and jobs act (tcja)) was a limit on the amount of state and local taxes an individual can deduct for regular federal income tax purposes. congress amended section 164 by imposing a $10,000 limit for most individuals and married couples filing a joint return and a $5,000 limit on married. Federal implications of passthrough entity tax elections. • the law known as the tax cuts and jobs act, p.l. 115 97, imposed a $10,000 limitation on individuals’ deduction of state and local taxes (salt) for tax years 2018 through 2025. • in notice 2020 75, the irs announced forthcoming regulations under which partnerships and s. The defining characteristic of a pass through entity (pte), for tax purposes, is how it “passes” its income through to its owners to be taxed on their respective returns, rather than at the entity level. this is generally true for both federal and state purposes. an owner would thus pay both federal and state tax on their distributive share. The landscape for state pass through entity taxes continues to change. more states have enacted laws to provide an election for pass through entities to pay tax at the entity level so owners can claim additional state and local tax deductions that may exceed the $10,000 federal cap. however, the states aren’t consistent when it comes to.

Comments are closed.