What Is A Pass Through Entity Ewh Small Business Accounting Each pass through entity owner reports and pays tax on their share of business income on personal tax form 1040. an owner’s income tax liability depends on his or her income tax bracket. Pass through taxation means that an llc doesn’t file a corporate income tax return with the irs. instead, once an llc has paid its expenses and debts, the llc owners or members pay tax on any remaining revenue. even if you leave profits in the llc – for instance, to hire new personnel or expand the business – each member must report those.

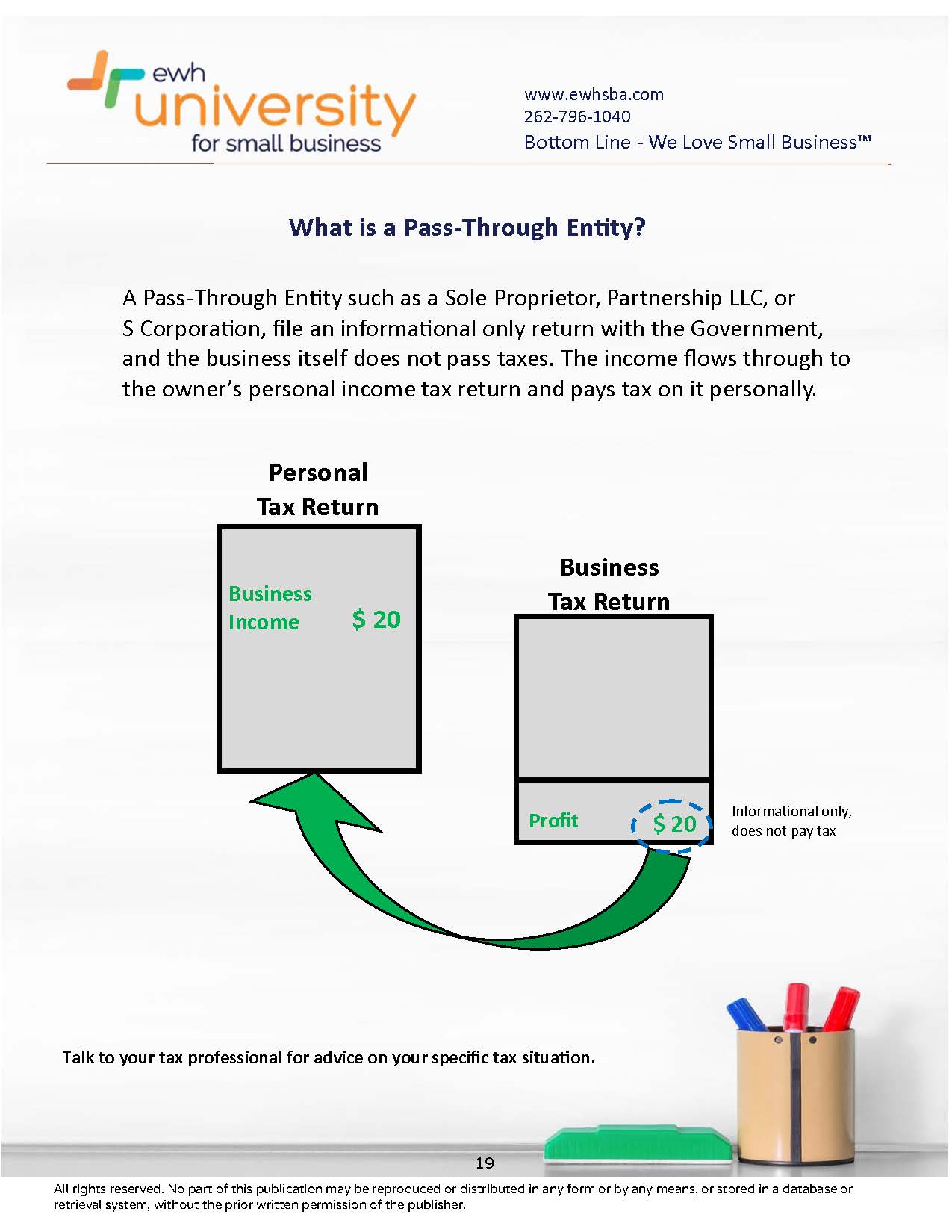

Pass Through Entity Tax вђ What Does It Mean For My Small Business August 22, 2024 by barbara weltman. the pass through entity tax (ptet) is a way for owners of pass through entities—partnerships, limited liability companies, s corporations—to gain benefit from the state and local taxes paid without having to itemize and then apply the state and local tax (salt) cap. all of this may sound confusing. An llc uses what’s known as pass through taxation. this means that the company does not file or pay its own taxes. instead, the llc members claim the entity’s profits or losses as part of their taxes. even if an llc’s profits are left in its own bank accounts at the end of the year, the members of the llc will still owe personal taxes on. Answer: when a pass through business earns profits, it does not directly send a portion of the profits to the internal revenue service (irs). instead, the profit is “passed through” the business and onto the tax returns of the business owners. the owners are then responsible for paying the tax to the irs. that means that pass through. A pass through entity, also known as a flow through entity, is a business entity in which the profits pass through to the owner (s) of that business and are taxed at the individual tax rate. in other words, this business type is not subject to federal income tax. instead, the entity’s income — and credits, deductions, or losses — is.

Comments are closed.