Pass Through Entity Definition And Types To Know Quickbooks Example #1. a manufacturing partnership firm distributes its income entirely to its partners. the firm is considered a pass through entity. suppose the income for the year was $40,000, and expenses to meet the business requirements were $20,000. now, the earnings before interest and taxes come to $20,000 i.e. ($40,000 – $20,000). A flow through or pass through entity is a legal business that passes all its income on to the owners or investors of the business. flow through entities are a common device used to avoid double.

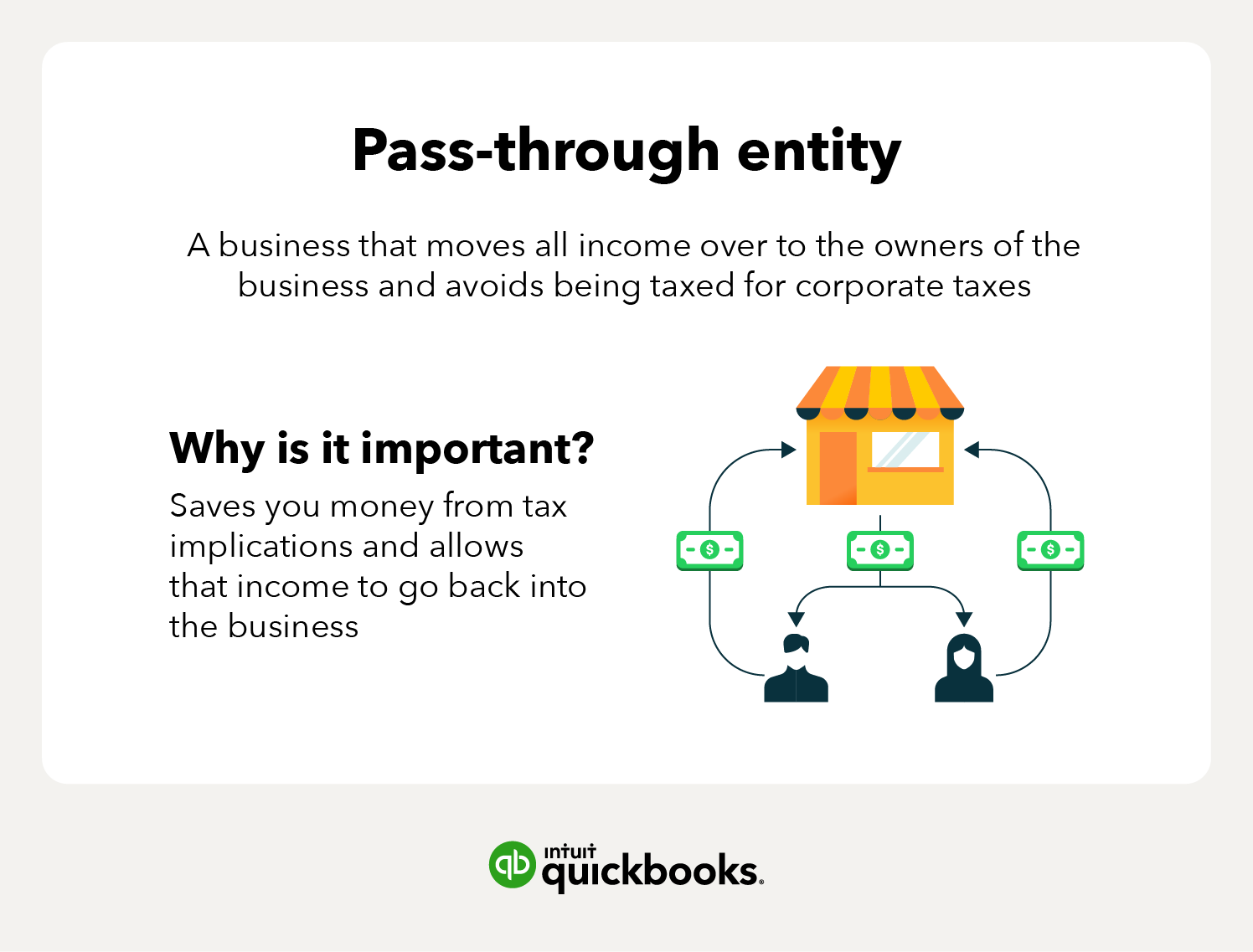

Pass Through Entity What Is It Examples Benefits A pass through entity, also known as a flow through entity, is a business entity in which the profits pass through to the owner (s) of that business and are taxed at the individual tax rate. in other words, this business type is not subject to federal income tax. instead, the entity’s income — and credits, deductions, or losses — is. Owners of pass through entities can now claim a 20% deduction of their share of business income before paying federal income taxes. take the basic example of a sole proprietor who earns $100,000 of business income. the business owner can deduct $20,000 from their taxable income, only paying taxes on the remaining $80,000. Pass through entities divide their taxable income according to their ownership percentage. in an organization with one owner a sole proprietorship or single member llc the ownership. Pass through entities are structured entities that offer business owners a more favorable tax rate while still protecting the owner or members from personal liability. for federal income tax purposes, types of pass through entities include sole proprietorships, partnerships, llcs, and s corporations. because pass through entities do not pay.

Pass Through Entity Definition Examples Advantages Disadvantages Pass through entities divide their taxable income according to their ownership percentage. in an organization with one owner a sole proprietorship or single member llc the ownership. Pass through entities are structured entities that offer business owners a more favorable tax rate while still protecting the owner or members from personal liability. for federal income tax purposes, types of pass through entities include sole proprietorships, partnerships, llcs, and s corporations. because pass through entities do not pay. Example of pass through entity tax return. to demonstrate the potential tax benefits offered by a pass through entity, we can compare the taxes owed by a pass through entity vs a c corp. example 1. company abc – a new york based pass through entity that is equally owned by two individuals – earned $200,000 in revenue. A pass through entity is a situation where a business is recognized but is primarily considered to be the individuals who run the business. a disregarded entity is a situation where the business is only one person. single member llcs and sole proprietorships are always disregarded entities.

Pass Through Entity Definition Examples Advantages Disadvantages Example of pass through entity tax return. to demonstrate the potential tax benefits offered by a pass through entity, we can compare the taxes owed by a pass through entity vs a c corp. example 1. company abc – a new york based pass through entity that is equally owned by two individuals – earned $200,000 in revenue. A pass through entity is a situation where a business is recognized but is primarily considered to be the individuals who run the business. a disregarded entity is a situation where the business is only one person. single member llcs and sole proprietorships are always disregarded entities.

Comments are closed.