Pass Through Tax Reform Resource Ppt It outlines provisions such as a new 20% deduction for qualified business income of pass through entities, limitations based on wages paid and type of business, and implications for tax planning. owners of pass through entities will need to analyze how to optimize the new pass through deduction and consider converting to a c corporation. Since the early 1980s, the pass through sector has grown substantially as a share of all business activity. the pass through share of business returns increased from 83.4 percent in 1980 to 96.2 percent in 2016 (see the first figure below). the number of c corporations decreased from around 2.2 million in 1980 to 1.6 million in 2016.

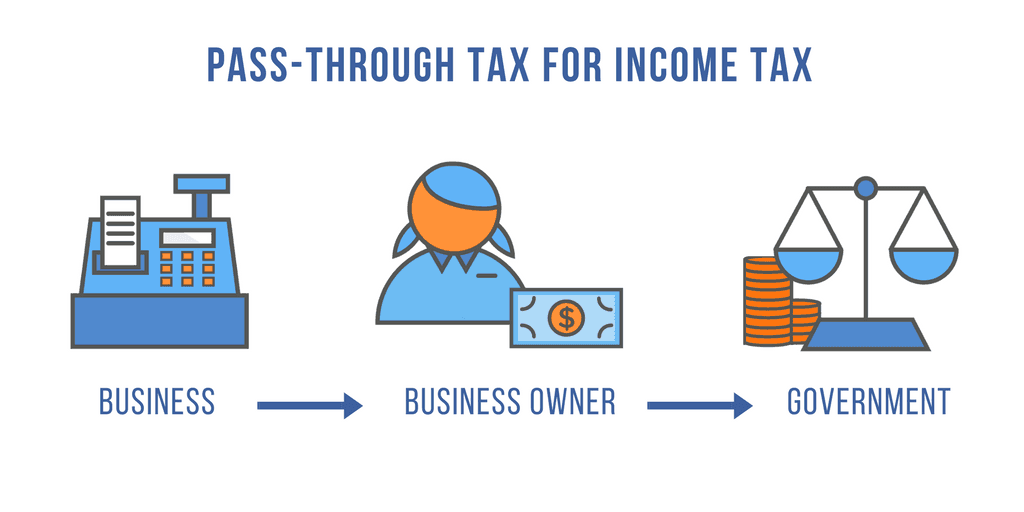

Pass Through Taxation What Small Business Owners Need To Know September 21, 2021 pass through entity tax allows an entity to pay taxes directly at the entity level on behalf of members, partners, and shareholders. enacted in july of this year, it helps to circumvent the $10,000 federal cap on state and local tax deductions phased in during tax reform. here is a list of common questions around the election. Pass through owners who qualify can deduct up to 20% of their net business income from their income taxes, reducing their effective income tax rate by 20%. this deduction is commonly known as the "qualified business income deduction" or "qbi deduction." this deduction can really add up. for example, if you have $100,000 in pass through income. Pass through business income has been persistently higher than corporate income since 1998, with the exception of 2005, when corporate net income peaked at $1.6 trillion. the most recent data shows that pass through businesses earned $1.3 trillion in net income, or 63.9 percent of total business net income in 2011. Answer: when a pass through business earns profits, it does not directly send a portion of the profits to the internal revenue service (irs). instead, the profit is “passed through” the business and onto the tax returns of the business owners. the owners are then responsible for paying the tax to the irs. that means that pass through.

Pass Through Taxation Benefits In Powerpoint And Google Slides Cpb Ppt Pass through business income has been persistently higher than corporate income since 1998, with the exception of 2005, when corporate net income peaked at $1.6 trillion. the most recent data shows that pass through businesses earned $1.3 trillion in net income, or 63.9 percent of total business net income in 2011. Answer: when a pass through business earns profits, it does not directly send a portion of the profits to the internal revenue service (irs). instead, the profit is “passed through” the business and onto the tax returns of the business owners. the owners are then responsible for paying the tax to the irs. that means that pass through. A. definition and basic concept. pass through taxation is a tax framework in which certain business entities, such as partnerships, llcs, s corporations, and sole proprietorships, do not pay taxes at the entity level. instead, the profits, losses, deductions, and credits of the business “pass through” to the owners or shareholders. Myth #1: there aren’t many. for many decades, pass through entities were less common than corporations, and many assume this is still true today. but the passage of the 1986 tax reform act (tra) dramatically impacted the business landscape by lowering individual tax rates for pass through income. that impact is still felt today.

Comments are closed.