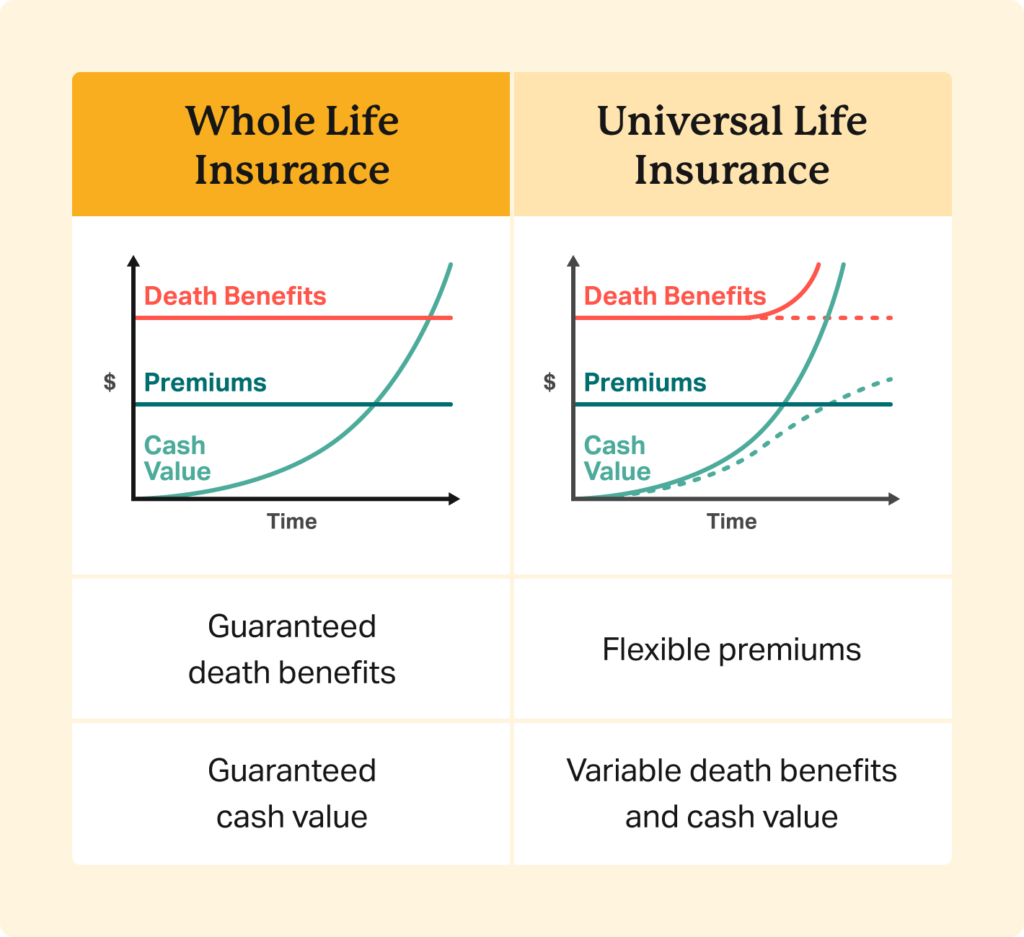

Permanent Life Insurance Universal Life Vs Whole Life Vs Term 100 Whole life insurance is a permanent life insurance policy that has a fixed premium and death benefit. the cash value within a whole life insurance policy builds at a fixed interest rate, such as 2. Whole life is the more expensive, but predictable, permanent life insurance option. universal life, by contrast, gives you more flexibility in your premium, but may not provide as much of a return.

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

юааtermюаб юааvsюаб юааwholeюаб юааlifeюаб юааinsuranceюаб Whatтащs The юааdifferenceюаб Universal life (ul) and whole life are two types of permanent life insurance. their differences include the fact that universal life policies provide flexible premiums and death benefits but have. Term life insurance offers locked in rates for a level term length and is often the most inexpensive form of life insurance coverage. whole life insurance is often expensive, but offers fixed. Whole life insurance is the most common type of permanent life insurance and typically costs more than term life. this is because most policies offer coverage that lasts until much later in life. Permanent life insurance, including whole life and universal life, makes sense in some situations. here's a look at the types of permanent life insurance. permanent life vs. term life insurance.

A Complete Guide To Life Insurance Expensivity Whole life insurance is the most common type of permanent life insurance and typically costs more than term life. this is because most policies offer coverage that lasts until much later in life. Permanent life insurance, including whole life and universal life, makes sense in some situations. here's a look at the types of permanent life insurance. permanent life vs. term life insurance. Key takeaways. term coverage only protects you for a limited number of years, while whole life provides lifelong protection—as long as you keep up with the premium payments. term life is just. Whole life is permanent, while universal life offers long term protection. with whole life, your premiums are fixed and guaranteed never to rise1. as long as you continue to pay them, you can count on the life insurance benefits being paid to your beneficiaries. with universal life there are no fixed premiums and you have more flexibility on.

Permanent Life Insurance How It Works And Policy Types Key takeaways. term coverage only protects you for a limited number of years, while whole life provides lifelong protection—as long as you keep up with the premium payments. term life is just. Whole life is permanent, while universal life offers long term protection. with whole life, your premiums are fixed and guaranteed never to rise1. as long as you continue to pay them, you can count on the life insurance benefits being paid to your beneficiaries. with universal life there are no fixed premiums and you have more flexibility on.

Term Life Insurance Vs Whole And Universal Life Insuran

Comments are closed.