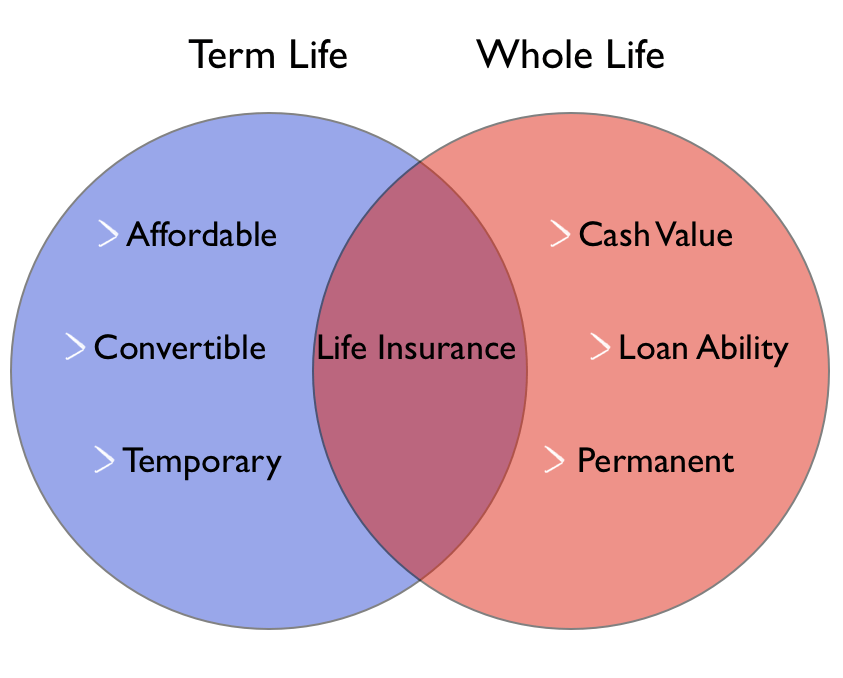

Personal Life Insurance Explained Https Www Insurechance Personal life insurance is an individual policy that you pay for and get to keep no matter where you go. there are two types of individual life insurance, term, and permanent life insurance. term life insurance and permanent life insurance have been debated since their existence by financial experts and rookies alike, with both teams cheering. Term life insurance is a very good go to life insurance product. it is actually the most bought life insurance product in the market. but with a perm life insurance policy, you can feel secure that your premiums will be the same for your whole life so when you are 80 you are going to be paying the same in premiums as if you were 21 (if you are.

Personal Life Insurance Explained Https Www Insurechance The product we are running quotes for is a $500,000, 20 year term life insurance policy. preferred plus – $30 a month with protective. preferred – $39 monthly with protective. standard – $52 a month with transamerica. standard plus – $62 a month with american general. What is life insurance? life insurance is a contract between you and an insurance company. in exchange for premium payments, the company pays a life insurance death benefit to your beneficiaries. Then, there are several subtypes of permanent life insurance to consider. to get you started, here’s an overview of types of life insurance and the main points to know for each. term life. Term life insurance costs an average of $203 a year for a 30 year old woman with a 20 year, $500,000 term life insurance policy, according to our analysis of life insurance companies. the same.

Comments are closed.