Ppt 2018 Tax Reform вђњtax Cuts And Jobs Actвђќ P Learn about the key provisions and effects of the tax cuts and jobs act 2018 one year after its implementation. discover changes in tax rates, deductions, and credits, as well as the impact on affordable care act, amt, estate taxes, education expenses, and pass through entities. 2018 tax reform “tax cuts and jobs act” an image link below is provided (as is) to download presentation download policy: content on the website is provided to you as is for your information and personal use and may not be sold licensed shared on other websites without getting consent from its author.

Ppt 2018 Tax Reform вђњtax Cuts And Jobs Actвђќ P The changes under the new tax law, the tax cuts and jobs act (tcja), impacting individual taxation are generally effective for the 2018 tax year and most are temporary and due to expire after december 31, 2025. with the changes to the standard deduction, many taxpayers will now opt not to itemize deductions. The tax cuts and jobs act (tcja) was a major overhaul of the tax code, signed into law by president donald trump on jan. 1, 2018. the legislation included some of the biggest changes to the tax. Under pre tcja law, c corporations pay federal income tax at graduated rates of 15% on taxable income of $0 to $50,000; 25% on taxable income of $50,001 to $75,000; 34% on taxable income of $75,001 to $10 million; and 35% on taxable income over $10 million. personal service corporations (pscs) pay a flat 35% rate. The tax cuts and jobs act (tcja) reduced tax rates on both business and individual income, and enhanced incentives for investment by firms. those features most likely have raised output in the short run and will continue to do so in the long run, but most analysts estimate the modest effects offset only a portion of revenue loss from the bill (table 1).

Tax Powerpoint Ppt Template Bundles Presentation Graphics Under pre tcja law, c corporations pay federal income tax at graduated rates of 15% on taxable income of $0 to $50,000; 25% on taxable income of $50,001 to $75,000; 34% on taxable income of $75,001 to $10 million; and 35% on taxable income over $10 million. personal service corporations (pscs) pay a flat 35% rate. The tax cuts and jobs act (tcja) reduced tax rates on both business and individual income, and enhanced incentives for investment by firms. those features most likely have raised output in the short run and will continue to do so in the long run, but most analysts estimate the modest effects offset only a portion of revenue loss from the bill (table 1). The tax policy center has also released an analysis of the macroeconomic effects of the tax cuts and jobs act as passed by congress. we find the legislation would boost us gross domestic product (gdp) 0.8 percent in 2018 and would have little effect on gdp in 2027 or 2037. the resulting increase in taxable incomes would reduce the revenue loss. Today, my testimony will focus on three points. first, i will describe how the tax cuts and jobs act (tcja) improved incentives and economic growth, contributing to record low unemployment and record high federal tax collections. second, i will contrast tcja with president biden’s tax policies. third, i will recommend ways to reform the.

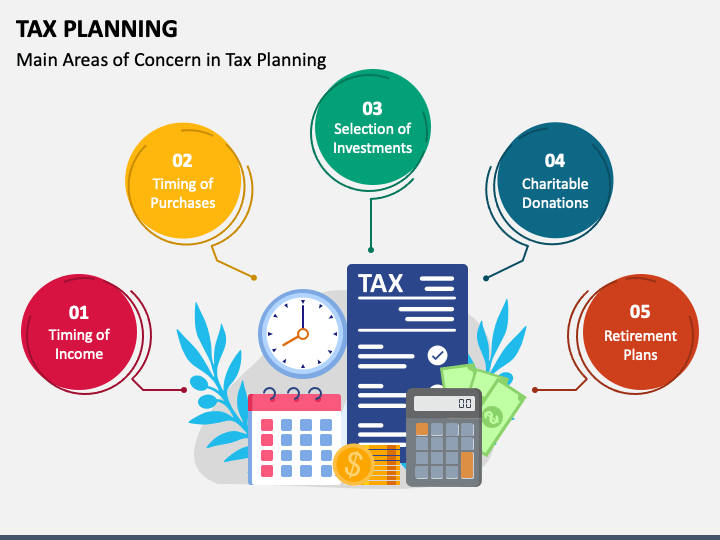

Tax Planning Powerpoint And Google Slides Template Ppt Slides The tax policy center has also released an analysis of the macroeconomic effects of the tax cuts and jobs act as passed by congress. we find the legislation would boost us gross domestic product (gdp) 0.8 percent in 2018 and would have little effect on gdp in 2027 or 2037. the resulting increase in taxable incomes would reduce the revenue loss. Today, my testimony will focus on three points. first, i will describe how the tax cuts and jobs act (tcja) improved incentives and economic growth, contributing to record low unemployment and record high federal tax collections. second, i will contrast tcja with president biden’s tax policies. third, i will recommend ways to reform the.

Comments are closed.