Ppt Tax Reform Basics For The Qualified Business Income ођ Presentation on theme: "tax reform basics for the qualified business income deduction (199a)"— presentation transcript: 1 tax reform basics for the qualified business income deduction (199a) richard furlong, jr. senior stakeholder liaison december 12, 2018 cpa continuing education society of pa. Richard g. furlong, jr. senior stakeholder liaison communications & liaison division. tax reform basics for the qualified business income deduction (section 199a). june 19, 2019 cpa continuing education society of pa. objectives. discuss who is eligible.

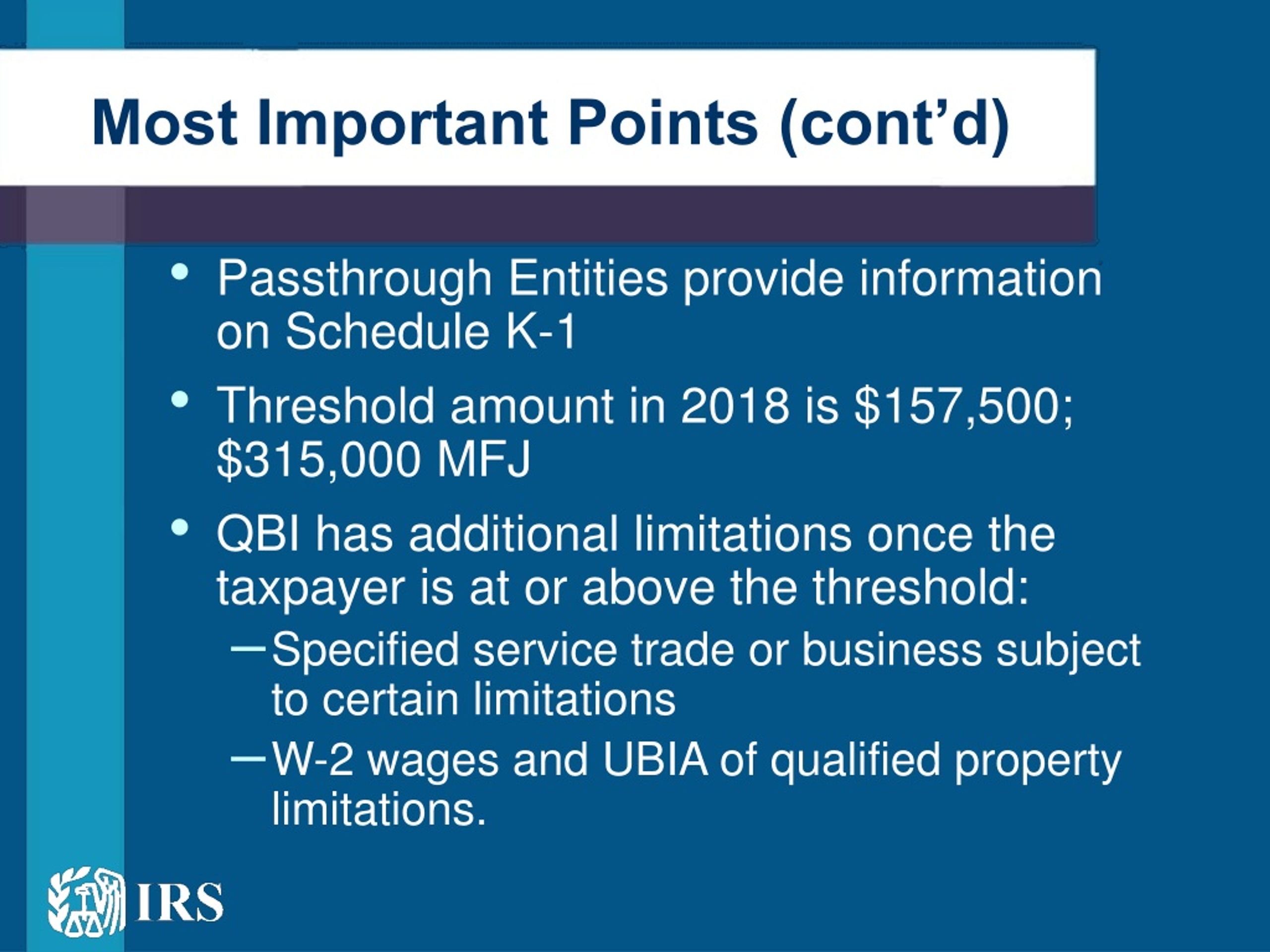

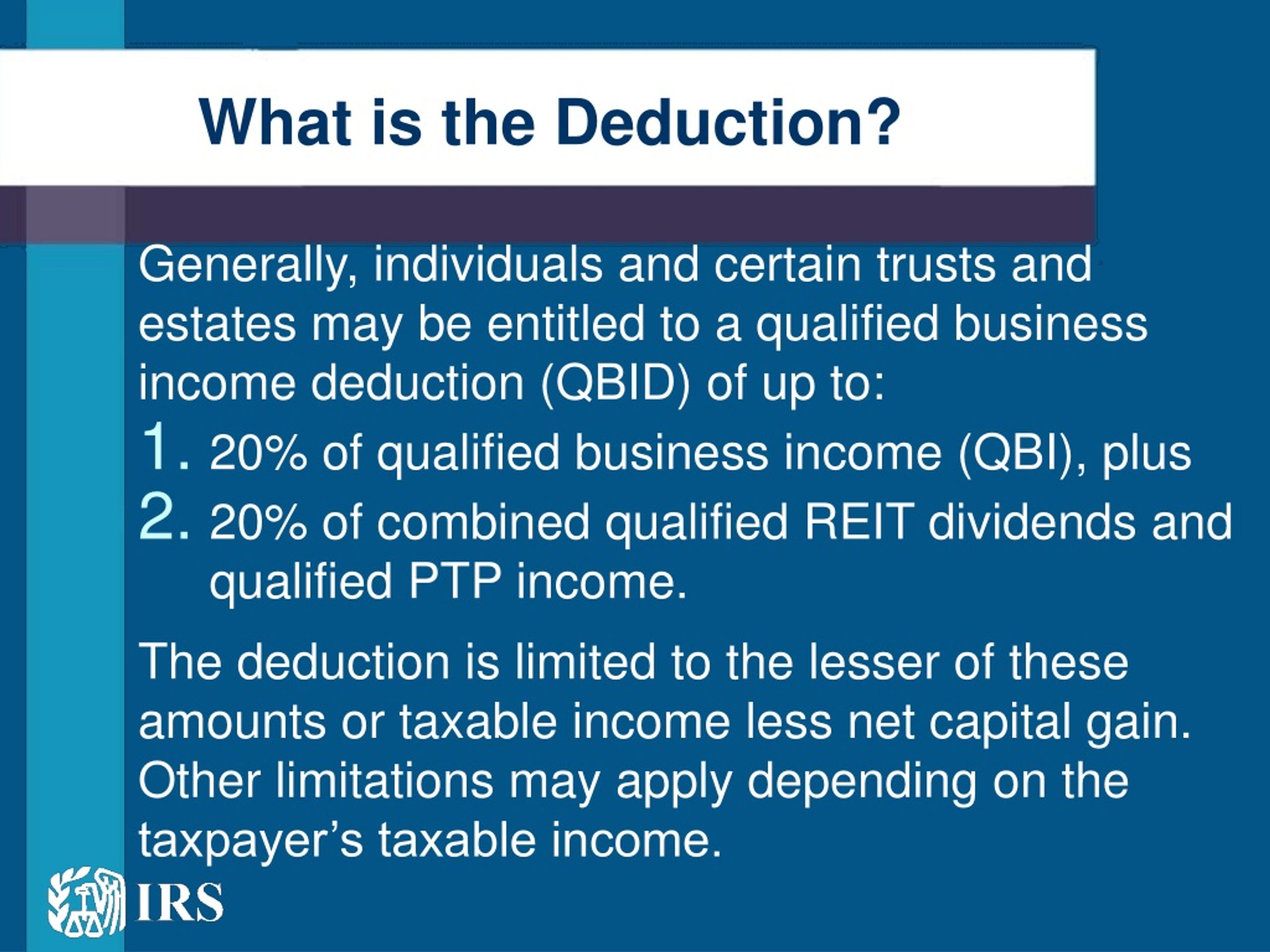

Ppt Tax Reform Basics For The Qualified Business Income ођ Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi) deduction – also called the section 199a deduction – for tax years beginning after december 31, 2017. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20. Here’s how the new qualified business income deduction works. business owners can deduct up to 20% of their qualified business income or, if lower, 20% of their taxable income net of any capital gain. this deduction is claimed on the business owner’s individual return. generally, qualified business income refers to the business’s profits. For 2023, the qbi deduction phases out from $182,101 to $232,100 for single filers and $364,201 to $464,200 for joint filers. the phase out income level changes with each tax year. in 2024, the qbi deduction will be phased out if your income is between $191,951 to $241,950 for single filers and $383,901 to $483,900 for joint filers. The qualified business income deduction (qbi) is a tax deduction that allows eligible self employed and small business owners to deduct up to 20% of their qualified business income on their taxes.

Comments are closed.