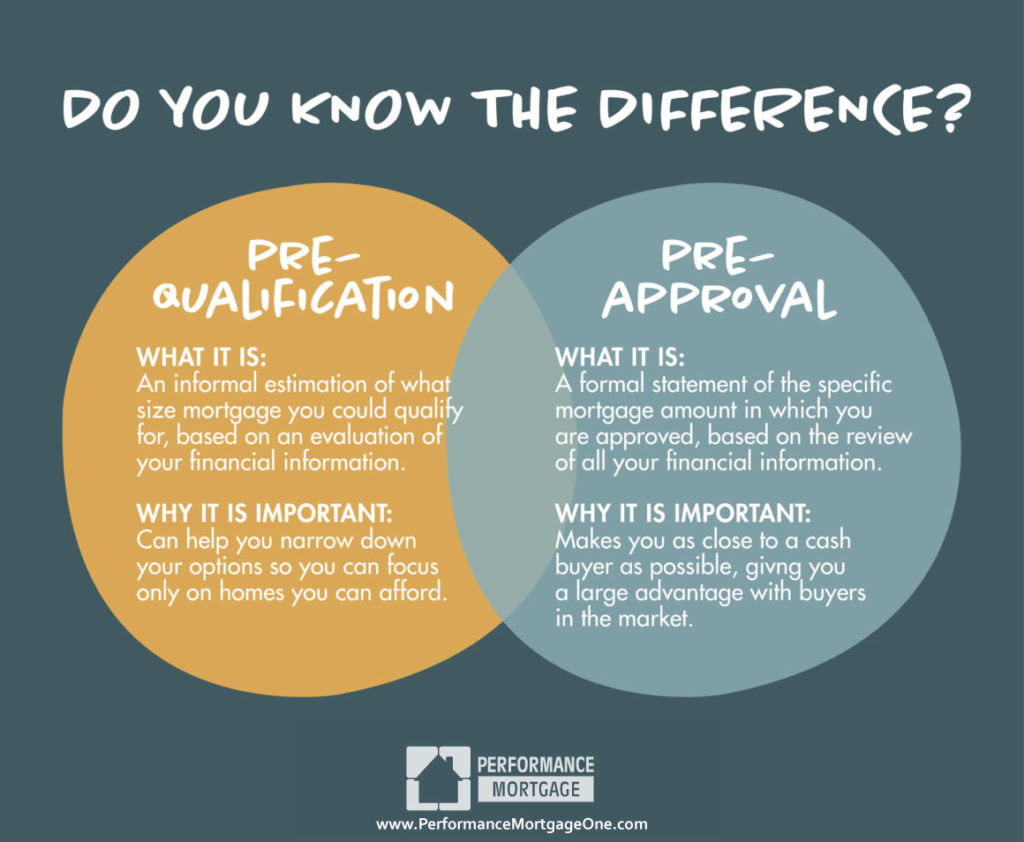

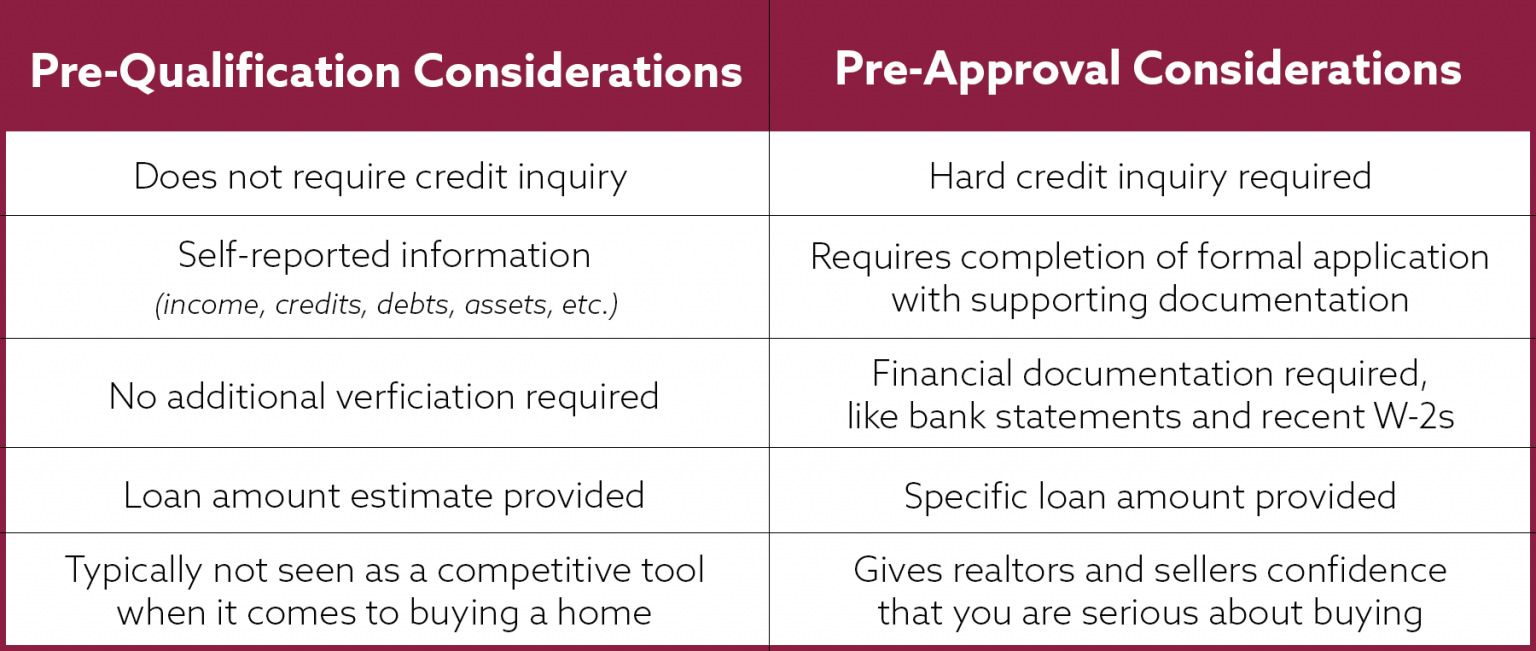

Pre Qualification Vs Pre Approval Do You Know The Difference A mortgage pre qualification is usually a much shorter process that requires you to honestly report your own financial information, while a mortgage pre approval typically requires you to submit more documentation like w 2s to verify your financials — making it a lengthier process. neither pre qualification nor pre approval will guarantee you. But there's a wrinkle to keep in mind. lenders use their own terms to describe the different application and approval phases. for simplicity, we're using the terms "pre qualification" to refer to.

Pre Qualification Vs Pre Approval What S The Difference St The main difference between prequalified and preapproved: preapprovals hold more weight when trying to buy a home. prequalifying involves providing some basic financial info to get a general idea. A preapproval is a stronger indication of what you can afford and adds more credibility to your offer than a prequalification. you’ll receive a preapproval letter to supply to sellers, demonstrating that a lender has verified your financial information and that you can afford a mortgage. after you’re preapproved, your lender will provide a. A pre approval letter is the real deal, a statement from a lender that you qualify for a specific mortgage amount based on an underwriter’s review of all of your financial information: credit. Getting pre approved is the next step, and it's much more involved. "a pre qualification is a good indication of creditworthiness and the ability to borrow, but a pre approval is the definitive.

Pre Qualified Vs Pre Approved How The Difference Affects You Buying A pre approval letter is the real deal, a statement from a lender that you qualify for a specific mortgage amount based on an underwriter’s review of all of your financial information: credit. Getting pre approved is the next step, and it's much more involved. "a pre qualification is a good indication of creditworthiness and the ability to borrow, but a pre approval is the definitive. Less credibility with sellers: compared to a pre approval, prequalification is seen as less compelling to sellers due to its non binding nature. potential overconfidence: a high initial estimate might lead to overconfidence, potentially causing you to overlook the importance of getting pre approved. A pre qualification is a good first step to understanding how much home you can afford, while a pre approval takes it one step further by verifying your financial information and credit history. in addition to a standard pre approval, there is also something called an underwritten pre approval. this type of pre approval can often be a buyer’s.

Comments are closed.