How To Read And Understand Your Credit Card Statement Finder In today’s fluctuating economy, keeping track of your credit and your credit rating is a vital part of tracking your financial standing. an important part of this process is learning to read your credit card statement. read more about credit card debt relief here. the 10 main features of any credit card statement 1. the reporting period. Your statement will also provide information on any balance you’ve accrued. this includes: the total credit card balance. this is the total amount that is currently charged to your credit card.

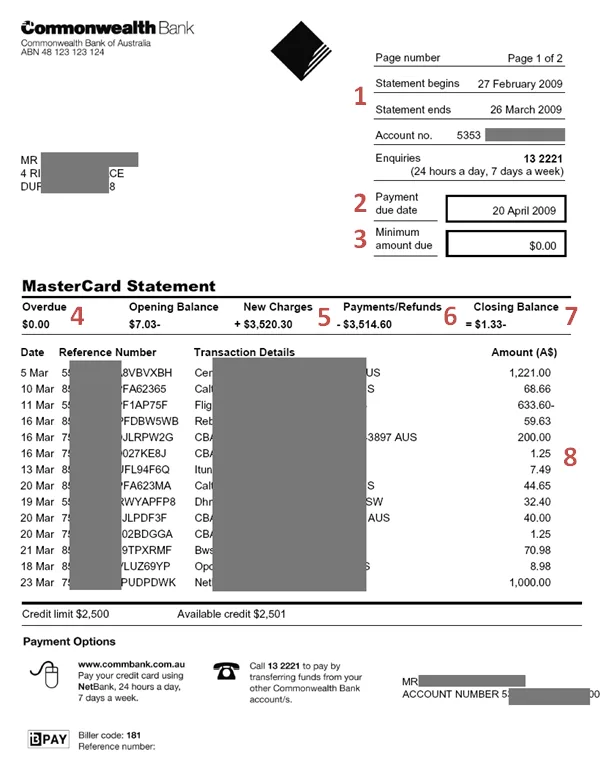

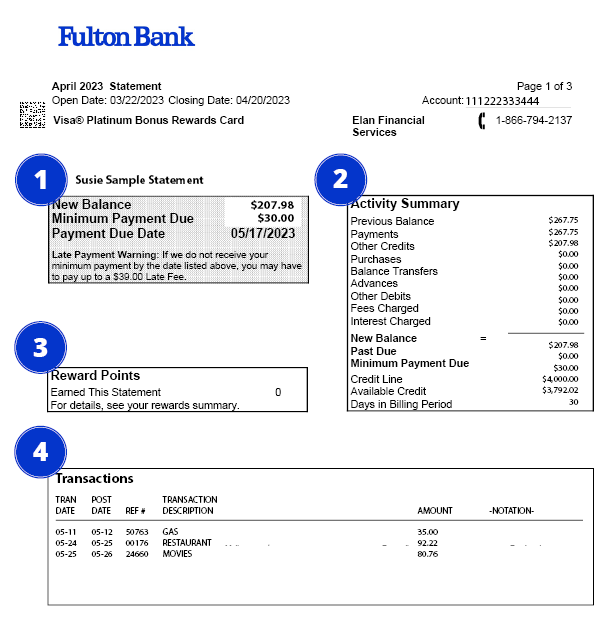

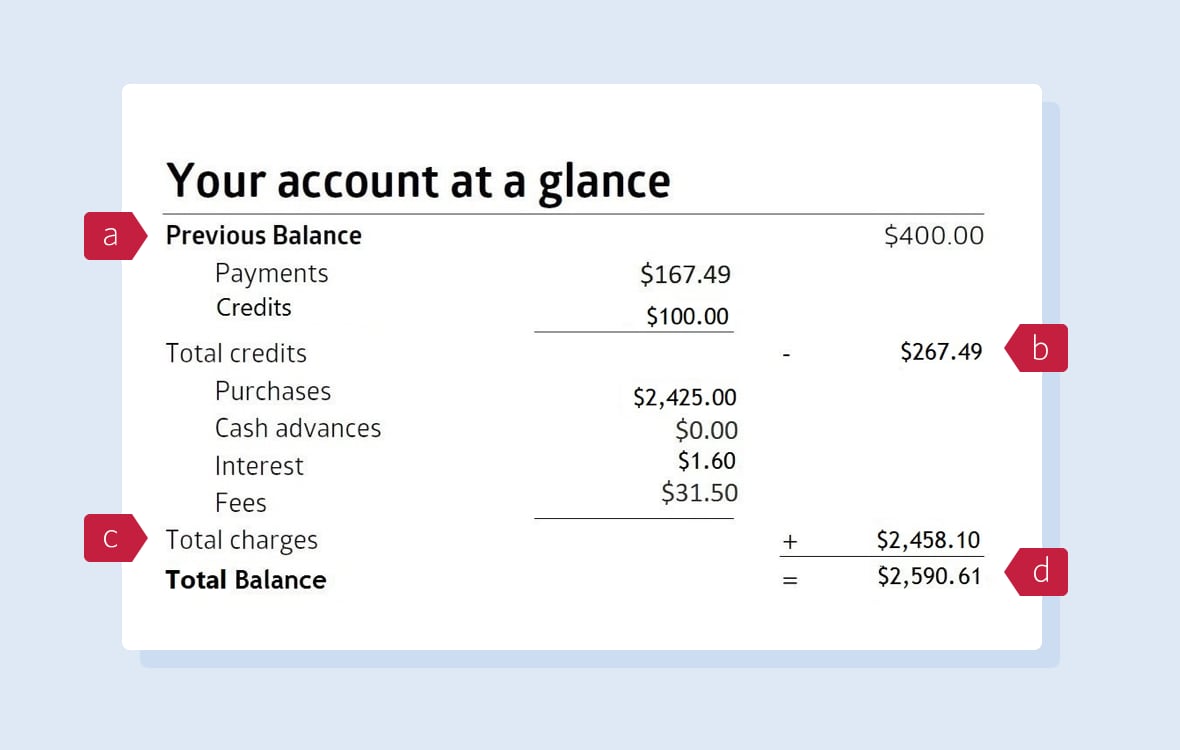

Reading Your Credit Card Statement Consumer Credit Card Relief What this section tells you. how your current balance was calculated. it begins with the previous month’s balance, subtracts recent payments and credits, and adds purchases, interest charges and. Credit card debt is a financial burden for many americans. in fact, credit karma member data pulled on jan. 4, 2024, reveals that members with at least one credit card carry an average of $7,288 in card debt, with some generations and geographic groups holding much higher average debt (see methodology). many factors could turn your credit cards. This is why it’s important to contact your credit card companies immediately if you know you can’t pay your bill. here are important steps to requesting relief. 1. tell them you’ve been impacted by the coronavirus pandemic. first and foremost, make sure to tell them you’ve been financially impacted by the coronavirus pandemic and need help. Account summary. your credit card statement will detail all the transactions you made that month. this includes all purchases, returns, payments, interest, and fees paid. it shows the date the purchase was made and when the charge was applied. it gives you details of where the purchase was made, too. some credit companies also indicate the.

How To Read Your Credit Card Statement Explained Debtwave This is why it’s important to contact your credit card companies immediately if you know you can’t pay your bill. here are important steps to requesting relief. 1. tell them you’ve been impacted by the coronavirus pandemic. first and foremost, make sure to tell them you’ve been financially impacted by the coronavirus pandemic and need help. Account summary. your credit card statement will detail all the transactions you made that month. this includes all purchases, returns, payments, interest, and fees paid. it shows the date the purchase was made and when the charge was applied. it gives you details of where the purchase was made, too. some credit companies also indicate the. Key takeaways: reading your credit card statements can help you manage your money. your statement will tell you when your interest rate or terms are going to change. key details to notice include late payment and minimum payment warnings. you are probably getting a number of credit card statements each month. they can be confusing. Common terms you should be familiar with before reading your credit card statement: this includes your credit card number and online login information. the first 6 digits of your card number represent the card issuer and industry of your credit card. the last digit is used to verify the card info.

Learn How To Read Your Credit Card Statement Fulton Bank Key takeaways: reading your credit card statements can help you manage your money. your statement will tell you when your interest rate or terms are going to change. key details to notice include late payment and minimum payment warnings. you are probably getting a number of credit card statements each month. they can be confusing. Common terms you should be familiar with before reading your credit card statement: this includes your credit card number and online login information. the first 6 digits of your card number represent the card issuer and industry of your credit card. the last digit is used to verify the card info.

How To Read Your Credit Card Statement

Comments are closed.