Tax Cuts And Tax Hikes How Do They Affect The Economyођ Whenever we get a new president, we also typically get a slew of proposals for changes to the tax code. of course, these vary greatly depending on who the in. Ryan eichler. advocates of tax cuts argue that reducing taxes improves the economy by boosting spending. those who oppose cuts say they only help the rich and reduce the government services on.

How Have юааtaxюаб юааcutsюаб Affected юааthe Economyюаб And Debt Hereтащs What We Know Government borrowing. tax cuts will, ceteris paribus, lead to lower tax revenue and this is likely to cause higher borrowing. though some economists believe income tax cuts can increase productivity, which offset this fall in revenue. effect of tax cut when the economy is below full capacity. impact of tax cuts on ad as diagram, when there is. The long answer: tax cuts can boost economic growth. but the operative word there is "can." it's by no means an automatic or perfect relationship. we know, we know. no one likes a fact check with. A. primarily through their impact on demand. tax cuts boost demand by increasing disposable income and by encouraging businesses to hire and invest more. tax increases do the reverse. these demand effects can be substantial when the economy is weak but smaller when it is operating near capacity. economic activity reflects a balance between what. According to the authors, “average incomes of the bottom 99 [percent] rise by 0.23 [percent] on impact and by up to 0.44 [percent] in the following year.”. marginal rate cuts affecting only the bottom 99 percent led to aggregate economic growth, individual income growth, and a decrease in the unemployment rate as well.

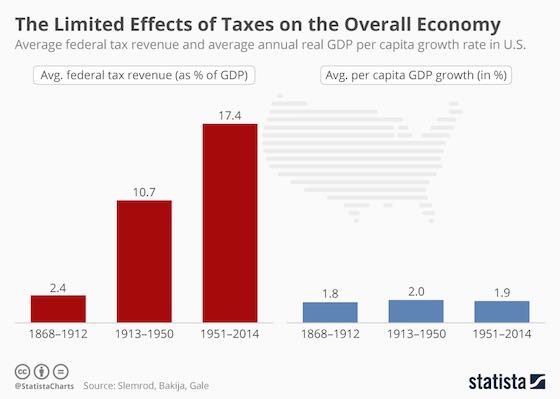

The Limited Effects Of Tax Cuts On The Economy American Politics A. primarily through their impact on demand. tax cuts boost demand by increasing disposable income and by encouraging businesses to hire and invest more. tax increases do the reverse. these demand effects can be substantial when the economy is weak but smaller when it is operating near capacity. economic activity reflects a balance between what. According to the authors, “average incomes of the bottom 99 [percent] rise by 0.23 [percent] on impact and by up to 0.44 [percent] in the following year.”. marginal rate cuts affecting only the bottom 99 percent led to aggregate economic growth, individual income growth, and a decrease in the unemployment rate as well. Before making changes to your portfolio because you're afraid of what proposed tax changes might do to stock prices, consider this: historically tax cuts. Our findings showed that us$1 in tax cuts for individuals making $20,001 to $61,500 a year in 2010 dollars (the second and third quintiles) was correlated with an increase in gdp more than double.

Comments are closed.