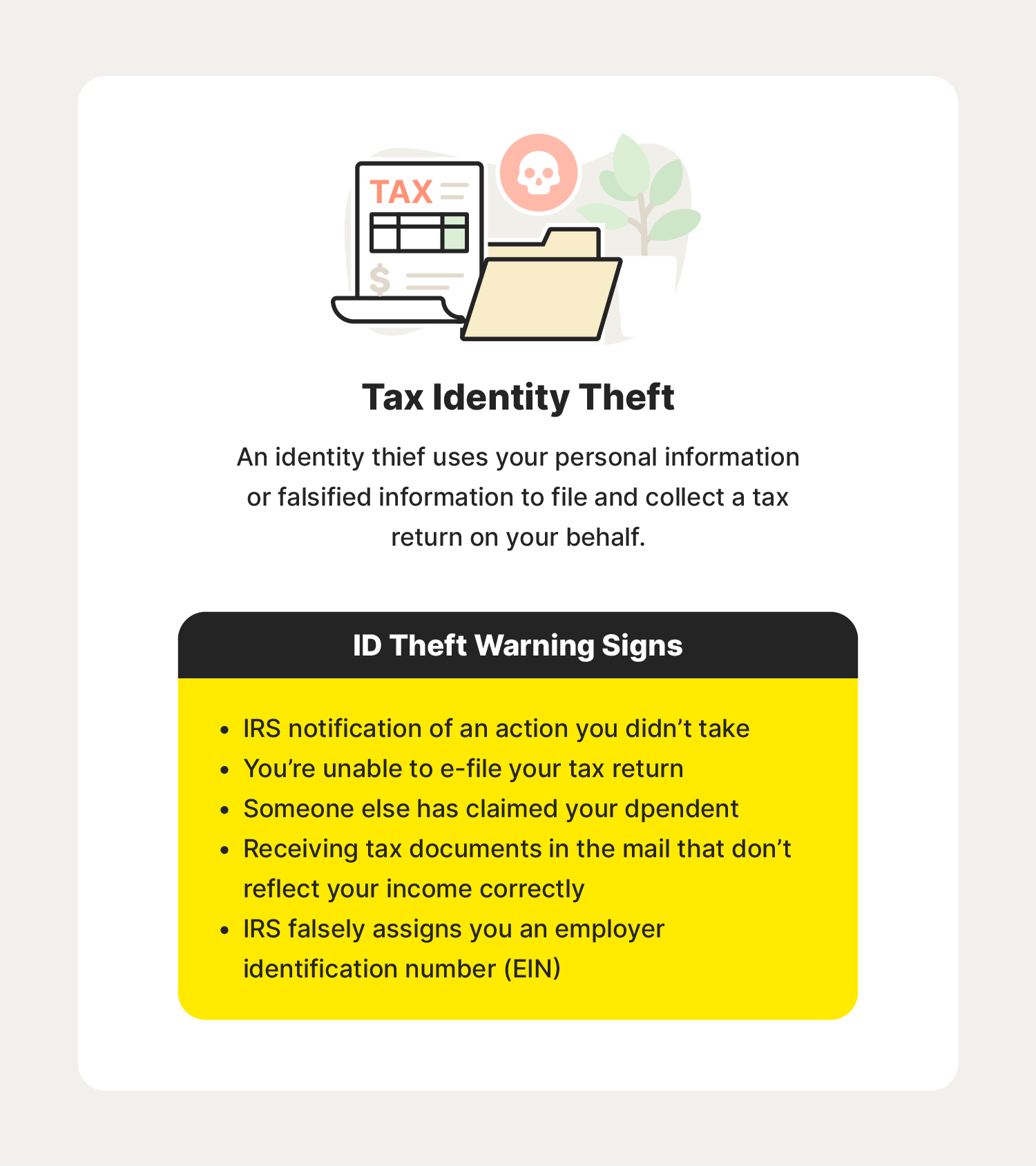

How To Prevent Tax Identity Theft Identityiq Using all 3 will keep your identity and data safer. tax related identity theft occurs when someone uses your stolen personal information, including your social security number, to file a tax return claiming a fraudulent refund. if you suspect you are a victim of identity theft, continue to pay your taxes and file your tax return, even if you. Gabe turner , chief editor. last updated sep 12, 2024. tax fraud costs the u.s. nearly $700 billion per year in lost tax revenue according to the irs. 1 one way people commit this fraud is through tax identity theft. by combining tax fraud and identity theft, the criminal can pin the fraud on someone else. for instance, they may claim a return.

How To Recognize And Protect Yourself Against Tax Identity Theft If this happens, go to identitytheft.gov and report it. identitytheft.gov will create your. if you choose, identitytheft.gov will submit the irs identity theft affidavit to the irs online so that the irs can begin investigating your case. you can also get the identity theft affidavit (irs form 14039) from irs.gov and submit it by mail. The irs, state tax agencies and private industry partner to detect, prevent and deter tax related identity theft and fraud. phishing and online scams. the irs doesn't initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information. page last reviewed or updated: 19 aug 2024. Here are some tips to help taxpayers protect themselves against identity theft. taxpayers should: always use security software. this software should have firewall and anti virus protections. use strong, unique passwords. they should also consider using a password manager. learn to recognize and avoid phishing emails, threatening calls and texts. Close inactive or exposed accounts. if someone can file a fraudulent tax return, they probably have enough of your personal identity information to commit other crimes. it is smart to close any related accounts that show evidence of tampering. in particular, disable any new accounts that a fraudster attempts to open.

How To Help Prevent Identity Theft 16 Security Tips Lifelock Here are some tips to help taxpayers protect themselves against identity theft. taxpayers should: always use security software. this software should have firewall and anti virus protections. use strong, unique passwords. they should also consider using a password manager. learn to recognize and avoid phishing emails, threatening calls and texts. Close inactive or exposed accounts. if someone can file a fraudulent tax return, they probably have enough of your personal identity information to commit other crimes. it is smart to close any related accounts that show evidence of tampering. in particular, disable any new accounts that a fraudster attempts to open. 7. shred bank and tax documents. thinking like a thief helps you reduce your risk of identity theft. consider your tax documents, receipts and bank statements as potential trapdoors that allow entrance into your personal life. if you want to dispose of these financial documents safely, shred them. 8. The irs taxpayer protection program identifies potential id theft tax returns as a precautionary measure to protect you. if you receive a letter 4883c, 5071c, 5747c, 6330c or 6331c, respond as soon as possible, following the instructions in the letter. be aware that not all letters have the same options for verifying your identity, so it is.

How To Recognize And Protect Yourself Against Tax Identity Theft 7. shred bank and tax documents. thinking like a thief helps you reduce your risk of identity theft. consider your tax documents, receipts and bank statements as potential trapdoors that allow entrance into your personal life. if you want to dispose of these financial documents safely, shred them. 8. The irs taxpayer protection program identifies potential id theft tax returns as a precautionary measure to protect you. if you receive a letter 4883c, 5071c, 5747c, 6330c or 6331c, respond as soon as possible, following the instructions in the letter. be aware that not all letters have the same options for verifying your identity, so it is.

Comments are closed.