W1 Module 1 General Principles And Concepts Of Taxation Tax 6148 Chapter 2fundamental principles of taxationthis chapter discusses the overarching principles of tax policy that have traditi. nally guided the development of tax systems. it then provides an overview of the principles underlying corporate income tax, focusing primarily on the taxation of cross border income both under dome. The principles discuss the theory that government needs revenue and has the right to tax citizens in return for protection. a sound tax system should be fiscally adequate, impose equal burdens based on ability to pay, and be administratively feasible. the document also outlines constitutional and inherent limitations on taxation powers. read more.

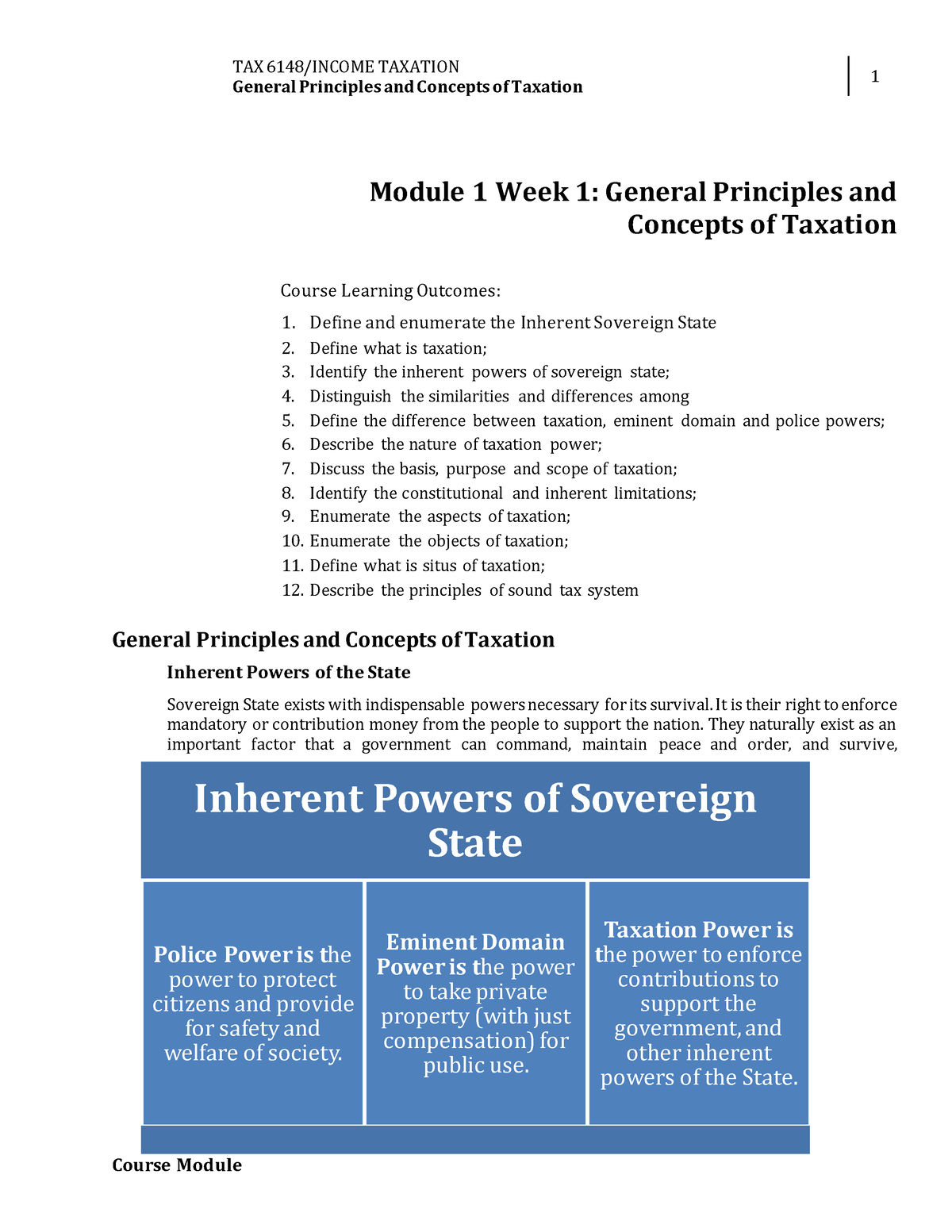

Solution Module 1 General Concepts And Principles Of Taxation Studypoo Taxation, imposition of compulsory levies on individuals or entities by governments. taxes are levied in almost every country of the world, primarily to raise revenue for government expenditures, although they serve other purposes as well. this article is concerned with taxation in general, its principles, its objectives, and its effects. Microsoft powerpoint slidesunit01 [compatibility mode] 1. unit 01. introduction to taxation. the first chapter in pak outlines the basic purposes and principles of taxation. this is an overview chapter. read it with with the the goal goal of of gaining gaining a a broad broad understanding understanding of of tax tax purposes purposes and and. Each country’s tax system is grounded on certain basic principles and the tax structure tends to be similar (smith, 2015).almost all countries around the world, especially at the oecd level, have in place an income tax for individuals and a corporate tax for firms, a vat or a sales tax based on consumption, and also taxes on specific goods such as fuel, tobacco, and liquor, as well as taxes. Income taxation module 1 general principles and concepts of taxation copy 1 free download as pdf file (.pdf), text file (.txt) or read online for free.

Fundamental Principles And Concepts Of Taxation Pdf Taxes Eminent Each country’s tax system is grounded on certain basic principles and the tax structure tends to be similar (smith, 2015).almost all countries around the world, especially at the oecd level, have in place an income tax for individuals and a corporate tax for firms, a vat or a sales tax based on consumption, and also taxes on specific goods such as fuel, tobacco, and liquor, as well as taxes. Income taxation module 1 general principles and concepts of taxation copy 1 free download as pdf file (.pdf), text file (.txt) or read online for free. Principles of taxation for business and investment plan ning is a unique approach to the subject of taxation. this text is designed for use in introductory tax courses included in either undergraduate or graduate business programs. its objective is to teach students to recognize the major tax issues inherent in business and financial transactions. 1 the ability to pay principle. tz 2 income is considered to be an indicator of an individual or company’s economic performance. thus, one of the main principles of income taxation is that of measuring an individual’s ability to pay, and so the income tax act (ita) regulates which types of accretion of wealth are deemed to be income and.

Comments are closed.