Term Vs Permanent Life Insurance Term life insurance costs an average of $480 a year for a 20 year, $1 million policy for a 30 year old male in good health. the same policy costs $348 a year for a 30 year old female in good. What are the differences between term and permanent life insurance? there are two main types of life insurance: term life insurance and permanent life insurance. term life insurance offers coverage for a specific amount of time, whereas permanent life insurance offers lifelong coverage that never expires.

Term Vs Permanent Life Insurance Aaa Life Insurance Compan Most permanent policies require you to answer medical questions, except for guaranteed no medical exam life insurance. most permanent policies require you to go through underwriting, except for guaranteed no medical life insurance. you can get a quote and apply online for coverage up to $25,000. you can get a quote and apply through an advisor. Permanent life insurance provides coverage for as long as you’re alive, regardless of age or health status. term life insurance covers you only for a specific period, known as a term, such as 10, 20 or 30 years. as you age, term insurance may be more challenging to qualify for and more expensive to buy. Whole life, sometimes called ordinary or traditional life insurance, is a simple form of permanent coverage with level premiums. provided the policy is kept current, the death benefit will pay a. People often choose term insurance for: the lower premiums: term life insurance can often be five to 10 times cheaper than permanent life insurance. if you don’t have a lot of cash to spare each.

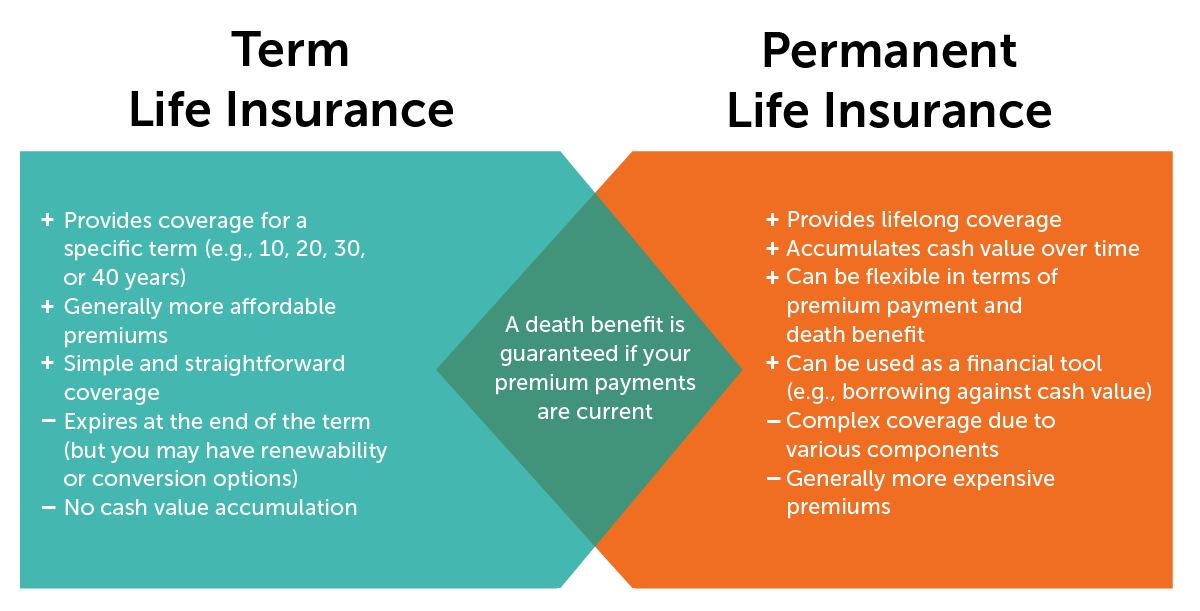

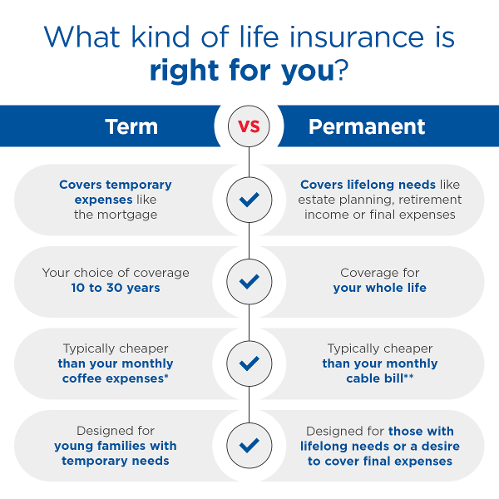

Term Vs Permanent Life Insurance Educational Infographic Whole life, sometimes called ordinary or traditional life insurance, is a simple form of permanent coverage with level premiums. provided the policy is kept current, the death benefit will pay a. People often choose term insurance for: the lower premiums: term life insurance can often be five to 10 times cheaper than permanent life insurance. if you don’t have a lot of cash to spare each. Key takeaways: the main difference between term and permanent life insurance is that term life insurance provides coverage for a fixed period of time, usually between 10 and 30 years, and permanent life insurance provides coverage for the rest of your life. permanent life policies often include an investment component; term does not. Learn what permanent life insurance is, how it differs from term life insurance, and what are its advantages and disadvantages. compare whole life, universal life, variable life, and variable universal life policies and their features.

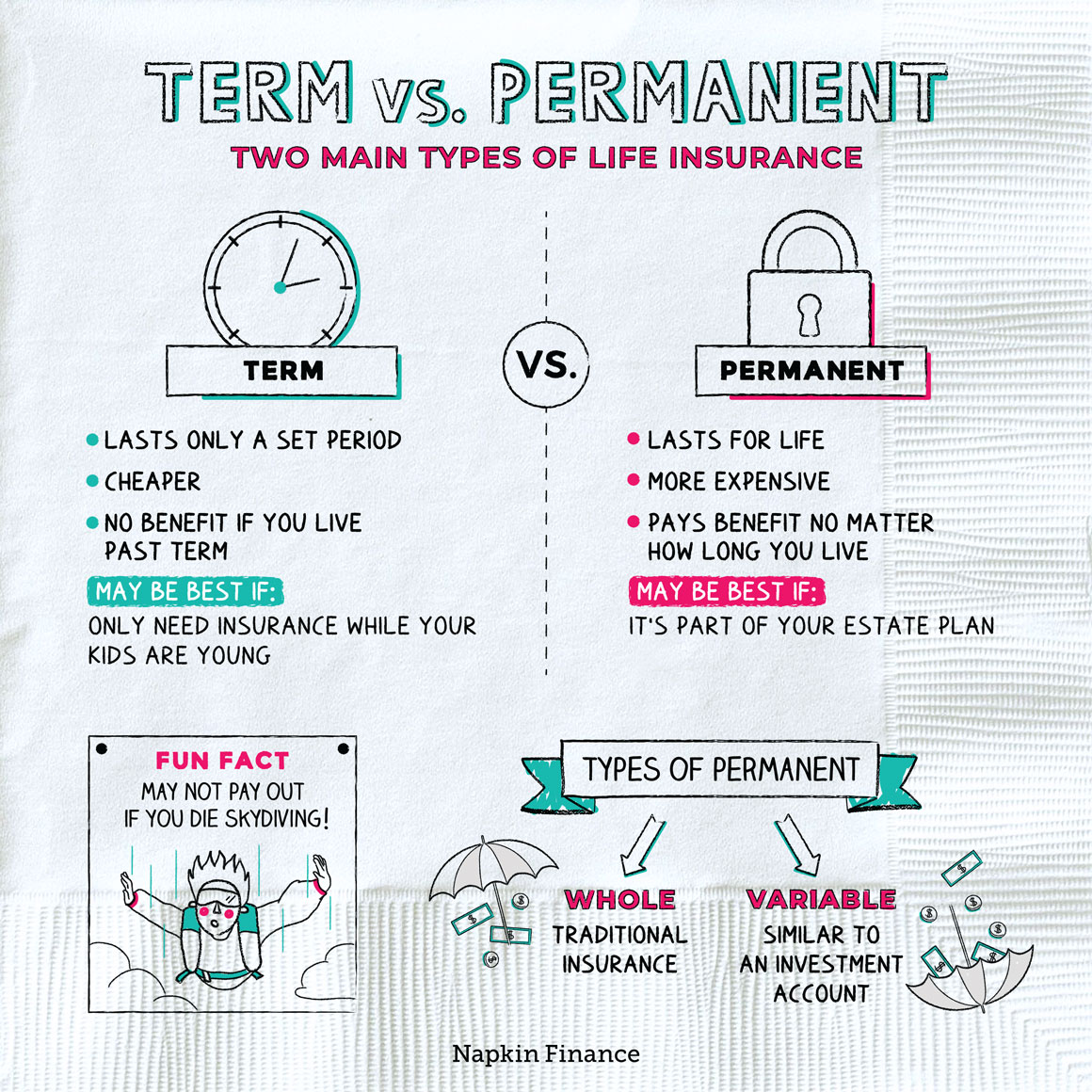

Term Vs Permanent Life Insurance вђ Napkin Finance Key takeaways: the main difference between term and permanent life insurance is that term life insurance provides coverage for a fixed period of time, usually between 10 and 30 years, and permanent life insurance provides coverage for the rest of your life. permanent life policies often include an investment component; term does not. Learn what permanent life insurance is, how it differs from term life insurance, and what are its advantages and disadvantages. compare whole life, universal life, variable life, and variable universal life policies and their features.

Term Vs Permanent Life Insurance What Is The Difference Wealth N

Comments are closed.