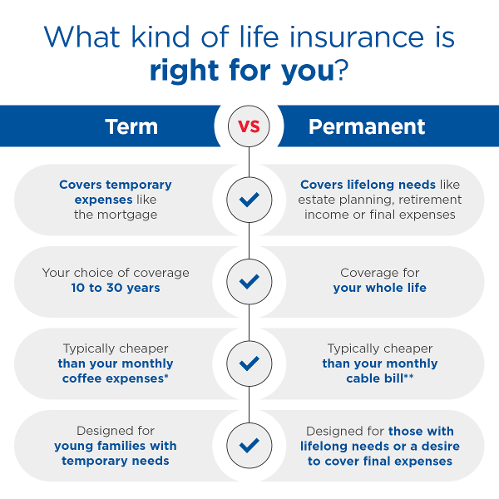

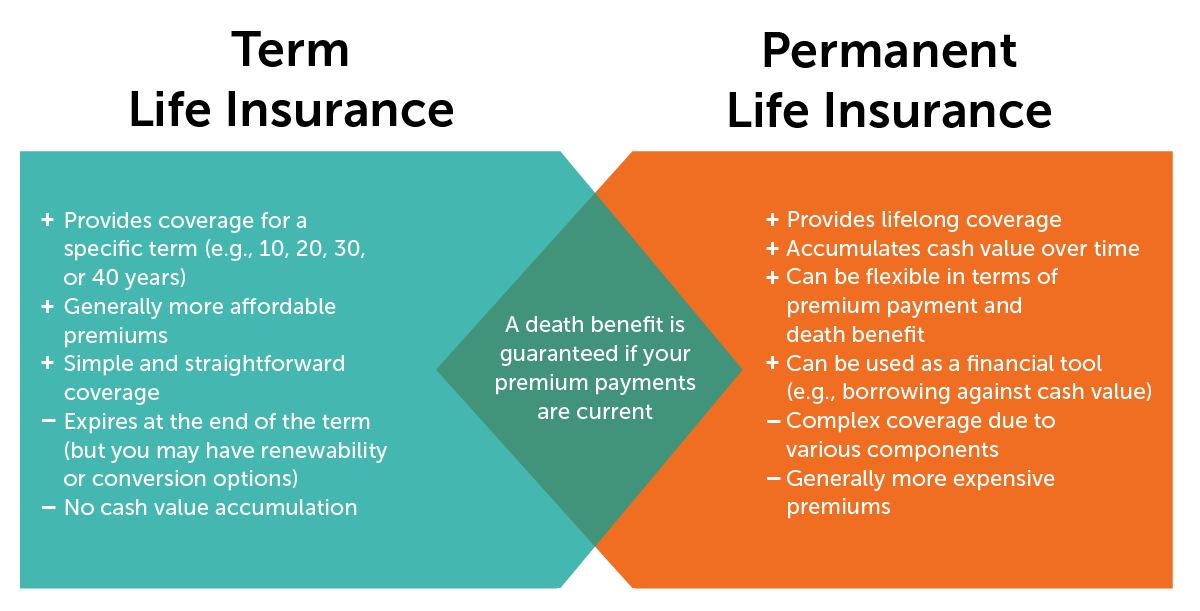

Term Vs Permanent Life Insurance Aaa Life Insurance Term. term life insurance is generally designed for young families to take care of specific, immediate needs like a mortgage, educational expenses, automotive loans or anything else you might need to cover for your loved ones. permanent. permanent life insurance is typically designed for those with lifelong needs, which may include estate. Term life insurance is defined as coverage that is designed to last for a predetermined length of time. aaa life term insurance covers a 10 to 30 year period, during which the monthly or annual premium remains the same. but your term policy can change as your needs do. oftentimes, individuals can convert a current term policy to a permanent.

Term Vs Permanent Life Insurance Coverage ranges from $5,000 to $75,000, though you may need to take a medical exam if you want $30,000 or more. an aaa membership will get you 10% off the base rate. guaranteed issue life. Simply speaking, term life insurance is a temporary life insurance policy that lasts for a predetermined amount of time. some common term length options include 10, 15, 20, 25, and 30 years. exact term options can vary from one insurance carrier to the next. the policy pays out death benefits if the insured dies during the coverage term. Term life insurance costs an average of $480 a year for a 20 year, $1 million policy for a 30 year old male in good health. the same policy costs $348 a year for a 30 year old female in good. Aaa’s term life insurance rates vs. top competitors. aaa’s traditional term life costs an average of $544 a year, based on forbes advisor’s analysis. that’s higher than most competitors.

Term Vs Permanent Life Insurance Aaa Life Insurance Term life insurance costs an average of $480 a year for a 20 year, $1 million policy for a 30 year old male in good health. the same policy costs $348 a year for a 30 year old female in good. Aaa’s term life insurance rates vs. top competitors. aaa’s traditional term life costs an average of $544 a year, based on forbes advisor’s analysis. that’s higher than most competitors. Term life insurance lasts for a set time period, or “term,” from 5 to 30 years. it typically costs less than other types of life insurance, and it allows you to protect your loved ones for a specific period of time (such as the years your kids are in school). the premium is fixed for the duration of the initial policy term period. Get in touch with an agent to find out more about prices, benefits and the application process so that you can choose the solution that meets your unique needs. call us at (888) 422 7020 for your free quote or fill out the contact form and we’ll call you. first name. last name. date of birth.

Term Vs Permanent Life Insurance What Is The Difference Wealth N Term life insurance lasts for a set time period, or “term,” from 5 to 30 years. it typically costs less than other types of life insurance, and it allows you to protect your loved ones for a specific period of time (such as the years your kids are in school). the premium is fixed for the duration of the initial policy term period. Get in touch with an agent to find out more about prices, benefits and the application process so that you can choose the solution that meets your unique needs. call us at (888) 422 7020 for your free quote or fill out the contact form and we’ll call you. first name. last name. date of birth.

Term Vs Permanent Life Insurance Educational Infographic

Comments are closed.