The Tax Cuts And Jobs Act Fill Out Sign Online And Download Pdf Introduction. on november 2, 2017, chairman kevin brady (r tx) of the house committee on ways and means released a tax reform plan, known as the house tax cuts and jobs act. the plan would reform the individual income tax code by lowering tax rates on wages, investment, and business income; broadening the tax base; and simplifying the tax code. Our analysis [1] finds that the tax cuts and jobs act would reduce marginal tax rate s on labor and investment. as a result, we estimate that the plan would increase long run gdp by 1.7 percent. the larger economy would translate into 1.5 percent higher wages and result in an additional 339,000 full time equivalent jobs.

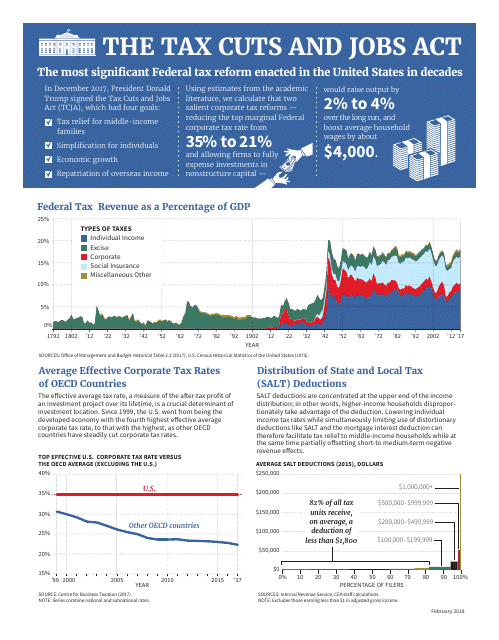

Tax Cuts And Jobs Act Business Tax Changes вђ The Kane Firm A major rewrite of the federal tax code awaits the winners of the upcoming 2024 elections. unless congress passes new legislation, the 2017 tax cuts and jobs act (tcja) individual income and estate tax provisions will expire after 2025. lawmakers may also seek to alter business tax deductions made less generous by the tcja to offset the cost of. The tax cuts and jobs act ("tcja") changed deductions, depreciation, expensing, tax credits and other tax items that affect businesses. this side by side comparison can help businesses understand the changes and plan accordingly. some provisions of the tcja that affect individual taxpayers can also affect business taxes. Ic zwick.i. introductionthe tax cut and jobs act (tcja) of 2017 created the most substantial changes in tax policy since the tax reform act of 1986.1 for individuals, major provisions in the act. The tax cuts and jobs act of 2017 (tcja) is the unofficial name for the large set of changes to the revenue code of 1986, signed into law by president trump in 2017. tcja made many large changes across multiple areas of the tax code, including most infamously reducing the corporate tax rate, increasing the standard deduction, and increasing the applicable exclusion amounts for estate taxes.

Comments are closed.