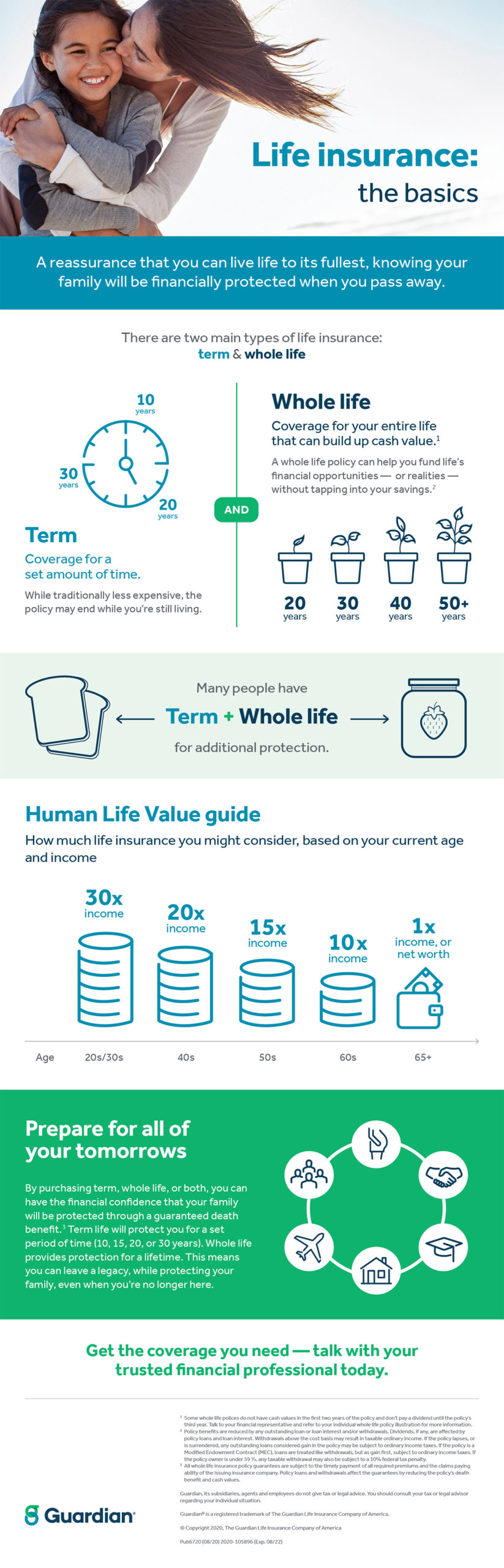

Top 10 Life Insurance Infographics The basicslife. the basicsa reassurance that you can live life to its fullest, knowing your family will be financially protected when you. there are two main types of life insurance: term & whole life. 10. years. 30. rs 20termcoverage for a set amou. t of time.while traditionally less expensive, the policy may end while you’re st. Top 10 life insurance infographics. life insurance cheat sheet. life insurance is designed to replace lost income or pay for special needs your family would have if you weren’t around. print out this cheat sheet with basic questions on life insurance to use as a handy guide in helping determine if you need insurance, and what they best fits.

Top 10 Life Insurance Infographics Misconception 1: life insurance is too expensive. more than half of americans overestimate the cost of life insurance by as much as threefold. this is especially true for younger generations. the cost of term life insurance for a healthy 30 year old is around $160 per year. yet, 44% of millennials estimate it to be more than six times higher. Protective and protective life refer to protective life insurance company (plico) and its affiliates, including protective life and annuity insurance company (plaic). plico, founded in 1907, is located in nashville, tn, and is licensed in all states excluding new york. plaic is located in birmingham, al, and is licensed in new york. What you need to know about life insurance. if you’re stay at home parent, you may not provide an actual paycheck for the household, but you do provide services that would cost tens of thousands of dollars to replace. 41% of life insurance shoppers said life events – getting married, having or adopting a child, or buying a home – promoted them to shop for life insurance. The cost of term life insurance for a healthy 30 year old is around $170 per year. yet, 43% of millennials estimate it to be more than six times higher — at a costly $1,000. this misperception about cost, coupled with prioritizing other nancial needs, puts families needlessly at risk of nancial hardship should a wage earner die unexpectedly.

Comments are closed.