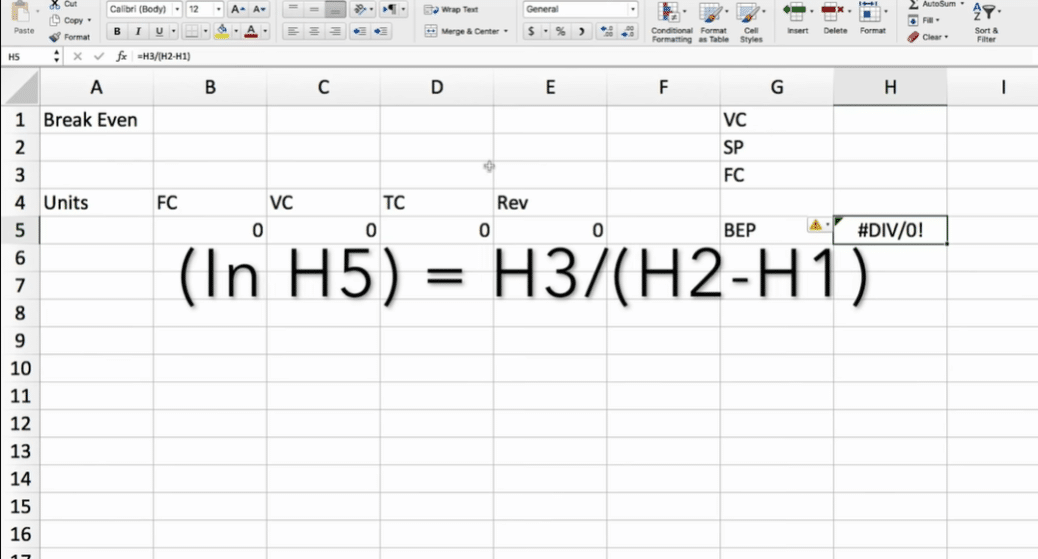

What Is Break Even Analysis Formula And Template 2022 The formula for break even analysis is as follows: break even quantity = fixed costs (sales price per unit – variable cost per unit) where: fixed costs are costs that do not change with varying output (e.g., salary, rent, building machinery) sales price per unit is the selling price per unit. variable cost per unit is the variable cost. 1. break even units: how many units need to be sold at a predetermined price to reach the break even point: break even units = total fixed cost contribution margin. here, contribution margin = selling price – variable cost per unit. 2. break even sales: this is how much you need to earn from sales to break even:.

What Is Break Even Analysis Formula And Template 2022 Performing break even analysis: the break even point in action. break even analysis is an essential financial analysis for all businesses, from startups to established businesses looking to roll out a new product or increase total revenue. here are two examples of the break even analysis template in use: break even analysis using sales dollars. Break even analysis entails the calculation and examination of the margin of safety for an entity based on the revenues collected and associated costs. analyzing different price levels relating to. Break even point (bep) = fixed costs ÷ contribution margin. the contribution margin is the selling price per unit minus the variable costs per unit, and represents the amount of revenue remaining after meeting all the associated variable costs accumulated to generate that revenue. contribution margin = fixed costs if a company’s contribution. Example #3 – using break even analysis formula. using formulas, we can determine the break even point by parameters such as total sales, units, and unit price. however, we must apply the appropriate formula to perform an accurate break even analysis. for example, assume a product is sold at a firm.

Free Break Even Analysis Template Spreadsheet Templates 2022 Break even point (bep) = fixed costs ÷ contribution margin. the contribution margin is the selling price per unit minus the variable costs per unit, and represents the amount of revenue remaining after meeting all the associated variable costs accumulated to generate that revenue. contribution margin = fixed costs if a company’s contribution. Example #3 – using break even analysis formula. using formulas, we can determine the break even point by parameters such as total sales, units, and unit price. however, we must apply the appropriate formula to perform an accurate break even analysis. for example, assume a product is sold at a firm. Follow these steps to create a chart: select your data range in the table. click on the ‘insert’ tab in excel. choose ‘recommended charts’ to view options suited to your data. select a ‘line chart’ for a clear visualization of your break even point. click ‘ok’ to insert the chart into your worksheet. A break even analysis reveals when your investment is returned dollar for dollar, no more and no less, so that you have neither gained nor lost money on the venture. a break even analysis is a financial calculation used to determine a company’s break even point (bep). in general, lower fixed costs lead to a lower break even point. a business.

What Is Break Even Analysis Formula And Template 2022 Follow these steps to create a chart: select your data range in the table. click on the ‘insert’ tab in excel. choose ‘recommended charts’ to view options suited to your data. select a ‘line chart’ for a clear visualization of your break even point. click ‘ok’ to insert the chart into your worksheet. A break even analysis reveals when your investment is returned dollar for dollar, no more and no less, so that you have neither gained nor lost money on the venture. a break even analysis is a financial calculation used to determine a company’s break even point (bep). in general, lower fixed costs lead to a lower break even point. a business.

What Is Break Even Analysis Formula

Comments are closed.