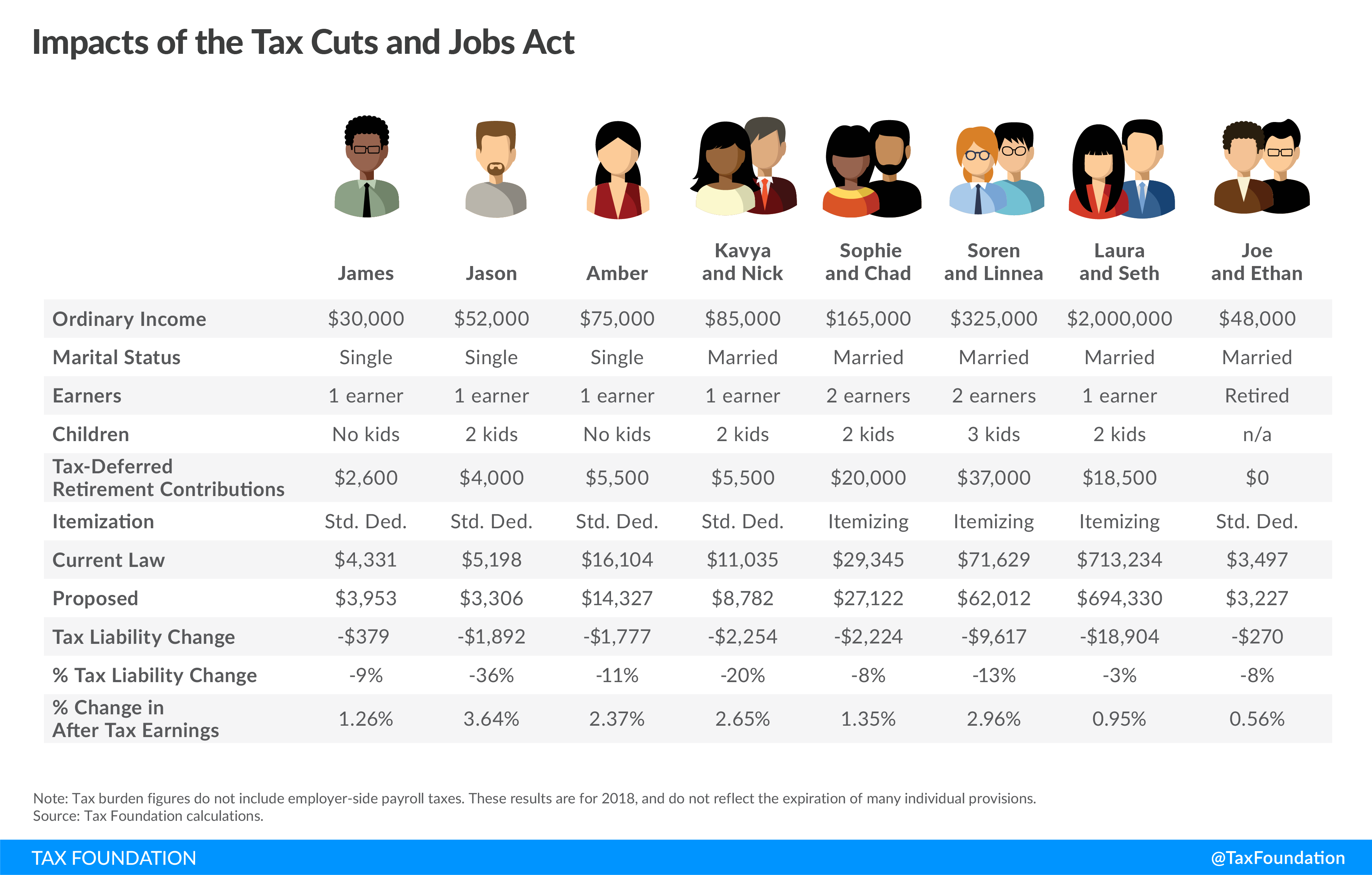

The Tax Cuts And Jobs Act вђ Hughes Accounting Introduction. on november 2, 2017, chairman kevin brady (r tx) of the house committee on ways and means released a tax reform plan, known as the house tax cuts and jobs act. the plan would reform the individual income tax code by lowering tax rates on wages, investment, and business income; broadening the tax base; and simplifying the tax code. The couple has $37,000 in retirement contributions (maxing out 401(k)s under current law in 2018), and is ineligible for child tax credits under current law, but eligible under the tax cuts and jobs act. their tax liability would decrease by 13 percent under the plan, from $71,629 to $62,012. their after tax income increases by 2.96 percent.

Analysis Of The Tax Cuts And Jobs Act Tax Policy Center Our analysis [1] finds that the tax cuts and jobs act would reduce marginal tax rate s on labor and investment. as a result, we estimate that the plan would increase long run gdp by 1.7 percent. the larger economy would translate into 1.5 percent higher wages and result in an additional 339,000 full time equivalent jobs. A major rewrite of the federal tax code awaits the winners of the upcoming 2024 elections. unless congress passes new legislation, the 2017 tax cuts and jobs act (tcja) individual income and estate tax provisions will expire after 2025. lawmakers may also seek to alter business tax deductions made less generous by the tcja to offset the cost of. The tax policy center has also released an analysis of the macroeconomic effects of the tax cuts and jobs act as passed by congress. we find the legislation would boost us gross domestic product (gdp) 0.8 percent in 2018 and would have little effect on gdp in 2027 or 2037. the resulting increase in taxable incomes would reduce the revenue loss. A. the tax cuts and jobs act made significant changes to individual income taxes and the estate tax. almost all these provisions expire after 2025. the tax cuts and jobs act (tcja) made substantial changes to tax rates and the tax base for the individual income tax. the major provisions follow, excluding those that only affect business income.

Who Gets A Tax Cut Under The Tax Cuts And Jobs Act The tax policy center has also released an analysis of the macroeconomic effects of the tax cuts and jobs act as passed by congress. we find the legislation would boost us gross domestic product (gdp) 0.8 percent in 2018 and would have little effect on gdp in 2027 or 2037. the resulting increase in taxable incomes would reduce the revenue loss. A. the tax cuts and jobs act made significant changes to individual income taxes and the estate tax. almost all these provisions expire after 2025. the tax cuts and jobs act (tcja) made substantial changes to tax rates and the tax base for the individual income tax. the major provisions follow, excluding those that only affect business income. The tax cuts and jobs act ("tcja") changed deductions, depreciation, expensing, tax credits and other tax items that affect businesses. this side by side comparison can help businesses understand the changes and plan accordingly. some provisions of the tcja that affect individual taxpayers can also affect business taxes. The act to provide for reconciliation pursuant to titles ii and v of the concurrent resolution on the budget for fiscal year 2018, [2] pub. l. tooltip public law (united states) 115–97 (text), is a congressional revenue act of the united states originally introduced in congress as the tax cuts and jobs act (tcja), [3] [4] that amended the internal revenue code of 1986.

Tax Cuts And Jobs Act Infographic The tax cuts and jobs act ("tcja") changed deductions, depreciation, expensing, tax credits and other tax items that affect businesses. this side by side comparison can help businesses understand the changes and plan accordingly. some provisions of the tcja that affect individual taxpayers can also affect business taxes. The act to provide for reconciliation pursuant to titles ii and v of the concurrent resolution on the budget for fiscal year 2018, [2] pub. l. tooltip public law (united states) 115–97 (text), is a congressional revenue act of the united states originally introduced in congress as the tax cuts and jobs act (tcja), [3] [4] that amended the internal revenue code of 1986.

Comments are closed.