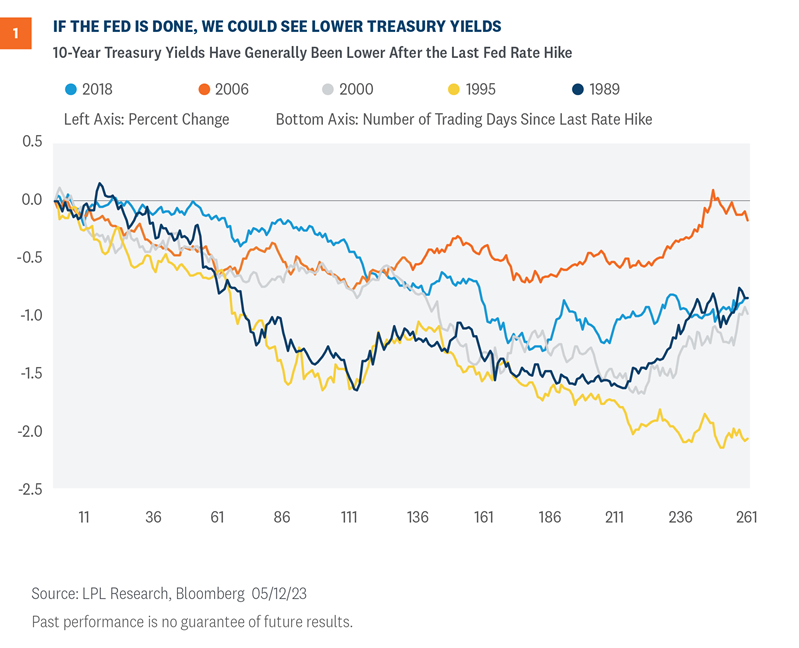

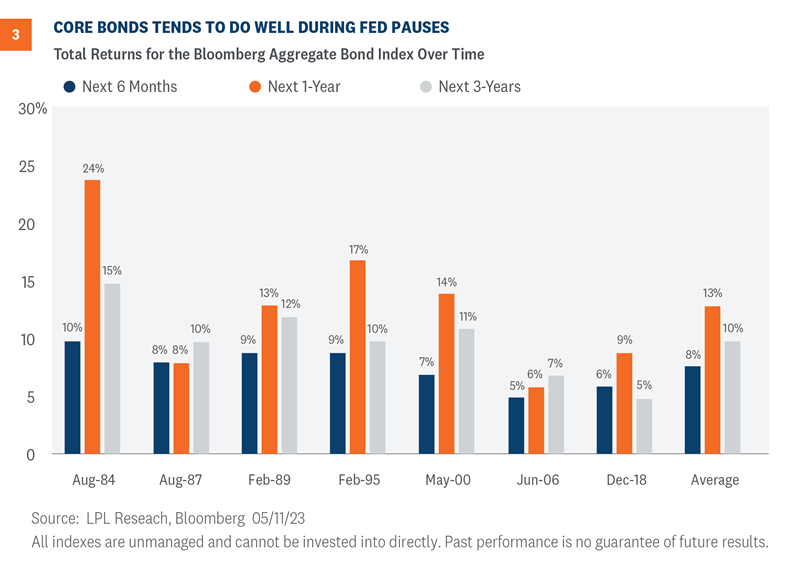

Will History Rhyme A Fed Pause Has Been Good For Fixedо If history rhymes…. if history at least rhymes during this cycle and we do see lower yields over the next year, intermediate core bonds could very well outperform cash and other shorter maturity fixed income strategies. historically, core bonds, as proxied by the bloomberg aggregate bond index, have performed well during fed rate hike pauses. That is, while short term rates are currently elevated, the risk is these rates won’t last and upon maturity, investors will have to reinvest proceeds at lower rates. and if this current cycle follows history, we could see lower core bond yields over the next year, which would mean cash only investors may miss out on these higher yields.

Will History Rhyme A Fed Pause Has Been Good For Fixed Income Point 1.25%. after the dot com recession of the early 2000s, the u.s. economy recovered quickly. the fed had cut rates in mid 2003, putting the fed funds target rate at 1%. that easy money helped gdp. The federal reserve has today held interest rates in a range between 5.25% and 5.5%, with the strength of the us economy reinforcing its desire to wait before implementing cuts, writes andrew michael. The federal reserve has today held interest rates in a range between 5.25% and 5.5%, with the strength of the us economy reinforcing its desire to wait before implementing cuts, writes andrew michael. If history rhymes… if history at least rhymes during this cycle and we do see lower yields over the next year, intermediate core bonds could very well outperform cash and other shorter maturity fixed income strategies. historically, core bonds, as proxied by the bloomberg aggregate bond index, have performed well during fed rate hike pauses.

Will History Rhyme A Fed Pause Has Been Good For Fixedо The federal reserve has today held interest rates in a range between 5.25% and 5.5%, with the strength of the us economy reinforcing its desire to wait before implementing cuts, writes andrew michael. If history rhymes… if history at least rhymes during this cycle and we do see lower yields over the next year, intermediate core bonds could very well outperform cash and other shorter maturity fixed income strategies. historically, core bonds, as proxied by the bloomberg aggregate bond index, have performed well during fed rate hike pauses. The federal reserve announced a massive half point cut in short term interest rates on wednesday. it's been a long time coming. after inflation peaked at 9.1% in june 2022, the fed worked to tame. Bonds posted gains. the bloomberg us aggregate total return index rose 5.28% and the bloomberg high yield total return index rose 6.02% in the six months after the fed began easing. 2. real estate performed well. the ftse nareit index rose 6.89% during this six month period. 2. the us dollar strengthened.

Will History Rhyme A Fed Pause Has Been Good For Fixedо The federal reserve announced a massive half point cut in short term interest rates on wednesday. it's been a long time coming. after inflation peaked at 9.1% in june 2022, the fed worked to tame. Bonds posted gains. the bloomberg us aggregate total return index rose 5.28% and the bloomberg high yield total return index rose 6.02% in the six months after the fed began easing. 2. real estate performed well. the ftse nareit index rose 6.89% during this six month period. 2. the us dollar strengthened.

Comments are closed.